INVESTOR RELATIONS

Medium-Term Management Plan

Formulation of Medium-Term Management Plan 2030

Tokyu Fudosan Holdings Corporation (“the Group”) hereby announces that it has formulated the medium-term management plan 2030 with a target year of fiscal 2030.

1. Background and purpose for formulating the Medium-Term Management Plan 2030

The Company established GROUP VISION 2030 in May 2021, which stipulates long-term management policy through fiscal 2030.

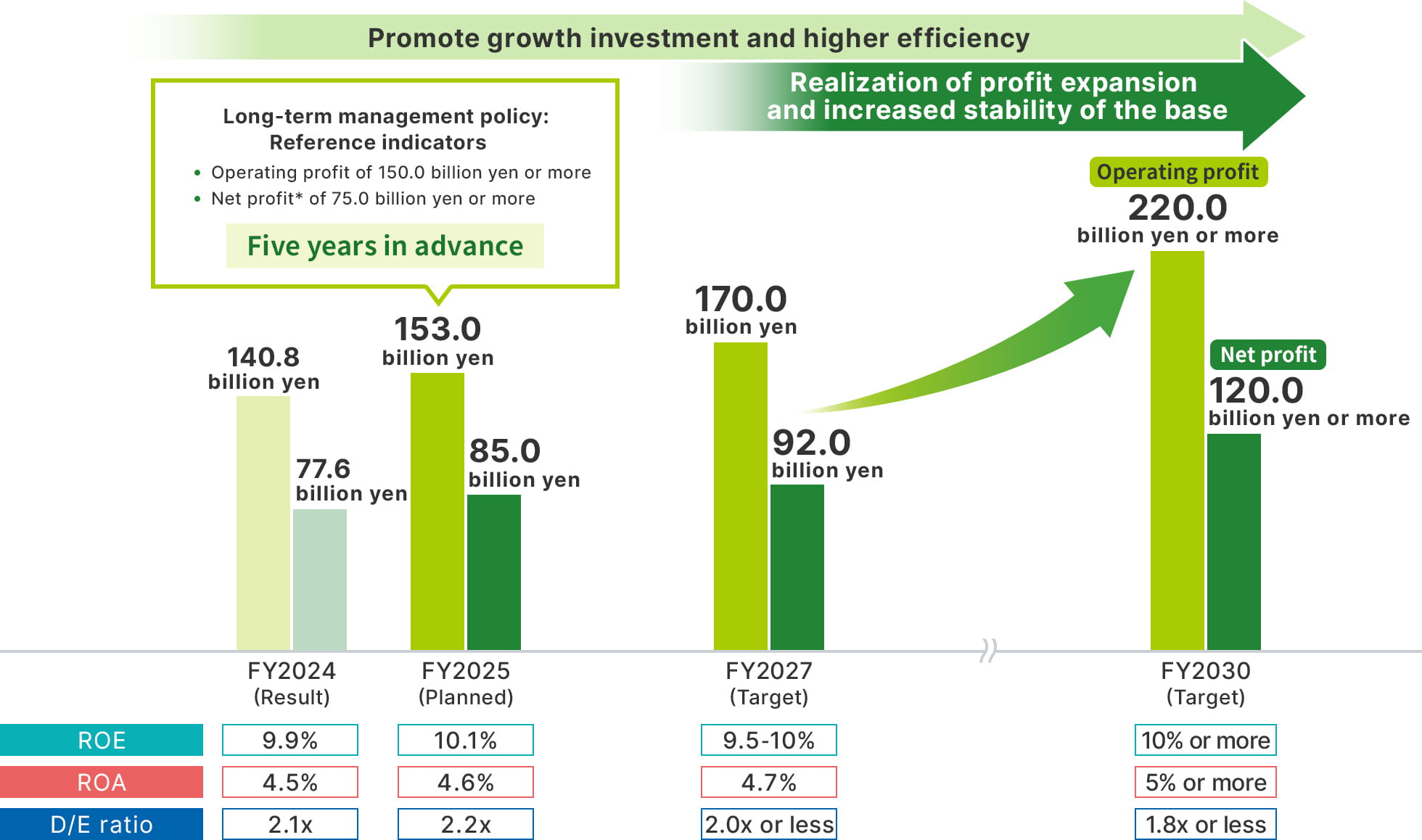

The medium-term management plan 2025, formulated in May 2022, positioned the first half of the long-term management policy as a restructuring phase, and by promoting business restructuring and other measures, the Group was able to achieve major profit growth beyond planned figures. (The Group achieved its 2025 operating profit target of 120.0 billion yen and net income target of 65.0 billion yen two years ahead of schedule.)

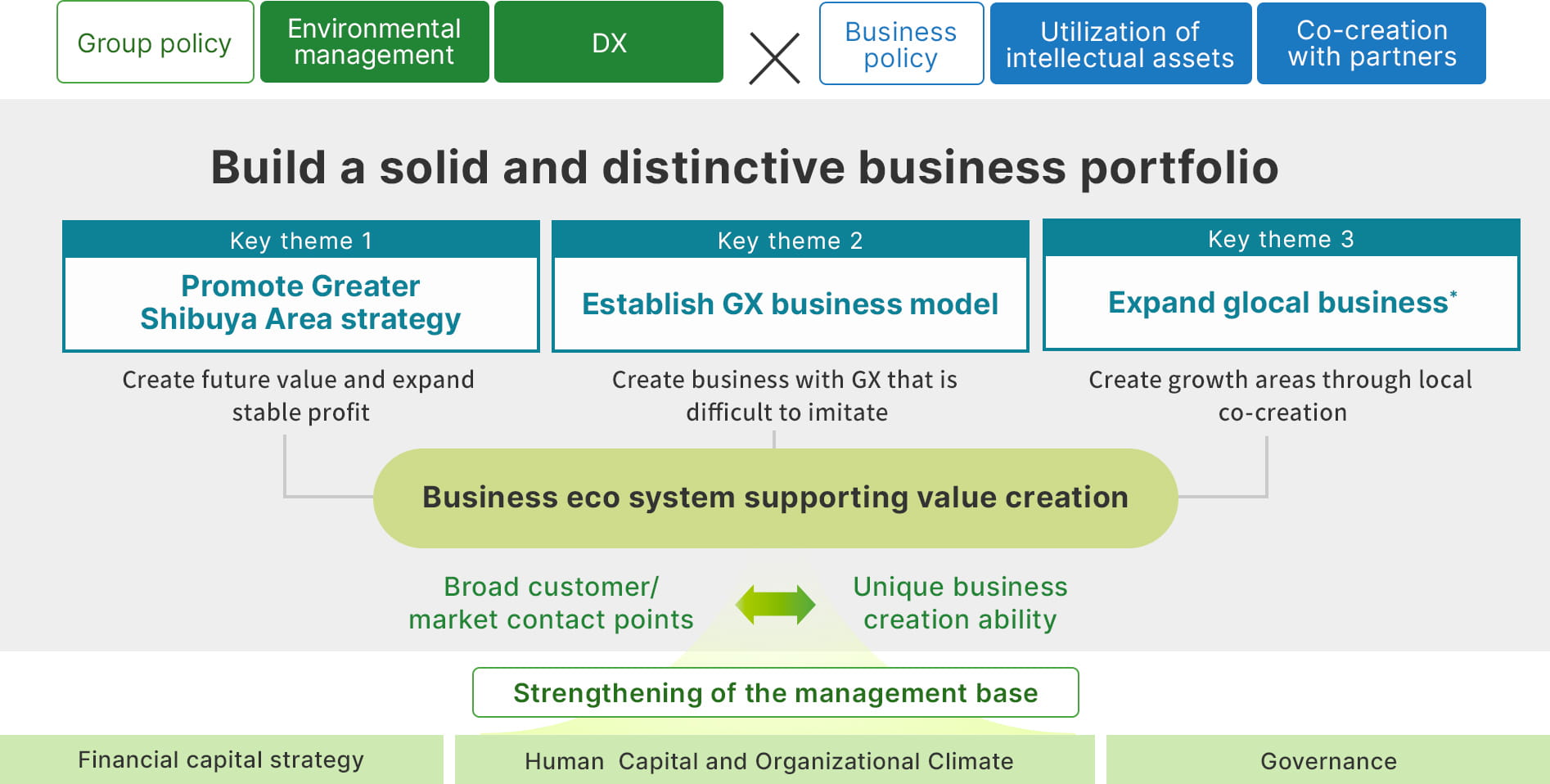

This new medium-term management plan 2030 positions the second half of the long-term management policy as the resilience phase, and under the plan the Group will build a solid and distinctive business portfolio to realize further profit growth while working to raise efficiency and tolerance.

2. Outline of the Management Plan

While deepening the policies stipulated as the long-term management policy: overall company policy, business policy and strengthening of the management base, the Group will promote initiatives for three strategic themes for which market expansion can be expected given the changes in and heightening of societal needs and will work to build a business portfolio that is solid and distinctive.

*1.Glocal business: Business that generates high added value by co-creating locally (regionally) while addressing changes in the business environment occurring globally (common for all pages)

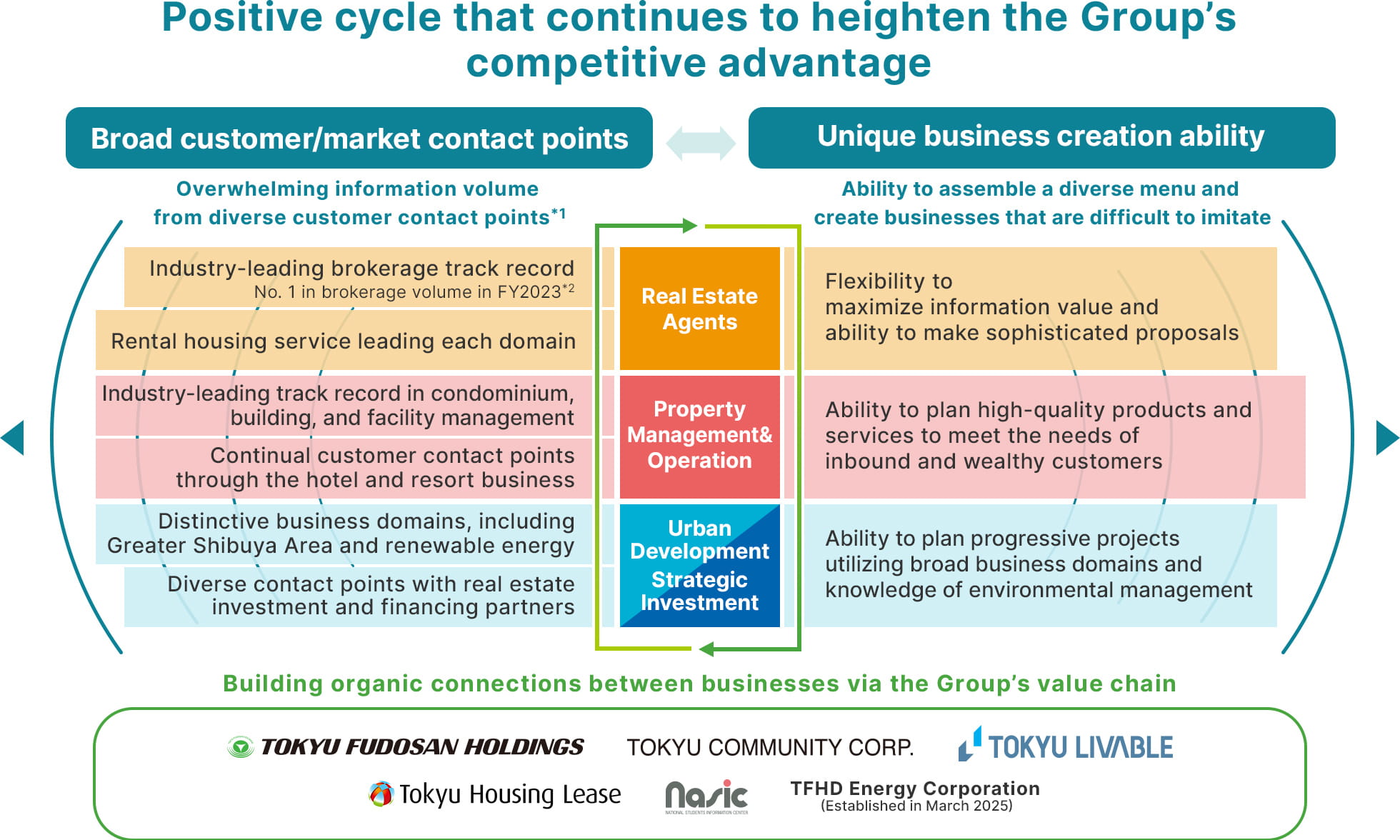

Business Ecosystem Supporting Value Creation

In promoting the strategic themes, the Group will deepen its characteristic business ecosystem by demonstrating synergies between each Group company’s broad range of contact points with customers and markets and unique business creation ability, which are the source of the Group’s strength.

*1.Approx. 18.10 million people as of FY2023 (welfare agency members, commercial facility app and card members, BRANZ CLUB members, Tokyu Cosmos members, Tokyu Harvest Club members, etc.)

*2.According to newspaper reporting (results of a transaction survey conducted from April 2023 to March 2024 of 20-30 major real estate companies selected by a newspaper for real estate agents)

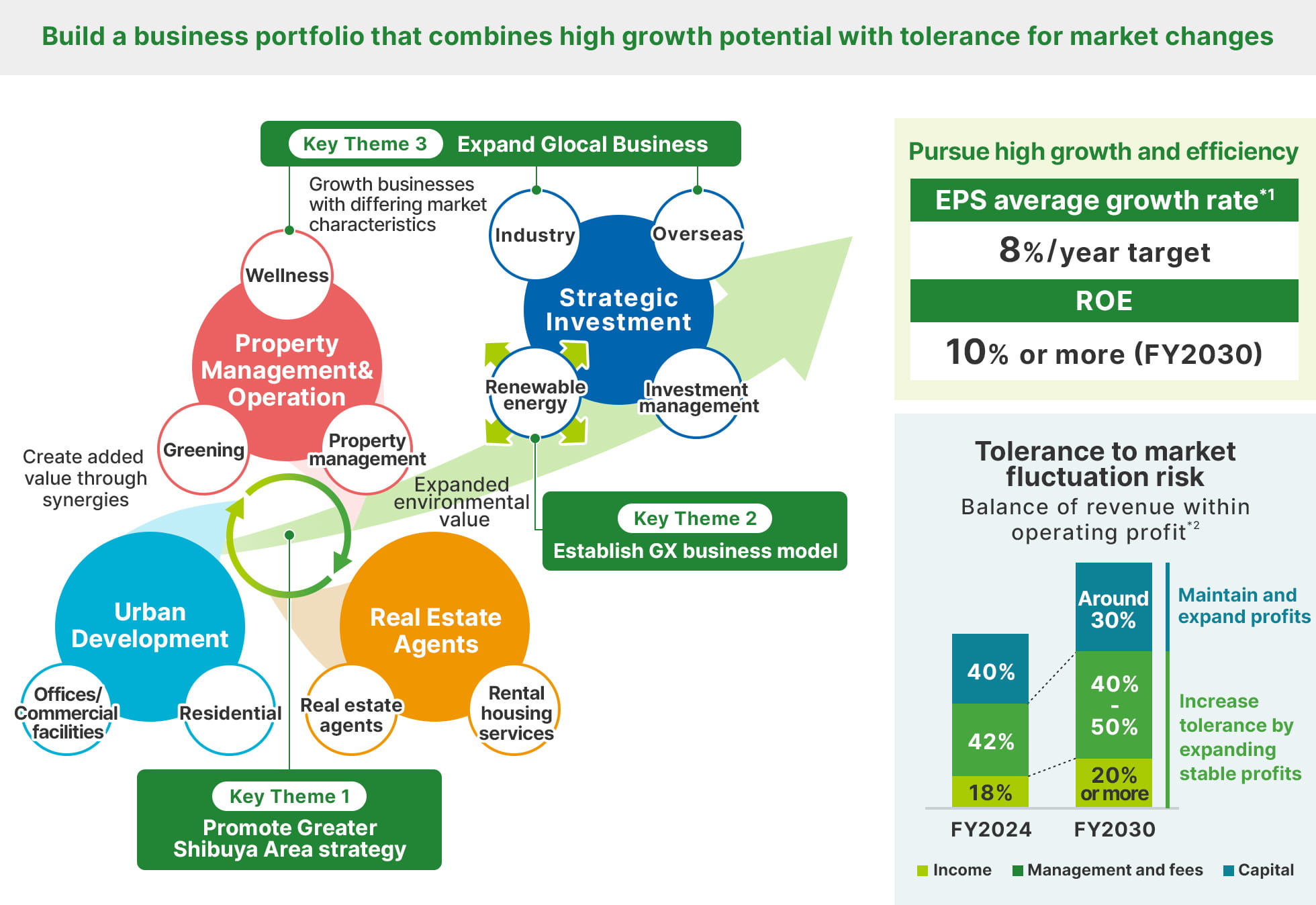

A Solid and Distinctive Business Portfolio

While promoting the strategic themes, the Group will have high growth by demonstrating synergies between businesses and will build a solid and distinctive business portfolio that also combines tolerance for market changes as a result of capturing markets with differing characteristics and expanding stable profits.

*1.Average annual growth rate from FY2024 to FY2030

*2.Income: Rental income, income from electricity sales, etc.; Management and fees: Brokerage, management and operations, PM fees, etc.; Capital: Profit from unit sales, gains on real estate sales, etc.

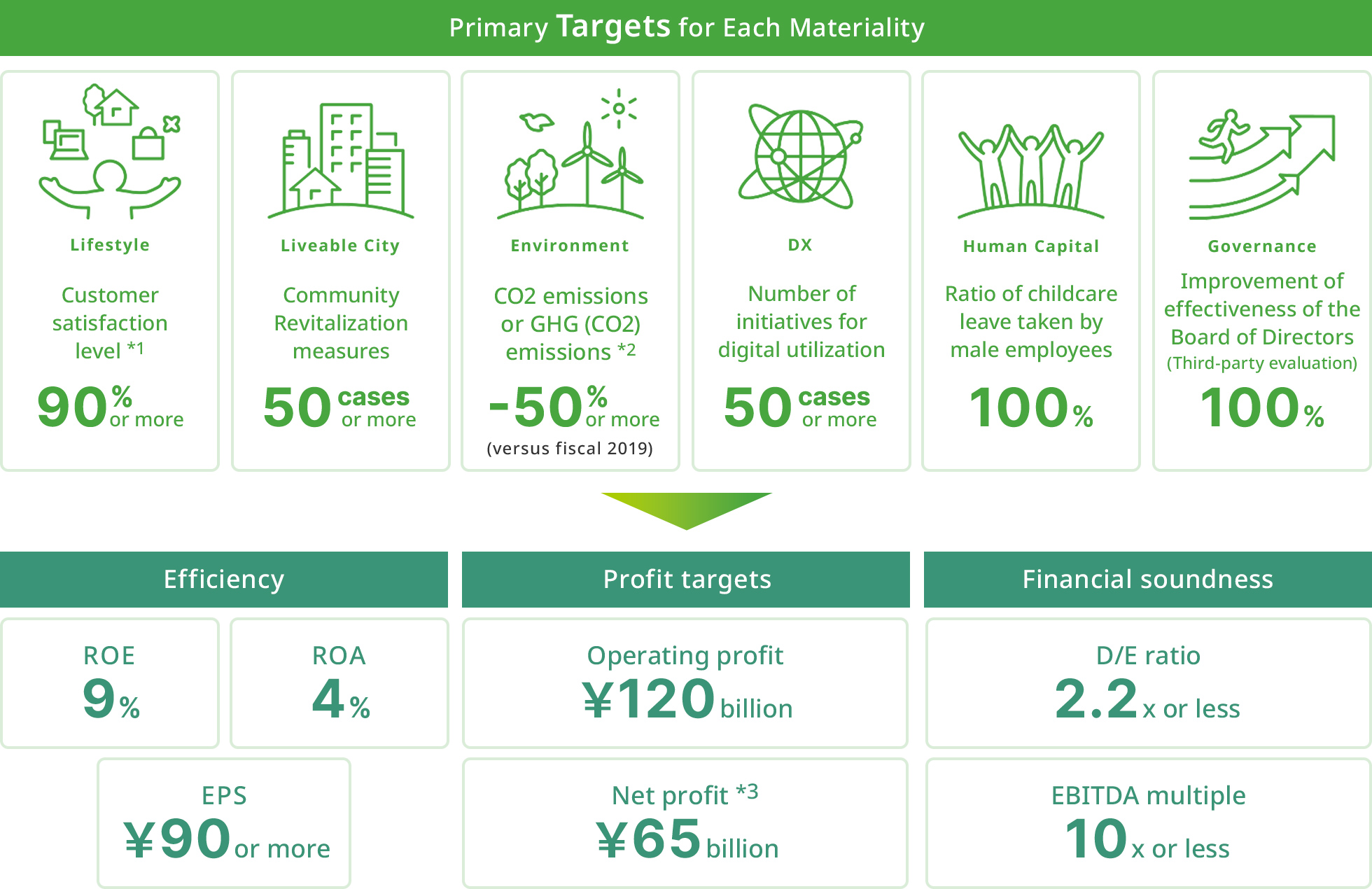

3. Target Indicators for Fiscal 2030

The Group aims to achieve the following targets by fiscal 2030. In addition, the shareholder return policy, will be revised and expanded as well as shown below.

*1.Based on Tokyu Cosmos Members Club questionnaire

*2.SBT certification for scopes 1 and 2

*3.Hiring, training, fostering a climate, etc.

*4.Profit attributable to owners of parent

*5.Dividend policy of always increasing or maintaining the dividend each year

Trends in Financial Targets

*Profit attributable to owners of parent