INVESTOR RELATIONS

Long-Term Vision

TOKYU FUDOSAN HOLDINGS

GROUP VISION 2030

Tokyu Fudosan Holdings Corporation (the "Group") announces that the Group has formulated its long-term vision

"GROUP VISION 2030" with fiscal 2030 as the target year.

1.Background and purpose of formulating the long-term vision

With respect to the long-term business environment in the future, the Group expects that the uncertain and unpredictable era called VUCA* will continue, given the COVID-19 pandemic, the rapid acceleration of digitalization, the advancement of a decarbonized society and the diversification of lifestyles. To realize a sustainable society under such an environmental recognition, the Group has formulated its long-term vision "GROUP VISION 2030" and reorganized its group philosophy by ascertaining its ideal vision a decade later based on a back casting approach, rather than the conventional building-up type plan.

We will work on value creation for all stakeholders by achieving further growth with diverse green power based on our slogan "WE ARE GREEN."

VUCA stands for volatility, uncertainty, complexity and ambiguity and refers to an unpredictable socioeconomic environment.

Slogan of the long-term vision "WE ARE GREEN"

It expresses our stance toward realizing our ideal vision in 2030 with diverse green power by expressing the diversity of businesses and human capital of the Group by gradation with green, our corporate color, as the basic tone. Green symbolizes our environmental efforts and sustainability, as well as our goal of creating the future where everyone can be themselves and shine vigorously, as if young leaves sprout and grow big by taking advantage of their own individuality. Under the banner "WE ARE GREEN," we will create a variety of appealing lifestyles by combining diverse green

2.Overview of "GROUP VISION 2030"

The Group Philosophy

We have reorganized our group philosophy in light of the origin and history of the Group.

-

Our ideal vision

Create value for the future

We resolve social issues through our business activities and aim for sustainable society and growth together with our stakeholders.

We realize a future where everyone can be themselves and shine vigorously through the creation of a variety of appealing lifestyles. -

Our pledge to society

We believe that corporate value is the sum total of the levels of satisfaction of all of our stakeholders.

Customers/Group employees/Business partners/Local communities Shareholders and investors/Future society

-

Our founding spirit

"Challenge-oriented DNA"

Themes to work on for value creation (Materialities)

To realize our ideal vision, we will work on six themes extracted from social issues we focus on.

Lifestyle

Create a variety of lifestyles.

Liveable City

Create communities and lifestyles that encourage well-being

Environment

Create a sustainable environment.

DX

Create value in the digital era.

Human Capital

Create an organizational climate under which diverse human capital is enlivened.

Governance

Create governance to accelerates growth.

Overview of the GROUP VISION 2030

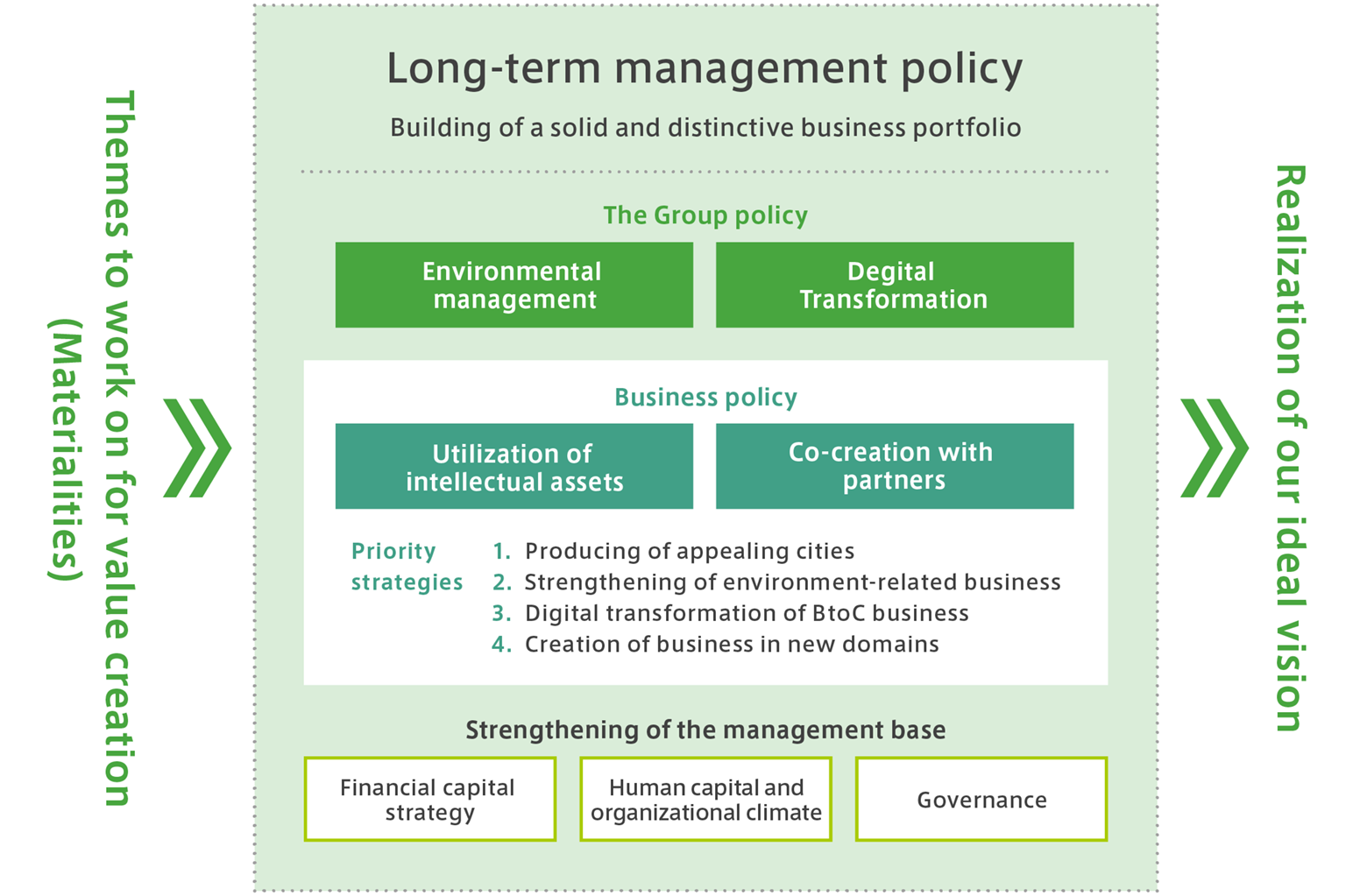

We will realize our ideal vision by promoting a long-term management plan developed based on materialities.

3.Long-term management policy

We will aim to enhance the shareholder value and the corporate value by building a solid and distinctive business portfolio toward fiscal 2030.

The Group policy: Make the Group's characteristics into its strengths

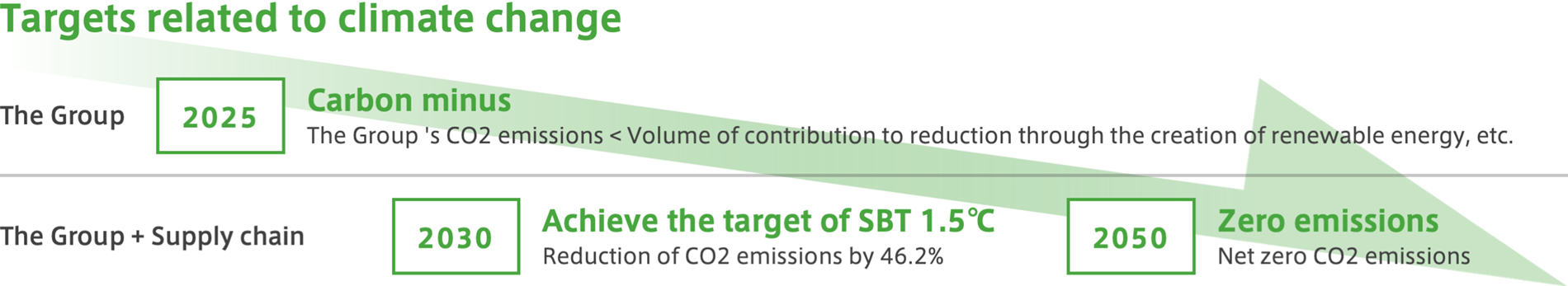

(1)Environmental management

[Carbon-free society and recycling-oriented society]Reduction of environmental impact through all businesses (dissemination of clean energy, etc.)

[Lifestyles]Creation of communities and lifestyles that contributes to the environment.

(2)DX

[Operation process]A shift to creative operations by promoting labor saving

[CX (customer experience))]Creation of impressive experience through the sophistication of contacts with customers

[Innovation]New value creation by utilizing intellectual assets

Business policy:Evolve the associated assets expansion model

(1)Utilization of intellectual assets

Earnings generation through the acquisition and utilization cycle of know-how and data

(2)Co-creation with partners

Maximization of business value through external collaboration in knowledge and capital, etc.

Four priority strategies in the business policy:Achieve the business transformation and sustainable growth.

- Producing of appealing cities

- Provision of lifestyles and experiences that integrate city operating system and content

- Increase in the value of the greater Shibuya area through appealing by creating an attractive urban center

- Strengthening of environment-related business

- Expansion of the renewable energy business

- People- and eco-friendly urban development

- Digital transformation of BtoC business (customer-oriented experience value creation)

- Evolution of services utilizing abundant contacts with customers (promotion of Online-Merge-Offline (OMO))

- Expansion of the source of earnings by providing our know-how to the outside

- Creation of business in new domains

- Promotion of business focusing on changes in social issues and the social structure

- Business construction by combining resources inside and outside the group

Financial capital strategy

We will aim to enhance the shareholder value and the corporate value by realizing efficiency-conscious profit growth under the optimum financial capital structure.

(1)Improvement of efficiency (ROA and profit margin) in existing businesses

(2)Business portfolio management

(3)Maintenance of financial discipline

(4)Shareholders return policy

Policy for the time being: Dividend payout ratio 30% or more, Continuation and maintenance of stable dividend payment

4.Target indicators for 2030

We will aim to achieve target indicators that integrate financial and non-financial data based on materialities to work on.

You can scroll this table sideways

| Themes to work on(Materialities) | Target indicators |

|---|---|

|

Lifestyle Create a variety of lifestyles. |

|

|

Liveable City Create communities and lifestyles that encourage well-being |

|

|

Environment Create a sustainable environment. |

|

|

DX Create value in the digital era. |

|

|

Human Capital Create an organizational climate under which diverse human capital is enlivened. |

|

|

Governance Create governance to accelerates growth. |

|

Reference indicators

- ROE 10% or More

- ROA 5% or More

- D/E ratio 2.0 times or less

- Operating profit 150 billion yen or More

- Net profit 75 billion yen or More

- *1Tokyu Cosmos Members Club Questionnaire survey

- *2Support people who have difficulty returning home in the event of a disaster in a large and non-residential building, etc.

- *3Tokyu Land Corporation employees