BUSINESS INTRODUCTION

Strategic Investment

Building next-generation infrastructure

Renewable energy power generation facilities / logistics facilities / overseas operations (North America and Asia) / investment management

Business overview

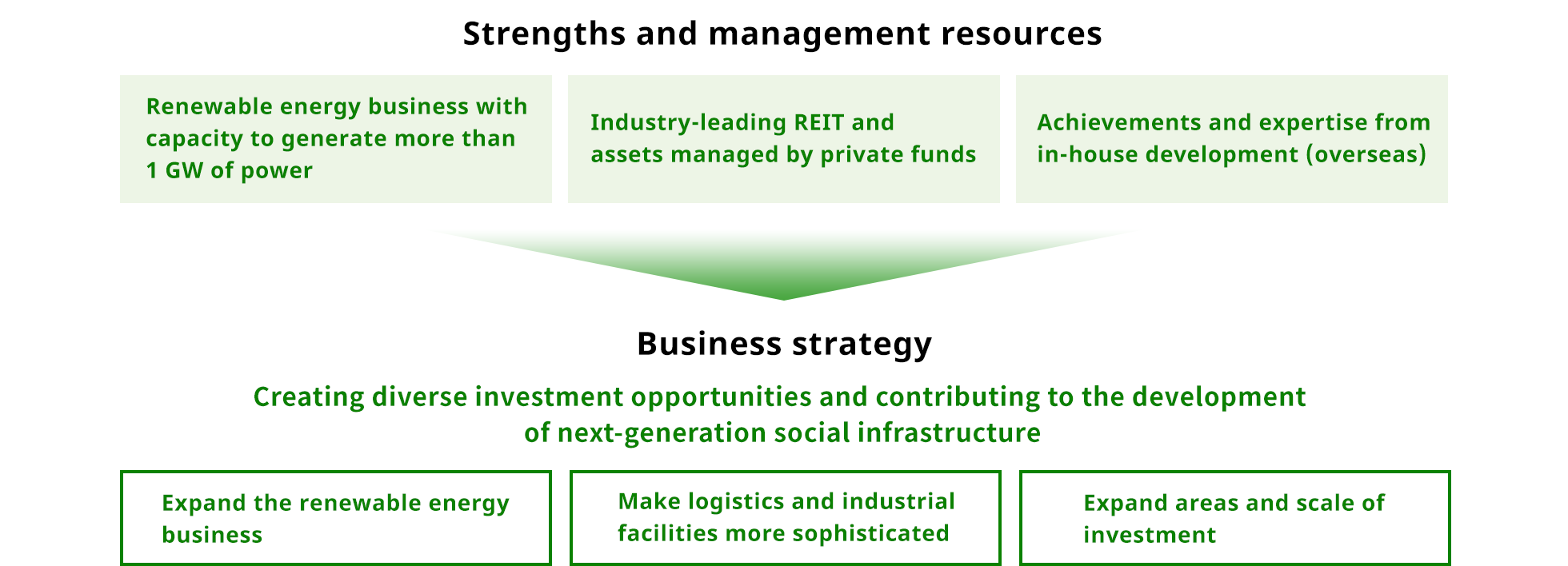

In the Strategic Investment segment, we are developing and improving lifestyle-supporting infrastructure, such as renewable energy power generation facilities and logistics facilities, and creating diverse investment opportunities by applying our real estate investment and asset management expertise in Japan and overseas. We are also leveraging the experience we have cultivated in our development activities to date to advance business development overseas. Specifically, we are contributing to the creation of next-generation social infrastructure that reflects recent changes in areas such as energy policy and industrial structure, while in areas around Asia and the United States, we are collaborating with regional partner companies and local talent to advance development and investment business that can flexibly accommodate changes in local market conditions.

*The figures on this page are those after Renewable Japan Co., Ltd. became a consolidated subsidiary (on January 16, 2025).

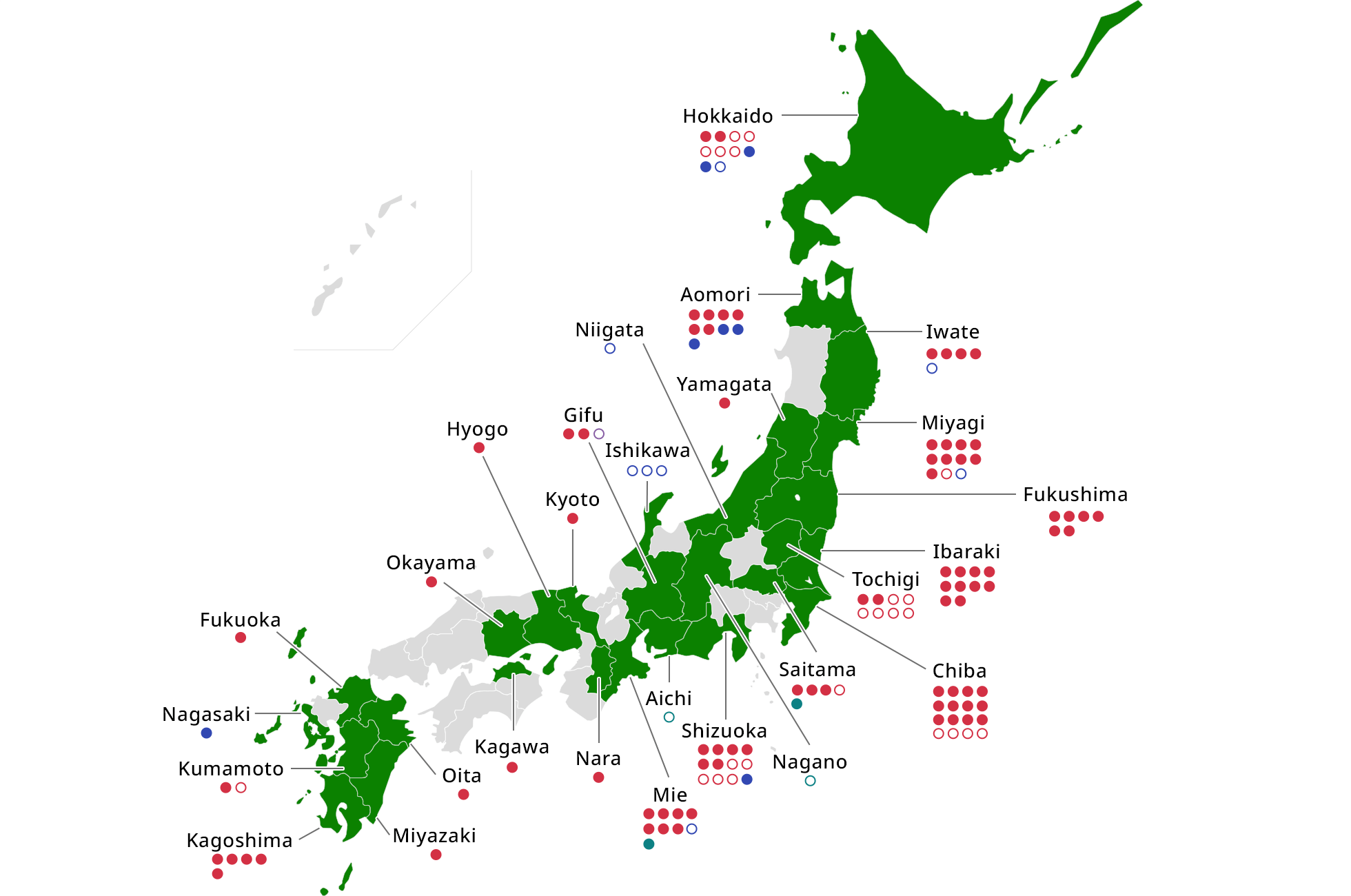

*The figures shown for each area of the portfolio are the rated capacity of the facilities in operation before converting it into equity interest and the percentage of the total facilities in operation.

Total Number of Businesses

156Subject

Rated Capacity

2,112MW

*Includes joint ventures.

*The values for rated capacity are before conversion to equities.

*Figures for total number of businesses, rated capacity, also include one rooftop business (completed locations and locations under development).

*The number of rooftop buildings does not include low-pressure bulk.

*MW values refer to the capacity of solar panels, etc.

| Solar Power |

Complete 101(1,266MW) 60% In development 33(102MW) 5% Rooftop 1(213MW) 10% |

|---|---|

| Wind Power |

Complete 7(247MW) 12% In development 8(226MW) 11% |

| Biomass |

Complete 2(4MW) 0% In development 2(52MW) 2% |

| Small and medium-sized hydropower |

Complete 0(0MW) 0% In development 2(2MW) 0% |

Other Business

| Storage Battery |

Power Generation Side 3(270MWh, 82MW) Grid Side 5(308MWh, 86MW) |

|---|

*Values before equity conversion.

*MWh: battery capacity, MW: battery output.

(As of September, 2025)

Major projects

Infrastructure & Industry

Renewable energy power generation facilities

Logistics facilities

Overseas Operations

(America)

(America)

(Indonesia)

(Malaysia)

REIT and Fund Management

An asset management company that manages listed REIT companies Activia Properties Inc. and Comforia Residential REIT, Inc. and the private REIT Broadia Private REIT, Inc. As real estate management professionals, we also aim to maximize investor value by providing high-quality investment management services.

An asset management company that organizes and operates private funds for various investments, including rental housing, offices, and commercial facilities as well as logistics facilities and renewable energy power generation businesses. We aim to maximize investor profits through dialogue by forming and operating funds that meet individual investors’ needs and formulating and implementing tailored exit strategies.