INVESTOR RELATIONS

IR Policy

1.Basic IR Policy

The Tokyu Fudosan Holdings Group (The Group) aims to disclose accurate information in a fair, timely manner to shareholders and investors. When disclosing information, the Group complies with applicable laws and regulations and the rules of the stock exchange, etc. and also discloses information on the management strategy, financial information, and the results of the Group in a timely, appropriate manner. In addition, to contribute to the sustainable growth and the improvement of medium- to long-term corporate value of the Group, we pursue constructive dialogues with shareholders and investors.

2.Disclosure Policy

①Criteria for information disclosure

The Group discloses information in accordance with applicable laws and regulations such as the Financial Instruments and Exchange Act and the Timely Disclosure Rules set by the Tokyo Stock Exchange. In addition, the Group discloses information that it considers to be useful to better understand the Group, including the content of the presentation of the results briefing and information that does not fall within the scope of applicable laws and regulations as much as possible.

Disclosures covered by this policy

This policy applies to the following disclosures as classified by the legal or regulatory frameworks requiring such disclosures.

Statutory disclosure filed with governing legal authorities ("Statutory Disclosure")

Statutory Disclosures are submitted in compliance with conditions and procedures under relevant laws and regulations. The following two categories of Statutory Disclosure constitute the basic, most important ones which consistently provide information on the Group's results of operations, financial conditions and business.

- Disclosures pursuant to Japanese Financial Instruments and Exchange Act

- Annual Securities Report

- Quarterly Financial Summary

- Extraordinary Report - Disclosures pursuant to Japanese Companies Act

- Notice of general shareholder meeting (including supplementary information on resolution matters)

- Financial Statements and Business Reports

Timely disclosure of material corporate information filed to stock exchanges and stock associations

Apart from the above-mentioned legal requirements, stock exchanges and stock associations have established rules that obligate listed companies to file information in a timely manner when material events affecting investors' decision arises. In this policy, such disclosure is referred to as "Timely Disclosure," and those filed to the Tokyo Stock Exchange("TSE") as "TSE Timely Disclosure." The TSE Timely Disclosures are listed below.

- Earnings report

Filing of annual or quarterly earnings report in a prescribed format for TSE Timely Disclosure (kessan tanshin) and related supplementary data. - Filing of information on material corporate decision or development

Filing of material corporate decision or development as it arises, in conjunction with the press release in that regard. The Group will voluntarily file relevant corporate information which qualifies as "Material Information" as defined in the Article ② of this policy even if such filing is not required by TSE.

Other communications and disclosure materials

The following disclosures will be made public in accordance with our policy. There are out of scope of filing requirements by governing legal authorities, stock exchanges or stock associations, and therefore are not subject to legal or regulatory requirement.

- Communications with analysts, investors, etc. and all relevant presentation materials

- Integrated Report

- Environmental Management Report, DX Report

- Information on our subsidiaries

②Materiality of Information

For purpose of this policy, the definition of "material information" is provided as below: Information is material if its disclosure would be likely to have an impact on the price of a security or if reasonable investors would want to know the information before making an investment decision. In concrete terms, quantitative thresholds which are lower than de-minimis criteria set by the TSE are voluntarily established as an internal guidance to judge the materiality covering the scope of information required to be disclosed pursuant to TSE Timely Disclosure regulations. Regardless of satisfaction of the criteria, information considered to be material to investment decision is disclosed in accordance with the clause.

③Method of disclosure

Information disclosure that falls within the scope of the Timely Disclosure Rules set by the Tokyo Stock Exchange is conducted through registration on the Timely Disclosure Network (TDnet), Tokyo Stock Exchange’s disclosure system. In addition, disclosure documents, such as financial statements, are disclosed through Electronic Disclosure for Investors' Network (EDINET), the Financial Services Agency’s electronic disclosure system.

The Group promptly releases the information disclosed through the Tokyo Stock Exchange’s TDnet on the Group website. We also disclose other information to investors in an appropriate manner with a fuller understanding of the purpose of timely disclosure.

④Management of insider information

The Group manages insider information in accordance with Anti-insider Trading Rules. In dialogues with shareholders and investors, insider information is strictly managed.

⑤Fair disclosure

The Group manages information on important facts and definitive account settlement, which has not been disclosed by the Group, as important information that significantly influences an investment decision, and discloses the information in an appropriate manner in a case where the disclosure of important information is required in accordance with laws and regulations when the information is disclosed to business contacts.

⑥Quiet period

To prevent the leakage of information that influences share prices during the preparation period of the announcement of financial results and to secure the fairness of information disclosure, the Group sets the period from the following day of each quarterly settlement to the announcement of each quarterly settlement as the IR activity quiet period. During this period, we withdraw replies, comments, etc. to account settlement inquiries. However, if a major revision of the earnings forecast is expected during this period, we disclose information on it in accordance with the Timely Disclosure Rules, in principle.

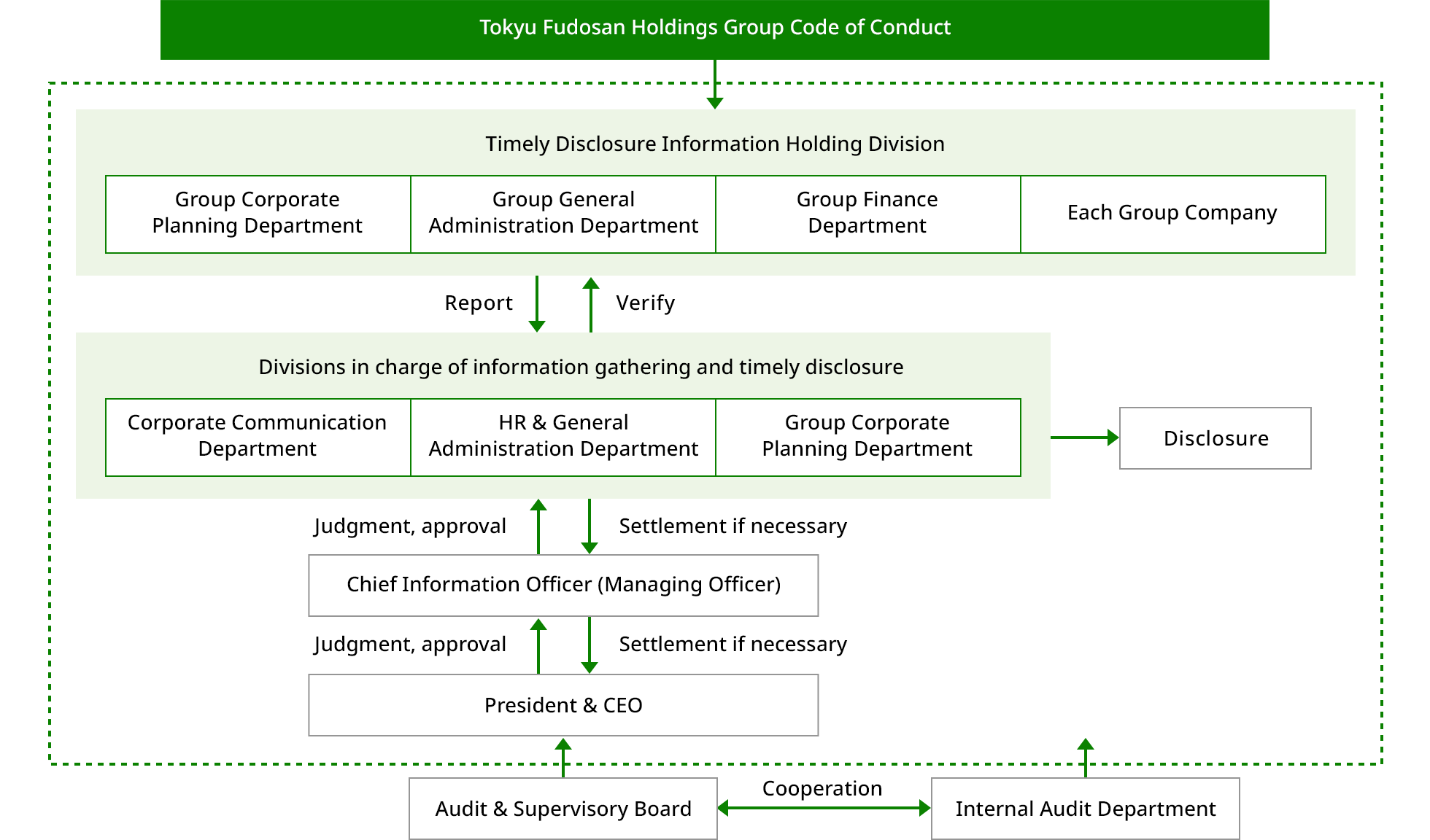

⑦Organizational chart

3.Policy on Constructive Dialogue with Shareholders

①Directors in charge of dialogues

To promote constructive dialogues with shareholders and investors, a directors in charge of Finance, Corporate Communication, General Administration, and Human Resources are working together on this project.

In addition, when it is necessary and to a reasonable extent, the president and director in charge have dialogues with shareholders and investors to promote mutual understanding.

②Cooperation between division in charge and related sectors

The IR Office, in charge of IR activities, is set within Corporate Communication Department. Through cooperation with related divisions such as general affairs and management planning, it conducts smooth, constructive dialogues between the president, director in charge, and person in charge and shareholders and investors.

③Efforts on enhancement of dialogue measures

We actively meet and talk individually with shareholders and investors, and also regularly hold a results briefing for institutional investors and analysts and a presentation meeting for individual investors, posting the materials for these meetings on our website.

④Feedback measures

The opinions, concerns, etc. obtained from dialogues with shareholders and investors are regularly reported at meetings attended by the management. The management understands the points put forth by shareholders and investors, and uses them to enhance the company and to work on the improvement of the medium- to long-term corporate value of the Group.