INVESTOR RELATIONS

Sustainability Finance

“WE ARE GREEN” Bond Policy

1. Basic Policy for ESG bond issuance

(i) Objective

The Tokyu Land Group (the “Group”) shall obtain comprehensive and continuous approval of its ESG approach from bond investors and other stakeholders. Moreover, Tokyu Land Corporation (the “Company”) shall offer stable ESG bond investment opportunities to bond investors and strengthen and expand its fundraising foundations through ESG bond issuance.

(ii) Targets

The Company aims to have ESG bonds account for 50% or more of the total corporate bond issuance volumes by the end of FY2025, and 70% or more by the end of FY2030.

(iii) Allocation of capital raised from ESG bonds, etc.

Capital raised from ESG bonds, etc. shall be allocated in accordance with the themes to work on for value creation (materiality) established in the long-term vision “GROUP VISION2030.”

(iv) Forms of ESG bonds

Green bond, social bond, sustainability bond and sustainability-linked bond.

For new issuance, obtaining certification from a third-party certification body shall be obligatory. Moreover, forms of ESG bonds may be added or deleted, depending on changes in the principles, which are the premise of certification, of each third-party certification body, etc.

2. Policy for information disclosure

(i) Information disclosure criteria

The Group shall disclose information in accordance with the Financial Instruments and Exchange Act and other applicable laws and regulations and the Timely Disclosure Rules established by Tokyo Stock Exchange, Inc. (TSE)

(ii) Method of information disclosure

Information which falls under statutory disclosure items in accordance with the Timely Disclosure Rules shall be disclosed by registering it with the Timely Disclosure network (TDnet) provided by TSE. Moreover, securities report and other disclosure documents shall be publicly disclosed through the Electronic Disclosure for Investors’ Network (EDINET) provided by the Financial Services Agency.

The Company shall promptly post on its webpage information disclosed through the timely information disclosure system of the stock exchange. It shall also work to transmit other information to bond investors at reasonable times in accordance with the objective of timely disclosure.

3. Policy for constructive dialogue with bond investors

(i) Officers in charge of dialogue with investors

Through collaboration among officers in charge of corporate communication, financial affairs and corporate planning, the Company shall facilitate a constructive dialogue with bond investors.

Moreover, it shall work to deepen bond investors’ understanding through dialogue between them and President and officers in charge to the extent necessary and reasonable.

(ii) Collaboration with departments in charge and related departments

The Finance Group has been established under the aegis of the Group Finance Department to take charge of financing activities, and through collaboration with IR Office, Corporate Sustainability Office and other departments related to corporate planning, it shall facilitate a constructive dialogue between bond investors and the President, officers in charge and personnel in charge.

(iii) Initiative for enhancing methods of dialogue

The Group shall hold periodic meetings with bond investors to thoroughly communicate the status of the Group’s ESG-related initiatives, progress of ESG bonds, etc. Moreover, it shall call for opinions, suggestions, etc. from bond investors through meetings. These opinions shall be shared with senior management and shall be reflected in the Group’s ESG initiatives. In this way, the Group strives to deepen bond investor engagement through bilateral communication.

Framework

Sustainability Finance Framework

1. Sustainability Finance Framework

The Company is committed to solving social and environmental issues and creating value for customers and society through a wide range of business areas originating from real estate development.

The Company established a Sustainability Finance Framework in October 2020 in accordance with the Green Bond Principles, Social Bond Principles, and Sustainability Bond Guidelines of the International Capital Market Association (ICMA) in order to raise funds for our business operations through sustainability finance. The Sustainability Finance Framework has been revised with the primary aim of adding and updating eligibility criteria.

The suitability of the revised Sustainability Finance Framework (hereinafter referred to as “the Framework”) has been assessed by Japan Credit Rating Agency, Ltd., a third-party assessment organization, and has obtained a third-party assessment. See below for details.

2. Use of funds raised

The funds raised by the Company based on the Framework will be allocated to expenditures or investments related to new or existing assets that satisfy the following green projects and/or social projects. All green projects and/or social projects satisfy the Company’s “value provided through business” and are measures/initiatives that contribute to the Company’s sustainable growth.

Excluding green buildings and renewable energy, expenditures related to existing assets are limited to those incurred within 36 months prior to the green/social/sustainability finance implementation date.

| Type | Content |

|---|---|

| Green finance: Green bonds and green loans | Financing exclusively for use in green projects |

| Social finance: Social bonds and social loans | Finance exclusively for use in social projects |

| Sustainability finance: Sustainability bonds and sustainability loans | Financing for use in both green projects and social projects |

(i) Green projects

Green buildings and energy saving

Expenditures (land acquisition costs, planning and development costs, construction costs, etc.) or investments related to new or existing properties that meet any of (1) to (3) below

- Properties that have obtained or renewed any of the following third-party certifications

- Properties that plan to obtain or renew any of the following third-party certifications

- Indicators of energy efficiency in buildings (BEI, etc.) that meet or exceed ZEB standards, and properties completed within the past 36 months prior to the Green Finance implementation date.

Third-party certification

- S rank or A rank in CASBEE Certification for Buildings or CASBEE Certification for Real Estate

- Platinum or Gold in LEED-BD+C, LEED-O+M certification (v4 or later)

- Four or five stars in BELS (2016 criteria)

- The following level in BELS (2024 criteria)

- Non-residential: Level 4 to Level 6

- Residences with renewable energy equipment: Level 3 to Level 6

- Residences without renewable energy equipment: Level 3 or Level 4

- Three to five stars in DBJ Green Building certification

- Low carbon building certification

The Company intends to maintain and improve its environmental performance through the preservation and renovation of the assets it owns, and to continue to renew this certification even after it has been obtained from a third party.

Energy saving (renovation work)

Expenditures for initiatives contributing to energy saving related to either (1) or (2) below

- New expenditures or existing expenditures related to renovation work that meets any of the following criteria

- Renovation work intended to improve the third-party certification of green buildings described in the preceding section by one level or more

- Renovation work that is expected to reduce energy consumption or CO2 emissions by 30% or more

- Equipment replacement costs

Examples:- Replacement of air conditioning equipment

- Introduction of LED lighting

Renewable energy (solar power, wind power)

- New or existing investment funds for renewable energy projects that meet the following criteria, generate clean energy, and contribute to job creation and economic revitalization in local communities through the development and operation of power plants

- The target equipment and projects have obtained equipment certification (Ministry of Economy, Trade and Industry) and permits, and environmental assessments (limited to where applicable) have been completed appropriately

- Consideration has been given to potentially negative environmental and social impacts

- Funds for acquiring shares in a company specializing in renewable energy businesses

Storage batteries

- Expenditures related to the installation of power generation-side, grid-use, or demand-side storage batteries

Forest conservation

- Expenditures related to new or existing assets in projects for creating a local recycling-oriented environment through the establishment of a local production for local consumption cycle for forest resources.

- Expenditures related to forest conservation activities

- Cost of purchasing thinned wood

Recycling-oriented society

- Expenditures related to renovation and construction of buildings aimed at resource conservation and longer service life by utilizing existing structures

- Expenditures related to the use of materials that reduce environmental impact, such as recycled materials and renewable resources

- Expenditures related to recycling of waste

Examples:- Expenditures related to renovation and refining of entire buildings

- Purchase cost of recycled refrigerant

- Expenditures related to the manufacture of fertilizer from food waste and biogas power generation

Biodiversity

- Expenditures related to the development and maintenance of green spaces that take biodiversity into consideration

- Expenditures related to obtaining or renewing the following third-party certifications

- ABINC

- SEGES

- SITES

- JHEP

- EDO-MIDORI Registered Green Spaces (Excellent Green Space)

- Nationally Certified Sustainably Managed Natural Sites

(ii) Social projects

Projects that contribute to any of (1) to (3) below (see table below for specific examples)

- Basic infrastructure development

- Access to essential services

- Socioeconomic advancement and empowerment / development

(1) Basic infrastructure development

You can scroll this table sideways

| Eligible projects | Targeted people | Social issues |

|---|---|---|

|

|

|

(2) Access to essential services

You can scroll this table sideways

| Eligible projects | Targeted people | Social issues |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Socioeconomic advancement and empowerment / regional development

You can scroll this table sideways

| Eligible projects | Targeted people | Social issues |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

3. Project evaluation and selection process

The Company has established eligibility criteria for selecting projects, and allocates funds raised through green finance, social finance, or sustainability finance to projects that meet the investment eligibility criteria.

Projects will be selected by personnel from the finance division and sustainability promotion division, and will be finalized after approval by the executive officers of the finance division and sustainability promotion division.

4. Management of funds raised

Funds raised through green finance, social finance, or sustainability finance based on the Framework are scheduled to be allocated to the project within approximately 24 months after implementation. In addition, the Group Finance Department uses the Company's internal control system to track and manage the linking of funds raised and assets, as well as the allocation of funds raised. The results of the tracking will be reviewed by the officer in charge of finance or the General Manager of the Finance Department on a quarterly basis. Until the funds are allocated, they will be managed as cash or cash equivalents.

5. Reporting

(i) Reporting on the status of allocation of funds

The following information will be disclosed on the website once a year until all funds are fully allocated. In addition, if a project eligible for the use of funds ceases to meet the eligibility criteria due to sale or other reasons prior to the repayment of the bonds or loans, the Company intends to use the funds for the acquisition of an alternative project that meets the eligibility criteria or for the refinancing of the acquisition funds.

- Projects funded by the funds raised

- Amount allocated

- Balance of unallocated funds and planned allocation dates

- Estimated amount or percentage of funds raised allocated to refinancing

(ii) Impact reporting

During the period until all of the funds raised are allocated to the target project, the following output indicators, outcome indicators, etc. will be published on the Company’s website once a year as impact reporting for the target project, within the scope of confidentiality obligations.

Green projects

You can scroll this table sideways

| Project category | Reporting items | |

|---|---|---|

| Green buildings and energy saving |

|

|

| Energy saving (renovation work) | Renovation work |

|

| Replacement of equipment |

|

|

| Renewable energy (solar power, wind power) | Project investment |

|

| Acquisition of shares |

All at the time of acquisition of shares |

|

| Storage batteries |

|

|

| Forest conservation | Expenditures related to new or existing assets in projects for creating a local recycling-oriented environment through the establishment of a local production for local consumption cycle for forest resources. |

|

| Expenditures related to forest conservation activities |

|

|

| Cost of purchasing thinned wood |

|

|

| Recycling-oriented society | Expenditures related to renovation and construction of buildings aimed at resource conservation and longer service life by utilizing existing structures |

|

| Expenditures related to the use of materials that reduce environmental impact, such as recycled materials and renewable resources |

|

|

| Expenditures related to recycling of waste |

|

|

| Biodiversity | Third-party certification acquisition/renewal expenses |

|

| Expenditures related to the development and maintenance of green spaces |

|

|

Social projects

You can scroll this table sideways

| Eligible projects | Output | Outcome | Input |

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sustainability Linked Finance Framework

1. About the Sustainability Linked Finance Framework

The Company has established a Sustainability Linked Finance Framework (hereinafter referred to as “the Framework”) to further implement initiatives based on materiality and environmental management, to gain recognition from our stakeholders for our efforts, and to sustainably enhance corporate value. This framework has been formulated to comply with the following principles and guidelines.

- ICMA Sustainability-Linked Bond Principles 2024

- LMA, APLMA and LSTA Sustainability Linked Loan Principles 2025

- Ministry of the Environment Green Bond and Sustainability Linked Bond Guidelines 2024

- Ministry of the Environment Green Loan and Sustainability Linked Loan Guidelines 2024

Additionally, we have referenced Sustainable Bonds for Nature: A Practitioner’s Guide (ICMA) for selecting KPI2 and setting SPT2 within the Framework. The Company will raise funds as nature-linked finance through sustainability linked finance using KPI2 and SPT2.

The suitability of the Framework has been assessed by Japan Credit Rating Agency, Ltd., a third-party assessment organization, and has obtained a third-party assessment. See below for details. (Japanese only)

2. KPIs

The following KPIs will be used for fundraising under sustainability linked finance based on this framework.

KPIs Used

| KPI No. | Details of KPIs | Scope |

|---|---|---|

| 1 | Reduction rate of Scope 3 CO2 emissions compared to FY 2019 | Total Scope 3 (Categories 1, 2 and 11) emissions of Tokyu Fudosan Holdings and its consolidated subsidiaries |

| 2 | Cumulative forest conservation area in the Midori wo Tsunagu Project | Cumulative area of forest conserved by the Tokyu Fudosan Holdings Group |

KPI2 is not used alone, but rather in combination with KPI1.

3. SPTs

The following SPTs will be used for fundraising under sustainability linked finance based on this framework.

SPTs Used

| SPT No. | Details of SPTs | Reference Period |

|---|---|---|

| 1 | Reduction of Scope 3 CO2 emissions by 46.2% in FY2030 with FY2019 as the baseline year | Actual results for April 1, 2030 to March 31, 2031 |

| 2 | Achievement of cumulative forest conservation area of 3,000ha in FY2030 | Actual results as of March 31, 2031 |

SPT2 is not used alone, but rather in combination with SPT1.

4. Finance Characteristics

Sustainability linked finance based on the Framework is expected to have financial and structural characteristics that change depending on the status of achievement of the SPTs. Changes in financial and structural characteristics include: (i) Donations to organizations engaged in environmental conservation activities, etc.; (ii) Emissions trading; (iii) Step-up or step-down of interest rates. Each time sustainability linked finance is carried out, disclosure will be made in the bond disclosure documents or loan agreement documents.

The figures in the SPTs may be updated in the event of significant M&A activities, substantial changes to regulatory frameworks or other systems, or the occurrence of abnormal events. If the figures in the SPTs are updated, the details of the update will be disclosed on the Company’s website.

For sustainability linked hybrid bonds or sustainability linked hybrid loans, the SPT determination date will be set by the first optional redemption date or the first optional repayment date.

5. Reporting

Starting with the fiscal year following the implementation of sustainability linked finance, the following items will be annually published on the Company’s website to the extent practicable, until the final determination date.

- Actual values for each KPI by fiscal year

- Status of achievement of each SPT by fiscal year

- Other information on the issuer’s latest sustainability strategies related to KPIs and SPTs

- Status of implementation of payment if SPTs are not achieved

When reporting, we plan to have the figures for KPIs verified annually by an independent third party until the determination date arrives, and the results of this verification will be disclosed on our website.

About the Sustainability Linked Bond

26th Bonds (Sustainability Linked Bond)

As a corporate group that continues to create value, Tokyu Fudosan Holdings resolves social issues through its business activities and aims to achieve a sustainable society and growth together with our stakeholders, as stated in its long-term GROUP VISION 2030. The Company has formulated the "WE ARE GREEN" Bond Policy, a policy for the issuance of ESG bonds for the long term, as a framework for financing under the group vision.

Under the policy, the Company will issue a sustainability-linked bond.

Overview

| Issue Name | Tokyu Fudosan Holdings Corporation 26th Unsecured Corporate Bond (limited inter-bond pari passurider) (Sustainability Linked Bond) |

|---|---|

| Pricing Date | October 5, 2021 |

| Issue Date | October 11, 2021 |

| Maturity Date | October 10, 2031 |

| Term | 10-year |

| Total Issue Amount | 10 billion yen |

| Interest Rate | 0.300% |

| Credit Rating | A(Japan Credit Rating Agency, Ltd.) |

| Conformity assessment | (i) The Sustainability-Linked Bond Principles 2020 (ICMA) (ii) Green Loan and Sustainability Linked Loan Guidelines 2020 (Ministry of the Environment) |

| SPTs | SPT1 : Reducing greenhouse gas emissions 46.2% in FY2030 SPT2 : Achieving carbon negative in FY2025 (The Company's contributions to CO2 emissions reductions, including the generation of renewable energy, exceeding its CO2 emissions) |

| Characteristics of the bond after assessment | If any failure to achieve SPTs is determined in assessment, the amounts below will be paid on the redemption date to entities to which donations are made in the Midori wo Tsunagu Project or other similar organizations making environmental contributions. SPT1 : 0.25% of the amount of issuance SPT2 : 0.25% of the amount of issuance |

| Other | The sustainability-linked bond has been chosen as a model in the Ministry of the Environment's 2021 Green Finance Model Creation Project. Its conformity is certified by Rating and Investment Information, Inc. and Green Pacific Co., Ltd., contractors of the Ministry of the Environment. The Company has received a third-party opinion from Japan Credit Rating Agency, Ltd. |

Third-Party Review Concerning Alignment

A third-party opinion by the Ministry of the Environment and its contractors (Rating and Investment Information, Inc. and Green Pacific Co., Ltd.)

http://www.env.go.jp/press/files/jp/116726.pdf (Japanese only) (1.74MB)A third-party opinion by Japan Credit Rating Agency, Ltd.

https://www.jcr.co.jp/download/483d96369addb9febe79da2a97dd5676e057d85d0d6789bb55/21d0546.pdf (Japanese only)(1.59MB)Investment Announcements for Tokyu Fudosan Holdings Corporation Sustainability Linked Bond

Please see the following investors that have announced their investments in the Tokyu Fudosan Holdings Corporation Sustainability Linked Bond

(As of October 5,2021, / Alphabetical order)

- BlackRock Japan Co., Ltd.

- FUJINOMIYA SHINKIN BANK

- Hanno Shinkin Bank

- Iwaki Shinkumi,Ltd.

- JA-aichiama

- Mitsui Sumitomo Insurance Company, Limited

- NAGANO SHINKIN BANK

- SaitamaDoctor Bank

- SHINONOME SHINKIN BANK

- The Dai-ichi Life Insurance Company, Limited

- THE GIFU SINKIN BANK

- The Prudential Life Insurance Company, Ltd.

- Tokio Marine Asset Management Co., Ltd.

- Yuki Shinkin Bank

- DaitokyoShinkumi Credit Cooperative

- HAMAMATSU IWATA SHINKIN BANK

- Iizuka Shinkin Bank

- JA GAMAGORI

- KIRYU SHINKIN BANK

- Miyazaki Daiichi Shinkin Bank

- Nissay Asset Management Corporation

- Shinkin Central Bank

- SUWA SHINKIN BANK

- The Gamagori Shinkin Bank

- THE KURE SHINKIN BANK

- The Seto Shinkin Bank

- Tokyo City Shinkin Bank

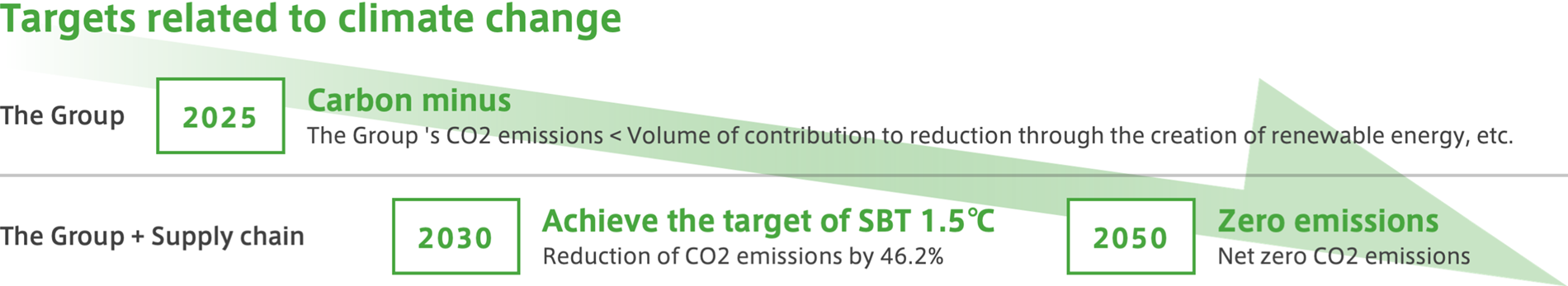

Targets and SPTs related to climate change in the Company's environmental management

Donations as part of the characteristics of the bond

The Midori wo Tsunagu Project chooses alliances in its forest conservation activities in consideration of the following: (i) appropriate management, (ii) records of use of produced wood, (iii) promotion of decarbonization (including use of J-Credit System), and (iv) initiatives to achieve the SDGs. The Company will continue to choose entities to which it will make donations, based on similar considerations if it fails to achieve SPTs.

For detailed information, visit the websites below.

Background and purpose of the formulation of long-term vision GROUP VISION 2030

Achieving SBT certification and signing the Business Ambition for 1.5°C

The Midori wo Tsunagu Project

News Release

The sole purpose of the creation of this information is disclosing information on the issuance of bonds by the Company. It is not created for any solicitation of investment or similar acts in Japan or overseas.

Reporting, Verification Report

| 2021 | |

|---|---|

| 2022 | |

| 2023 | |

| 2024 |

4th Publicly Offered Hybrid Bonds

(Climate Change/Forest Conservation Target Achievement Bonds)

Tokyu Fudosan Holdings Corporation(“the Company”) has made environmental management the group policy in Long-Term Management Policy and Medium-Term Management Plan 2030, and is aiming to expand business opportunities with the environment as a starting point through proactive initiatives to address the three key environmental issues of “Decarbonized society,” “Recycling-based society,” and “Biodiversity conservation.” The Bonds were issued as “Climate/Nature-Linked Bonds” with KPIs and SPTs set in the areas of both “Decarbonized society” and “Biodiversity conservation” conservation to clearly demonstrate the Company’s commitment to solving environmental issues.

For this issuance, the Group has developed a Sustainability Linked Finance Framework that is compatiblewith the ICMA’s Sustainability-Linked Bond Principles 2024, the LMA/APLMA/LSTA Sustainability Linked Loan Principles 2025, the Ministry of the Environment’s Green Bond and Sustainability Linked Bond Guidelines 2024, and the Green Loan and Sustainability Linked Loan Guidelines 2024. Furthermore,Sustainable Bonds for Nature: A Practitioner’s Guide published by ICMA was use as a reference for the formulation of the framework.

Overview

| Issue Name | 4th Series Deferrable Interest and Callable Unsecured Subordinated Bonds (Climate/Nature-Linked Bonds) |

|---|---|

| Alternate name | Climate Change/Forest Conservation Target Achievement Bonds |

| Pricing Date | December 5, 2025 |

| Issue Date | December 16, 2025 |

| Maturity Date | December 15, 2062 |

| Optional Early Redemption | The bonds may be redeemed prior to maturity at the discretion of the Company on any interest payment date on or after December 16, 2032 |

| Total Issue Amount | 40 billion yen |

| Interest rate | 2.753% per annum (※) |

| Credit Rating | A-(Japan Credit Rating Agency, Ltd.) |

| KPIs | KPI1: Reduction rate of Scope 3 (Categories 1, 2, and 11) CO2 emissions compared to FY2019 KPI2: Cumulative forest conservation area in the Green Connection Project |

| SPTs | SPT1: Reduction of CO2 emissions in Scope 3 (Categories 1, 2, and 11) by 46.2% in FY2030 with FY2019 as the baseline year (reference period: April 1, 2030 to March 31, 2031) SPT2: Achievement of cumulative forest conservation area of 3,000ha in FY2030 (reference point: March 31, 2031) |

| Bond characteristics after assessment | If SPT1 is not achieved, an amount equivalent to 0.05% of the issue amount, and if SPT2 is not achieved, an amount equivalent to 0.05% of the issue amount will be donated by the redemption date of the Bonds to donation recipients related to the “Green Connection Project” or organizations, etc. that aim to conduct similar environmental conservation activities, etc. |

The fixed interest rate shall be applied from the day immediately following December 16, 2025 until December 16, 2032 and variable interest rates shall be applied from the day immediately following December 16, 2032 (Coupon Step-up shall be effective on December 17, 2032)

Third-Party Review Concerning Alignment

the Sustainability Link Finance Framework Evaluation by Japan Credit Rating Agency, Ltd. (Japanese only) (3.3MB)Press releases

About the Sustainability Bond

2nd Publicly Offered Hybrid Bonds

Tokyu Fudosan Holdings Corporation (“the Company”) addresses social issues through its business operations, with the aim of realizing a sustainable society and continuously creating value of the Tokyu Fudosan Holdings Group (“the Group”).

The Company has decided to issue a Sustainability Bond in order to more widely communicate the Group’s initiatives for addressing the environmental and social issues to broader stakeholders and contribute to the realization of a sustainable society through the projects financed with the proceeds from the bonds.

The issuance of the Sustainability Bonds is based on the Company’s Sustainability Finance Framework formulated in line with the “Green Bond Principles 2018,” the “Social Bond Principles 2018,” the “Sustainability Bond Guidelines 2018” and the “Green Loan Principles 2018” published by the International Capital Market Association (“IMCA”) and the “Green Bond Guidelines 2020” published by Japan’s Ministry of the Environment and has obtained an evaluation from a third-party assessment agency to verify the alignment with such principles and guidelines.

Overview

| Issue Name | Tokyu Fudosan Holdings Corporation the 2nd Unsecured Subordinated Bonds with the Optional Interest Payment Deferral and Optional Early Redemption Clauses (Sustainability Bond) |

|---|---|

| Pricing Date | December 9, 2020 |

| Issue Date | December 17, 2020 |

| Maturity Date | December 17, 2060 |

| Optional Early Redemption | The bonds may be redeemed prior to maturity at the discretion of the Company on any interest payment date on or after December 17, 2030 |

| Total Issue Amount | 30 billion yen |

| Interest rate | 1.24% per annum (*1) |

| Use of Proceeds | All funds were fullly allocated to the redemption funds of the commercial paper, for the refinancing funds related to expenditures or investments concerning the existing or new assets of the five projects: 1. TOKYO PORTCITY TAKESHIBA; 2. Kudan Minami 1-chome Project (tentative name); 3. Membership-based Shared Office Business, “Business-Airport;” 4. Start-up Support and Co-creation Business; and 5. Senior Housing Business. |

| Credit Rating | BBB+ (Japan Credit Rating Agency, Ltd.) |

(*1)The fixed interest rate shall be applied from the day immediately following December 17, 2020 until December 17, 2030 and variable interest rates shall be applied from the day immediately following December 17, 2030 (Coupon Step-up shall be effective on December 18, 2030)

Third-Party Review Concerning Alignment

Investment Announcements for Tokyu Fudosan Holdings Corporation Sustainability Bond

Please see the following investors that have announced their investments in the Tokyu Fudosan Holdings Corporation Sustainability Bond

(As of December 9, 2020 / Alphabetical order)

- Akita Shinkin Bank

- Asahi Mutual Life Insurance Company

- Asset Management One Co., Ltd.

- Daiwa Asset Management Co.Ltd.

- ECHIZEN SHINKIN BANK

- Fukue Shinyokumiai

- FUKUOKA HIBIKI SHINKIN BANK

- GUNMAMIRAI Shinkumi Bank.

- Himifusiki Shinkin Bank

- Hokkaido Zennsinnbunnhannbaijuugyouinnfukurikyoukai

- Ichinoseki Shinkin Bank

- IIDA SHINKIN BANK

- KANAGAWA PREFECTURAL CREDIT FEDERATION OF AGRICULTURAL CO-OPERATIVES

- KITAMI SHINKIN BANK

- Koto Shinkin Bank

- Kyoei Community Bank

- Manulife Investment Management (Japan) Limited

- Medical Corporation Nanzankai

- Meiji Gakuin Educational Foundation

- Meiji Yasuda Asset Management Company Ltd.

- Midori Life Insurance Co., Ltd.

- Mitsubishi UFJ Trust and Banking Corporation

- Moka Shinkumi Bank

- Nagahama Shinkin Bank

- Nagano Prefecture credit federation of agricultural cooperatives

- Nagaoka Shinkin Bank

- NAGASAKI MITSUBISHI CREDIT UNION

- Niigata credit union

- Niigata daiei shinkumi bank

- NISHI CHUGOKU SHINKIN BANK

- Nishihyogo Shinkin Bank

- Public Corporation for Housing Improvement and Development

- SAGA PREFECTURAL CREDIT FEDERATION OF AGRICULTURAL COOPERATIVES

- SAGAHIGASHI SHINYOUKUMIAI

- Seiwa Shinkumi Bank

- Sumitomo Mitsui DS Asset Management Company, Limited

- Sumitomo Mitsui Trust Asset Management Co., Ltd.

- TAIYO LIFE INSURANCE COMPANY

- The Aichi Bank, Ltd.

- The Aichikenchuo Credit cooperative

- THE CHUNICHI SHINKIN BANK

- The Ishinomaki Shinkin Bank

- The Kimitsu Credit Cooperative

- THE MISHIMA SHINKIN BANK

- THE MIZUSAWA SHINKIN BANK

- The Nara Shinkin Bank

- THE SANJO SHINKIN BANK

- THE TANYO SHINKIN BANK

- THE YAMATO SHINKIN BANK

- Tokio Marine Asset Management Co., Ltd.

- Toryo Shinkumi

Allocation Report

On March 12, 2021, the proceeds from this sustainability bond were fully allocated to redemption of existing commercial paper to refinance the construction funds related to the five projects: "TOKYO PORTCITY TAKESHIBA"; "KUDAN-KAIKAN TERRACE"; Membership Shared Office Business, “Business-Airport”; Support For Start-ups and Co-creation Business; and Senior Housing Business.

| Proceeds from this sustainability bond (After deducting the estimated issuance expenses) |

Appropriations Used |

|---|---|

| JPY 29,711 million | The "TOKYO PORTCITY TAKESHIBA" : JPY 12,000 million |

| The "KUDAN-KAIKAN TERRACE" : JPY 4,000 million | |

| Membership Shared Office Business, the “Business-Airport” : JPY 1,000 million | |

| Support for Start-ups and Co-creation Business : JPY 300 million | |

| Senior Housing Business : JPY 12,411 million |

Sustainability projects to be financed with the proceeds from the Sustainability Bonds

TOKYO PORTCITY TAKESHIBA

TOKYO PORTCITY TAKESHIBA is a large-scale complex construction project that aims to connect people, information and businesses across the world with a focus on “Digital x Content,” creating a new lifestyle where people live close to their workplaces. The project develops an international business base by utilizing the land owned by the Tokyo metropolitan government and promotes the area management through an industry-government-academia collaboration.

For an overview of the project, please refer to the following news release.

Social initiatives taken in the TOKYO PORTCITY TAKESHIBA

- Secures space for accepting stranded commuters in the event of a disaster

- Provides storage warehouses for emergency supplies

- Furnishes child-rearing support facilities

- Develops barrier-free facilities designed to improve convenience of elderly and disabled people

Environmental initiatives taken in the TOKYO PORTCITY TAKESHIBA

DBJ Green Building Certification 5 Stars

The property has been certified as Japan’s top-class environmentally and socially conscious building under the “DBJ Green Building Certification,” the certification system established by Development Bank of Japan to certify real estate demonstrating exceptional environmental and social considerations.

KUDAN-KAIKAN TERRACE

KUDAN-KAIKAN TERRACE opened on October 1, 2022 (Saturday) as a multi-use facility consisting of 17 floors above ground and 3 floors below with a total square foot of approximately 68,000m2, including office and commercial facilities. Based on the concept of "retro-modernism in bloom along the waterfront," the former Kudan Kaikan, a registered tangible cultural property, was partially preserved while being reconstructed to embody various contemporary needs, including the use of the latest technology and corporate health management.

For an overview of the project, please refer to the following news release.

Social initiatives taken in KUDAN-KAIKAN TERRACE

- Secures space for accepting stranded commuters in the event of a disaster

- Provides storage warehouses for emergency supplies

- Develops barrier-free facilities designed to improve convenience of elderly and disabled people

Environmental initiatives taken in KUDAN-KAIKAN TERRACE

DBJ Green Building Plan Certification 5 Stars

The project has been certified as a construction plan for Japan’s top-class environmentally and socially conscious building under the “DBJ Green Building Plan Certification,” the certification system established by Development Bank of Japan to certify real estate demonstrating exceptional environmental and social considerations.

Membership Shared Office Business, “Business-Airport;”

The Group operates the membership shared office business, “Business-Airport” in Shibuya, Ebisu, Marunouchi and other centers of business in Tokyo to offer quality workplaces to all businesspersons seeking growth.

For an overview of the business, please visit the following website.

Social initiatives taken in the Membership Shared Office Business ”Business-Airport”

- Provides basic infrastructure for start-ups to pursue business opportunities and growth

- Provides places enabling business start-ups to exchange information and collaborate with each other as well as interact with major corporations and investors

Support For Start-ups and Co-creation Business

The Group operates its co-creation facilities supporting business start-ups in the greater Shibuya area under the brands of “Plug and Play Shibuya Powered by Tokyu Land Corporation” and “GUILD.” The purpose of the project is to attract start-ups to the greater Shibuya area and facilitate them to create their open innovation capabilities. Additionally, the Group aims to develop an innovation (venture) eco system that underpins growth of quality small-to-medium-sized companies through partnerships with venture capitals and financial assistance for start-ups.

For an overview of the business, please visit the following website.

Social initiatives taken in the Support For Start-ups and Co-creation Business

- Provides basic infrastructure for start-ups to pursue business opportunities and growth

- Provides places enabling business start-ups to exchange information and collaborate with each other as well as interact with major corporations and investors

Senior Housing Business

The Group operates the “Grancreer” senior housing series offering senior residences (for self-supporting residents) and nursing homes (for residents needing nursing care), with the aim of creating housing that enables senior citizens to enjoy their own lifestyles. Particularly, Grancreer Setagaya Nakamachi and Creer Residence Yokohama Tokaichiba are complexes of senior residences and general condominiums for sale, developed based on the concept of facilitating communications among generations in order to realize the “Intergenerational Interactive City Development.”

For an overview of the business, please visit the following website.

Social initiatives taken in the Senior Housing Business

- Provides barrier-free facilities indispensable for senior citizens

- Offers 24-hour 365-day nursing care services (nursing home)

- Offers compound facilities consisting of senior residences for self-supporting residents and nursing homes

30th Bonds (Kudan-Kaikan Terrace Sustainability Bonds)

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the Kudan-Kaikan Terrace Sustainability Bonds (hereinafter referred to as the “Sustainability Bonds”).

The Sustainability Bonds are based on the Sustainability Finance Framework in accordance with the International Capital Market Association (ICMA) Green Bond Principles 2018, Social Bond Principles 2018, and Sustainability Bond Guidelines 2018, the Green Loan Principles 2018 issued by the Loan Market Association (LMA) and the Asia-Pacific Loan Market Association (APLMA), and the Green Bond Guidelines 2020 issued by the Ministry of the Environment.

Overview

You can scroll this table sideways

| Tokyu Fudosan Holdings Corporation 30th Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Sustainability Bonds) Alternate name: Kudan-Kaikan Terrace Sustainability Bonds |

|

|---|---|

| Pricing date | May 26, 2023 |

| Issue date | June 1, 2023 |

| Maturity date | June 1, 2033 |

| Term | 10 years |

| Total issue amount | 10 billion yen |

| Interest rate | 0.880% |

| Use of funds | Refinancing funds to be allocated for equipment costs for Kudan-Kaikan Terrace |

| Bond rating | A (Japan Credit Rating Agency) |

Third-party evaluation of conformity, etc.

Status of allocation of funds

The proceeds from the Sustainability Bonds were used in full on September 29, 2023, as part of the repayment of borrowings for the refinancing of funds for the equipment costs for Kudan-Kaikan Terrace.

| Funds raised through the Sustainability Bonds (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,947 million yen | Refinancing for equipment costs for the Kudan-Kaikan Terrace: 9,947 million yen |

Kudan-Kaikan Terrace Project

The Kudan-Kaikan Terrace is a multi-use facility comprising 17 floors above ground and three floors below ground, with a total floor area of approximately 68,000m2, including offices and commercial facilities. It opened on Saturday, October 1, 2022. Based on the concept of “retro-modern blooming by the water,” this retro-modern facility was rebuilt while preserving part of the former Kudan Kaikan, a registered cultural property, and incorporating the latest technology and corporate health management to meet various modern needs.

Please refer to the following release for an overview of the project.

Kudan-Kaikan Terrace’s initiatives to address social issues

- Provision of spaces to accommodate people unable to return home

- Provision of disaster preparedness supply stockpile warehouses

- Provision of emergency power supply during power outages

Kudan-Kaikan Terrace’s environmental initiatives

DBJ Green Building Certification (five stars)

The Development Bank of Japan has certified the building as one of the top buildings in Japan in terms of environmental and social considerations under its DBJ Green Building Certification, which certifies real estate with exceptional environmental and social considerations.

Association for Business Innovation in harmony with Nature and Community® Certification (ABINC Certification)

JBIB (Japan Business Initiative for Biodiversity) has received Association for Business Innovation in harmony with Nature and Community Certification (ABINC Certification), which evaluates and certifies office buildings, factories, commercial facilities, and other establishments that are committed to creating green spaces that take biodiversity into consideration.

EDO-MIDORI Registered Green Spaces (Excellent Green Space)

The Tokyo Metropolitan Government has registered and announced green spaces where native species are actively planted, and biodiversity conservation efforts are being made under the EDO-MIDORI Registered Green Spaces system. Among these, this green space has been registered as an Excellent Green Space for its outstanding qualities.

Press releases

Reporting

32nd Bonds (Forestgate Daikanyama Sustainability Bonds)

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the Forestgate Daikanyama Sustainability Bonds (hereinafter referred to as the “Sustainability Bonds”).

The Sustainability Bonds are based on the Sustainability Finance Framework in accordance with the International Capital Market Association (ICMA) Green Bond Principles 2024, Social Bond Principles 2023, and Sustainability Bond Guidelines 2021, the Green Loan Principles 2023 and the Social Loan Principles 2023 issued by the Loan Market Association (LMA) and the Asia-Pacific Loan Market Association (APLMA), the Green Bond Guidelines 2024 and Green Loan Guidelines 2024 issued by the Ministry of the Environment, and the Social Bond Guidelines 2021 issued by the Financial Services Agency.

Overview

You can scroll this table sideways

| Tokyu Fudosan Holdings Corporation 32nd Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Sustainability Bonds) Alternate name: Forestgate Daikanyama Sustainability Bonds |

|

|---|---|

| Pricing date | July 9, 2025 |

| Issue date | July 15, 2025 |

| Maturity date | July 13, 2035 |

| Term | 10 years |

| Total issue amount | 10 billion yen |

| Interest rate | 2.045% |

| Use of funds |

|

| Bond rating | A+ (Japan Credit Rating Agency) |

Third-party evaluation of conformity, etc.

Status of allocation of funds

All of the funds raised through the Sustainability Bonds was used as part of the repayment of borrowings on September 30, 2025, as stated below.

| Funds raised through the Sustainability Bonds (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,947 million yen | Refinancing funds to be allocated for equipment costs for Forestgate Daikanyama (Main Building): 8,942 million yen |

| Refinancing funds to be allocated for equipment costs for Forestgate Daikanyama (TENOHA Building): 1,000 million yen Cost of purchasing thinned wood included therein: 6 million yen |

|

| Refinancing funds for environmental education event expenses at Forestgate Daikanyama: 5 million yen |

Sustainability projects for which the funds from the Sustainability Bonds were used

Forestgate Daikanyama

Forestgate Daikanyama is a new mixed-use facility that embodies the concept of “work, live, and play” in close proximity, with a focus on “green/environmental sustainability” and “food” as keywords, offering a rich and new lifestyle. It opened on October 19, 2023. The facility consists of two buildings: the MAIN building, which comprises rental apartments, shared offices, and commercial facilities, and the TENOHA building (TENOHA Daikanyama), a two-story wooden building constructed using thinned wood from Nishiawakura Village in Okayama Prefecture. The interior of the building has a forest-like atmosphere, allowing visitors to feel close to nature anywhere.

For details on the facility, please refer to the facility website below.

Forestgate Daikanyama’s initiatives to address social issues

-

Provision of TENOHA facilities as part of initiatives for regional revitalization

「The TENOHA building (TENOHA Daikanyama) is a hub that provides users with opportunities to encounter and learn about sustainable initiatives, as well as offering a new lifestyle. The space consists of a cafe based on the theme of the local charm and cycle of Daikanyama, an event space where you can enjoy workshops and markets, and shops. -

Provision of events on environmental education (TENOHA Building)

Tokyu Land Corporation is implementing an environmental education program called “ReENE ÉCOLE” with the aim of enabling children across Japan to learn about environmental issues centered on renewable energy in an enjoyable way. In November 2024, ReENE ÉCOLE was held at TENOHA Daikanyama, with 55 participants. -

Provision of membership-based Business-Airport shared office space (Business-Airport Daikanyama)

Business-Airport provides high-quality workspaces for all business professionals seeking to take their careers to the next level, with locations in Shibuya, Ebisu, Marunouchi, and other areas. Business-Airport Daikanyama is located on the third floor of the Forestgate Daikanyama MAIN Building in a prime location just a 1-minute walk from Daikanyama Station, providing an office space offering both convenience and an environment conducive to concentrating.

Forestgate Daikanyama’s environmental initiatives

-

Planning to obtain DBJ Green Building certification (MAIN Building)

The building is planned to be certified by the Development Bank of Japan as one of the top buildings in Japan in terms of environmental and social considerations under its DBJ Green Building Certification, which certifies real estate with excellent environmental and social considerations. -

BELS (Building-Housing Energy-efficiency Labeling System) 5-star rating (TENOHA building)

The building obtained a 5-star rating in BELS (Building-Housing Energy-efficiency Labeling System). -

Sustainable construction utilizing thinned wood from preserved forests in Nishiawakura Village, Okayama Prefecture (TENOHA Building)

The TENOHA building is a two-story wooden structure built using timber from forest thinning in Nishiawakura Village in Okayama Prefecture. The design was handled by SUEP., an architectural unit that specializes in environmental architectural design that harmonizes nature and architecture. The TENOHA building is designed to connect the community and the city, with the intent that it will become a place where sustainable life experiences can flourish. The TENOHA building itself is sustainable and designed to be relocated without wasting materials, reflecting the attention to detail and thought that went into it as hardware in the form of a building.

Press releases

About the Green Bond

27th Bonds and 28th Bonds (ReENE Green Bonds) ※27th Bonds have already matured

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the ReENE Green Bonds (hereinafter referred to as the “Green Bonds”).

The Green Bonds are based on the Sustainability Finance Framework in accordance with the International Capital Market Association (ICMA) Green Bond Principles 2018, Social Bond Principles 2018, and Sustainability Bond Guidelines 2018, the Green Loan Principles 2018 issued by the Loan Market Association (LMA) and the Asia-Pacific Loan Market Association (APLMA), and the Green Bond Guidelines 2020 issued by the Ministry of the Environment.

Overview

You can scroll this table sideways

| Tokyu Fudosan Holdings Corporation 27th Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Green Bonds) Alternate name: ReENE Green Bonds |

Tokyu Fudosan Holdings Corporation 28th Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Green Bonds) Alternate name: ReENE Green Bonds |

|

|---|---|---|

| Pricing date | February 22, 2023 | |

| Issue date | March 1, 2023 | |

| Maturity date | February 27, 2026 | March 1, 2028 |

| Term | 3 years | 5 years |

| Total issue amount | 10 billion yen | 10 billion yen |

| Interest rate | 0.320% | 0.694% |

| Use of funds |

The entire amount will be used as part of the repayment funds for commercial paper to refinance the equipment costs for the above power plants. |

The entire amount will be used as part of the repayment funds for commercial paper to refinance the equipment costs for the above power plants. |

| Bond rating | A (Japan Credit Rating Agency) | |

A portion of the funds originally allocated for the ReENE Ube Solar Power Plant has been reallocated to the ReENE Choshi Solar Power Plant.

Third-party evaluation of conformity, etc.

Status of allocation of funds

Tokyu Fudosan Holdings Corporation 27th Unsecured Bonds

| Funds raised (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,958 million yen | ReENE Namegata Solar Power Plant: 8,800 million yen |

| ReENE Choshi Solar Power Plant: 490 million yen | |

| Nogata Solar Power Plant: 420 million yen | |

| ReENE LOGI’Q Kyoto Kumiyama Solar Power Plant: 70 million yen | |

| ReENE CPD Hirakata Solar Power Plant: 178 million yen |

A portion of the funds originally allocated for the ReENE Ube Solar Power Plant has been reallocated to the ReENE Choshi Solar Power Plant.

Tokyu Fudosan Holdings Corporation 28th Unsecured Bonds

| Funds raised (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,953 million yen | Noheji Mutsu Bay Wind Farm: 2,240 million yen |

| ReENE RJ South Kyushu Solar Power Plant:1,770 million yen | |

| ReENE Chonan Solar Power Plant: 1,390 million yen | |

| ReENE RJ Urushihara Solar Power Plant: 1,730 million yen | |

| Nishigohabuto Solar Power Plant: 450 million yen | |

| ReENE Tamano Solar Power Plant: 2,120 million yen | |

| ReENE Shibayama Golf Club Solar Power Plant: 150 million yen | |

| ReENE Sashima Country Club Solar Power Plant: 103 million yen |

Renewable Energy Business (ReENE)

Tokyu Land Corporation runs a renewable energy business under the ReENE brand, which was launched in 2018 by combining two ambitions: Re-Creating the Value, and Edit Next Energy.

Tokyu Land will further drive the growth of renewable energy and offer renewable-energy-based solutions to local communities.

Press releases

Reporting

29th Bonds (COCONO SUSUKINO Green Bonds)

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the COCONO SUSUKINO Green Bonds (hereinafter referred to as the “Green Bonds”).

The Green Bonds are based on the Sustainability Finance Framework in accordance with the International Capital Market Association (ICMA) Green Bond Principles 2018, Social Bond Principles 2018, and Sustainability Bond Guidelines 2018, the Green Loan Principles 2018 issued by the Loan Market Association (LMA) and the Asia-Pacific Loan Market Association (APLMA), and the Green Bond Guidelines 2020 issued by the Ministry of the Environment.

Overview

You can scroll this table sideways

| Tokyu Fudosan Holdings Corporation 29th Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Green Bonds) Alternate name: COCONO SUSUKINO Green Bonds |

|

|---|---|

| Pricing date | May 26, 2023 |

| Issue date | June 1, 2023 |

| Maturity date | June 1, 2028 |

| Term | 5 years |

| Total issue amount | 10 billion yen |

| Interest rate | 0.450% |

| Use of funds | Allocated as refinancing funds for equipment for COCONO SUSUKINO |

| Bond rating | A (Japan Credit Rating Agency) |

Third-party evaluation of conformity, etc.

Status of allocation of funds

The proceeds from the Green Bonds were used in full on September 29, 2023, as part of the repayment of borrowings for the refinancing of funds for the equipment costs for COCONO SUSUKINO.

| Funds raised through the Sustainability Bonds (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,953 million yen | Refinancing funds for equipment costs for COCONO SUSUKINO: 9,953 million yen |

COCONO SUSUKINO Project

COCONO SUSUKINO was opened on November 30, 2023 (Thu) as a commercial complex that will serve as a new Susukino landmark based on the aim of bringing a playground to the city of Sapporo and making Susukino a town that is active in the daytime as well.

The commercial complex hosts a lifestyle hotel by Tokyu Hotels & Resorts Co., Ltd., a cinema complex by TOHO Cinemas Ltd., a food supermarket by DAIICHI CO., LTD., a cosmetics & drug store by Ain Pharmaciez Inc., amusement offerings by GENDA GiGO Entertainment Inc., other F&B/merchandise sales/service establishments, and entertainment offerings, making it a facility where one can get a sense of that “play” for themselves.

Please refer to the following release for an overview of the project.

COCONO SUSUKINO’s environmental initiatives

Obtained 5 stars under the Building-Housing Energy-efficiency Labeling System (BELS) and ZEB Ready(*1) certification

- In addition to receiving a 5-star rating under the Building-Housing Energy-efficiency Labeling System (BELS), the facility obtained ZEB Ready certification for the entire commercial and hotel complex (*2), which is the largest scale in Japan (*3).

※1ZEB is short for Net Zero Energy Building. ZEB Ready refers to a building whose primary energy consumption has been reduced by 50% or more using power-saving technology

※2F&B establishments, department stores, meeting places, hotels, etc.

※3Total floor area used for scale criteria. According to “BELS Example Data List” from The Association for Evaluating and Labeling Housing Performance’s website (as of February 28, 2022).

Press releases

Reporting

3rd Publicly Offered Hybrid Bonds (RJ ReENE Green Bonds)

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the RJ ReENE Green Bonds (hereinafter referred to as the “Green Bonds”).

The Green Bonds will be issued based on a Sustainability Finance Framework that complies with the following principles and guidelines.

- ICMA Green Bond Principles 2021

- ICMA Social Bond Principles 2023

- ICMA Sustainability Bond Guidelines 2021

- LMA, APLMA, LSTA Green Loan Principles 2023

- LMA, APLMA, LSTA Social Loan Principles 2023

- Ministry of Environment Green Bond Guidelines 2024

- Ministry of Environment Green Loan Guidelines 2024

- Financial Services Agency Social Bond Guidelines 2021

Overview

You can scroll this table sideways

| 3rd Series Deferrable Interest and Callable Unsecured Subordinated Bonds (Green Bonds) Alternate name: RJ ReENE Green Bonds |

|

|---|---|

| Pricing date | March 7, 2025 |

| Issue date | March 13, 2025 |

| Maturity date | March 12, 2060 |

| Early redemption | Early redemption possible at the discretion of the Company on each interest payment date from March 13, 2030 |

| Total issue amount | 40 billion yen |

| Interest rate | 2.208% per annum (*) |

| Use of funds |

The funds will be used for new financing or refinancing for expenditures for the above-mentioned share acquisition and power plant equipment costs. Until the actual allocation date, the funds will be managed as cash or cash equivalents. |

| Bond rating | A- (Japan Credit Rating Agency) |

The interest rate will be fixed from the day after March 13, 2025 until March 13, 2030, and the interest rate will be variable from the day after March 13, 2030, (with an interest rate step-up occurring on March 14, 2030).

Third-party evaluation of conformity, etc.

Status of allocation of funds

| Funds raised through the Green Bonds (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 39,666 million yen | Refinancing funds for acquisition of shares in Renewable Japan Co., Ltd.: 22,000 million yen |

| New investment funds for acquisition of shares in Renewable Japan Co., Ltd.: 3,000 million yen | |

| Refinancing funds for equipment costs for ReENE Ebino Solar Power Plant: 7,160 million yen | |

| Refinancing funds for equipment costs for ReENE Izumi Solar Power Plant: 4,770 million yen | |

| Refinancing funds for equipment costs for Valdecarretas Solar Power Plant: 1,256 million yen | |

| Refinancing funds for equipment costs for Manzanares Solar Power Plant: 1,250 million yen | |

| Refinancing funds for equipment costs for ReENE LOGI’Q Shiraoka II Solar Power Plant: 230 million yen |

Green projects for which RJ ReENE Green Bonds were used

Acquisition of shares in Renewable Japan Co., Ltd.

- In order to swiftly respond to rapid changes in the market environment and structure of the renewable energy business, as well as intensification of competition due to the entry of new players, Renewable Japan Co., Ltd. will be acquired through a tender offer to make it a consolidated subsidiary.

- Renewable Japan Co., Ltd. is engaged in various renewable energy businesses, including the development, power generation, operation, and management (asset management/O&M) of renewable energy power plants such as solar power, wind power, and hydroelectric power.

Please refer to the following release for an overview of the share acquisition.

Renewable Energy Business (ReENE)

Tokyu Land Corporation runs a renewable energy business under the ReENE brand, which was launched in 2018 by combining two ambitions: Re-Creating the Value, and Edit Next Energy.

Tokyu Land will further drive the growth of renewable energy and offer renewable-energy-based solutions to local communities.

Press releases

31st Bonds (Greater Shibuya Area Biodiversity Green Bonds)

The Company aims to solve social issues through its business in order to realize a sustainable society and enhance the value of the Group. In order to further raise awareness among a wide range of stakeholders of our proactive stance and initiatives toward ESG, we have decided to issue the Greater Shibuya Biodiversity Green Bonds (hereinafter referred to as the “Green Bonds”).

The Green Bonds are based on the Sustainability Finance Framework in accordance with the International Capital Market Association (ICMA) Green Bond Principles 2024, Social Bond Principles 2023, and Sustainability Bond Guidelines 2021, the Green Loan Principles 2023 and the Social Loan Principles 2023 issued by the Loan Market Association (LMA) and the Asia-Pacific Loan Market Association (APLMA), the Green Bond Guidelines 2024 and Green Loan Guidelines 2024 issued by the Ministry of the Environment, and the Social Bond Guidelines 2021 issued by the Financial Services Agency.

Overview

You can scroll this table sideways

| Tokyu Fudosan Holdings Corporation 31st Unsecured Corporate Bonds (with limited inter-bond pari passu rider) (Green Bonds) Alternate name: Greater Shibuya Area Biodiversity Green Bonds |

|

|---|---|

| Pricing date | July 9, 2025 |

| Issue date | July 15, 2025 |

| Maturity date | July 12, 2030 |

| Term | 5 years |

| Total issue amount | 10 billion yen |

| Interest rate | 1.374% |

| Use of funds |

|

| Bond rating | A+ (Japan Credit Rating Agency) |

Third-party evaluation of conformity, etc.

Status of allocation of funds

A portion of the funds raised through the Green Bonds was used as part of the repayment of borrowings on September 30, 2025, as stated below.

| Funds raised through the Green Bonds (After deducting estimated issuance costs) |

Amount allocated |

|---|---|

| 9,953 million yen | Refinancing funds for equipment costs for Shibuya Sakura Stage (District A, District B): 9,922 million yen |

| Greenery maintenance expenses for Shibuya Sakura Stage: 10 million yen (scheduled to be allocated within 1 year of issue date) | |

| Greenery maintenance expenses for Tokyu Plaza Harajuku Harakado: 8 million yen (scheduled to be allocated within 1 year of issue date) | |

| Greenery maintenance expenses for Forestgate Daikanyama: 7 million yen (scheduled to be allocated within 1 year of issue date) | |

| Greenery maintenance expenses for Shibuya Solasta: 5 million yen (scheduled to be allocated within 1 year of issue date) | |

| Greenery maintenance expenses for Tokyu Plaza Omotesando Omokado: 0.8 million yen (scheduled to be allocated within 1 year of issue date) |

Green projects for which the Green Bonds will be used

Shibuya Sakura Stage

Shibuya Sakura Stage fully opened on July 25 2024 as a new landmark in Shibuya with the aim of being the “birth of a new gateway to Shibuya - a pleasant place to walk around.”

As the final piece of the large-scale development of the central district of Shibuya Station, said to be a once in a century occurrence, the facility was created to improve accessibility and circulation around the station and to serve as a hub for new trends and culture. Adjacent to Shibuya Station, one of Japan's most iconic terminal stations, the facility is located on a site approximately 2.6 hectares in size in the Sakuragaoka area, and offers easy access to Daikanyama and Ebisu. Together with other facilities in the central district of Shibuya Station, it will enhance international competitiveness by expanding transportation infrastructure, introducing various functions to improve hub functionality, and strengthening disaster prevention capabilities.

For details on the facility, please refer to the facility website below.

Shibuya Sakura Stage’s environmental initiatives

-

Highest S rank (District A) and A rank (District B) in CASBEE (Comprehensive Assessment System for Built Environment Efficiency)

In CASBEE (Comprehensive Assessment System for Built Environment Efficiency) certification, District A (SHIBUYA side) has been awarded an S rank and District B (SAKURA side) has been awarded an A rank, recognizing the high level of sustainability and other environmental initiatives of the buildings. -

Green space that takes biodiversity into consideration

The outdoor plaza, Hagukumi STAGE, features lush greenery, fruit trees, vegetable gardens, and towering mountain cherry trees that serve as a symbol of the facility. It fosters healthy mental space for people in the heart of the metropolis, and embodies biodiversity in the Greater Shibuya area.

Tokyu Plaza Harajuku Harakado

Tokyu Plaza Harajuku Harakado opened on April 17, 2024, with the aim of creating a new place where people can experience and enjoy Harajuku culture that stimulates the senses of a diverse range of people.

Tokyu Plaza Harajuku Harakado’s environmental initiatives

-

Establishment of green space that takes biodiversity into consideration

This facility has a lush rooftop terrace overlooking Tokyu Plaza Omotesando Omokado’s Omohara no Mori, located across Jingumae intersection. In the heart of the city, the rare green space with lush gardens spreads out, featuring plantings of foreign tree species and herbs, as well as artificial ground green spaces, which contribute to the well-being of visitors and support biodiversity and green space expansion in the Greater Shibuya area.

Forestgate Daikanyama

Forestgate Daikanyama is a new mixed-use facility that embodies the concept of “work, live, and play” in close proximity, with a focus on “green/environmental sustainability” and “food” as keywords, offering a rich and new lifestyle. It opened on October 19, 2023.

Forestgate Daikanyama’s environmental initiatives

-

Establishment of green space that takes biodiversity into consideration

When you step into Forestgate Daikanyama, the first thing you notice is the abundance of greenery. It is overflowing with greenery both indoors and outdoors. The green design of the facility was handled by SOLSO, which is involved in all aspects of green-related businesses, from plant production and purchasing to design, construction and maintenance, and features many native species, especially trees and seasonal flowers found in the Daikanyama area.

Shibuya Solasta

Shibuya Solasta was completed in March 2019 with the aim of realizing the office building concept of “building smiles—making people who work smile.”

Shibuya Solasta’s environmental initiatives

-

Establishment of green space that takes biodiversity into consideration

The facility promotes environmentally conscious activities such as installing birdhouses on the Sky Terrace, preserving trees (ubame oak) planted on the roof of the Shin-nanpeidai Tokyu Building, and replanting them in the exterior of Shibuya Solasta.

Tokyu Plaza Omotesando Omokado

Tokyu Plaza Omotesando Omokado opened in April 2012 as an urban commercial facility located at the intersection of Meiji-dori and Omotesando in Harajuku, Tokyo. This facility features a large rooftop garden called “Omohara no Mori.”

Tokyu Plaza Omotesando Omokado’s environmental initiatives

-

Establishment of green space that takes biodiversity into consideration

Omohara no Mori is located between Meiji Jingu Shrine and Jingu Gaien, and is lined with zelkova trees along Omotesando. Many living creatures inhabit the area nearby, making it a stopping point for birds and butterflies as they travel. Biodiversity conservation measures have been implemented for over a decade, including the installation of bird baths and a wide variety of plants, and a total of 22 species of birds and 151 species of insects have been observed.

In 2024, “Ikimono Tokyu Real Estate,” a housing project designed with birds in mind, was launched, with nest boxes specifically for great cinereous tits, created with the help of experts.

In this way, ecological networks involving various plants and objects are steadily forming, expanding the green spaces in the Greater Shibuya area and contributing significantly to biodiversity through rooftop gardens.

Press releases

22th Bonds (Tokyu Fudosan Holdings Corporation Green Bonds) ※matured bond

Tokyu Fudosan Holdings Corporation ("the company") strives to create solutions for social issues through its businesses in order to realize a sustainable society and enhance the Tokyu Fudosan holdings Group's value.

The company has decided to issue a green bond to spread awareness of the company's positive attitude for ESG and actions to a broad base of stakeholders.

The green bond issued by the company obtained the reviews that the green bonds to be issued is based on the framework that is in align with the Green Bond Principles 2018 published by the International Capital Market Association (ICMA) and the Green Bond Guidelines 2017 published by Ministry of the Environment Japan, by the third party reviewer.

Overview

| Name | Tokyu Fudosan Holdings Corporation 22th Unsecured Corporate Bond (limited inter-bond pari passu rider) (Green Bond) Alias : Tokyu Fudosan Holdings Corporation Green Bond |

|---|---|

| Pricing Date | January 17, 2020 |

| Issue Date | January 23, 2020 |

| Maturity Date | January 23, 2025 |

| Term | 5-year |

| Total amount of issue | 10 billion yen |

| Interest rate | 0.190% |

| Use of proceeds | All funds were fullly allocated to the redemption funds of the commercial paper, for the refinancing funds related to the construction of the "SHIBUYA SOLASTA" and the development of the "ReENE Matsumae Wind Farm". |

| Bond Rating | A (Japan Credit Rating Agency, Ltd.) |

Investment Announcements for Tokyu Fudosan Holdings Corporation Green Bond

Please see the following investors that have announced their investments in the Tokyu Fudosan Holdings Corporation Green Bond.

(As of January 17, 2020 / Alphabetical order)

- Asset Management One Co., Ltd.

- Daitokyo shinkumi credit corporative

- KANAGAWA PREFECTURAL CREDIT FEDERATION OF AGRICULTURAL CO-OPERATIVES

- Kanonji Shinkin Bank

- Naraken Japan Agricultural Co-operatives

- NUMAZU SHINKIN BANK

- Meiji Yasuda Life Insurance Company

- OITA-KEN CREDIT COOPERATIVE

- OTEC CORPORATION

- PineBridge Investments Japan Co., Ltd.

- Sumitomo Mitsui DS Asset Management Company, Limited

- Sumitomo Mitsui Trust Asset Management Co., Ltd.

- SUWA SHINKIN BANK

- THE KAGAWA BANK, LTD.

- The Kita Osaka Shinkin Bank

- The Rokinren Bank

- Tokyo University of Agriculture Educational Corporation

- Western Asset Management Company Ltd

Allocation Report

On February 14, 2020, the funds raised by this green bond were fully allocated to the redemption funds of the commercial paper, for the refinancing funds related to the construction of the "SHIBUYA SOLASTA" and the development of the "ReENE Matsumae Wind Farm".

| Funds raised by this green bond (After deducting the estimated issuance expenses) |

Appropriations Used |

|---|---|

| JPY 9,952 million | Refinancing funds related to the construction of the "SHIBUYA SOLASTA" : JPY 8,000 million |

| Refinancing funds related to the development of the "ReENE Matsumae Wind Farm" : JPY 1,952 million |

"SHIBUYA SOLASTA" Project

"SHIBUYA SOLASTA" is the office building with 21 floors above ground, 1 below ground, approximately 107 meters high, and a leased area of approximately 27,769㎡. In Mar 2019, we completed the construction of "SHIBUYA SOLASTA", reconstructing the former site areas of 4 buildings in the district including the Shin-Nampeidai Tokyu Building, where the company and TOKYU LAND CORPORATION were headquartered.

Please see the following press release for information on "SHIBUYA SAOLASTA"

Environmental Initiatives of “SHIBUYA SOLASTA”

CASBEE(Comprehensive Assessment System for Built Environment Efficiency)S rank, the best rating

"SHIBUYA SOLASTA" was given an S rank rating, which indicates its high environmental performance, in the evaluation system that comprehensively inspects the environmental performance of buildings based on the "Building Environmental Performance Indication" under the act on promotion of measures to prevent global warming.

DBJ Green Building Certification 5 Stars

"SHIBUYA SOLASTA" was certified as a building with the highest level of environmental and social considerations in Japan under the DBJ Green Building Certification which certifies real estate with outstanding environmental and social considerations by Development Bank of Japan.

Creature Symbiosis Office Certification System(ABINC Certification)

"SHIBUYA SOLASTA" has been recognized for its promotion of green spaces that take biodiversity conservation into consideration, and was given ABINC Certification.

EDO-MIDORI Registration Green Zone(registration system for the planting of the native species)

"SHIBUYA SOLASTA" is registered with the "EDO-MIDORI Registration Green Zone", the system to register native species. This is because "SHIBUYA SOLASTA" is taking steps to restore the environment suited to living things in Tokyo, including insects, birds and other animals, through the planting of plants (native species) that are naturally distributed in Tokyo.

"ReENE Matsumae Wind Farm" Project

"ReENE Matsumae Wind Farm" is the wind power plant that was developed in Matsumae-machi, Matsumae-gun, Hokkaido, mainly by Tokyu LAND CORPORATION and started operation on Apr 3, 2019.

Please see the following press release for information on "ReENE Matsumae Wind Farm"

Positive Impact Finance

Tokyu Fudosan Holdings Corporation (Headquarters: Shibuya-ku, Tokyo; President: Hironori Nishikawa) announces that it concluded Positive Impact Finance (PIF) (loans whose uses are not specified to an operating company) agreements on March 31, 2021 (an agreement on 5.0 billion yen) and September 28, 2021 (an agreement on approximately 7.2 billion yen) with Sumitomo Mitsui Trust Bank, Limited.

PIF is a loan to be extended in line with the Principles for Positive Impact Finance(*1) and its implementation guidelines established by the United Nations Environmental Programme Finance Initiative (hereinafter “UNEP FI”)(*2), for the purpose of providing continuing support for corporate activities with a positive impact to the environment, society and the economy based on comprehensive analysis and the evaluation of both positive and negative impacts of the activities. The most notable characteristics of PIF is that the degree of contribution from corporate activities in achieving the Sustainable Development Goals (SDGs) is used as evaluation indicators and monitored based on publicly disclosed information.

In concluding the agreements, the following themes in the Company’s key issues of sustainability were assessed qualitatively and quantitatively as initiatives that have a particular impact on achieving SDGs.

The progress and results of these initiatives will be disclosed in sustainability reports, etc. (*3) published by the Company.

| Theme | Description | Targets and Indicators (KPIs) | SDGs |

|---|---|---|---|

| Improvement in quality of life, formation of communities for mutual assistance | Solve changing social issues through Life Story Town, Lifestyle Creation 3.0 and other initiatives. |

Targets Indicators (KPIs) |

|

| Resilience of cities | Develop disaster-resistant urban functions. |

Targets Indicators (KPIs) |

|

| Environmental protection | Urban development for coexistence with the environment |

a) Initiatives to reduce CO2 emissionsTargets

Indicators (KPIs)

b) Expand the use of renewable energyTargets Indicators (KPIs) c) Promote achievement of environmentally friendly real estate certificationTargets Indicators (KPIs) d) Appropriate management and use of water resourcesTargets Indicators (KPIs) e) Reduction of waste emissionsTargets Indicators (KPIs) |

|

Third-party assessment, etc. on conformity

(*1)Principles for Positive Impact Finance: The principles were established by UNEP FI in January 2017. Under the principles, companies disclose KPIs that indicate their contributions to achieving the SDGs. Banks evaluate the positive impact of companies' contributions and provide funds. As a result, companies that receive funds make efforts to increase the positive impact and reduce the negative impact. Banks that give loans monitor indicators as responsible financial institutions and confirm that the impact is continuing.