Office buildings and commercial facilities, condominium development, rental housing unit development (rental condominiums and student residences)

- About Tokyu Fudosan Holdings

- About Tokyu Fudosan Holdings

- Message from the President

- Group Philosophy

- The Value Creation Story

- Corporate Profile & Organization Chart

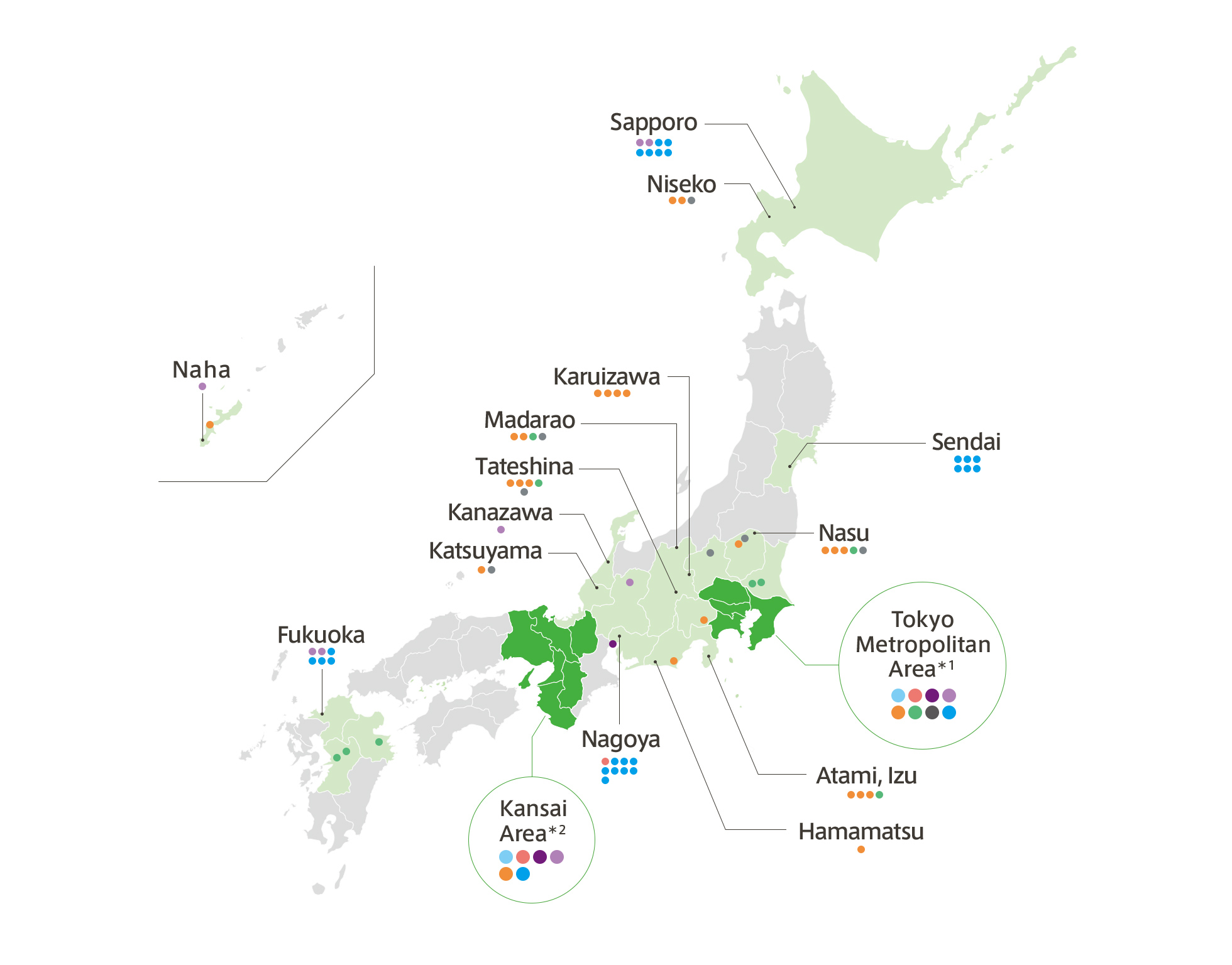

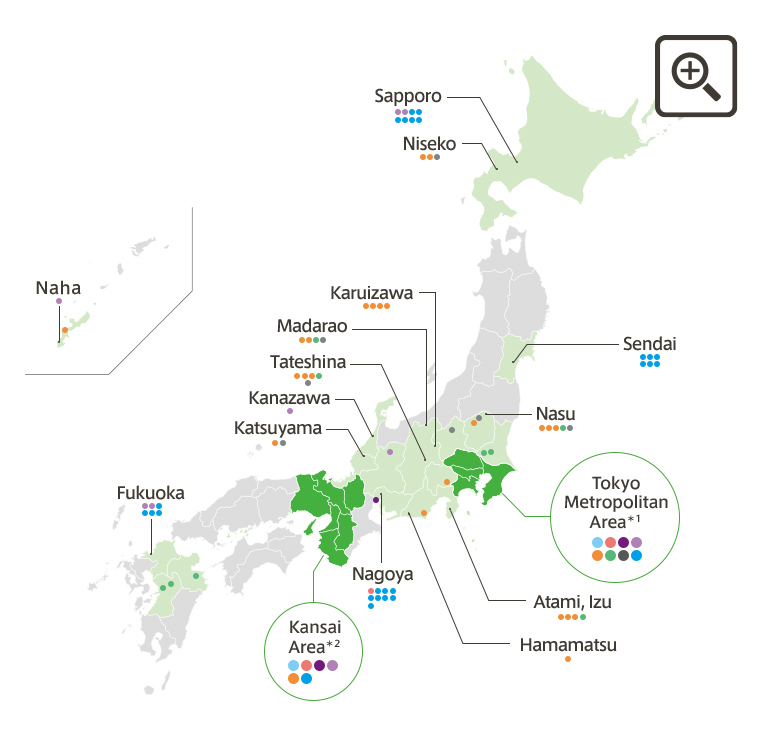

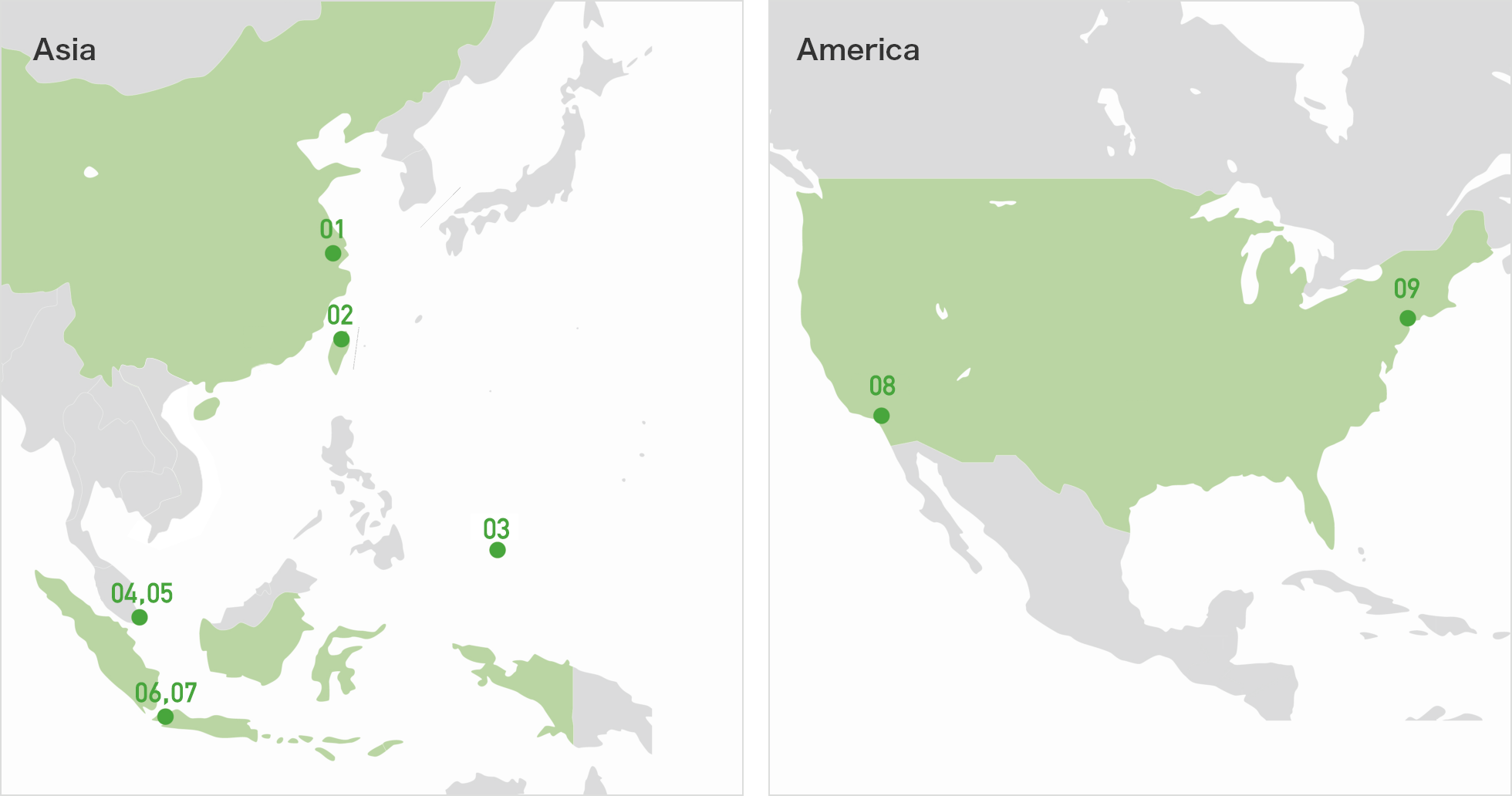

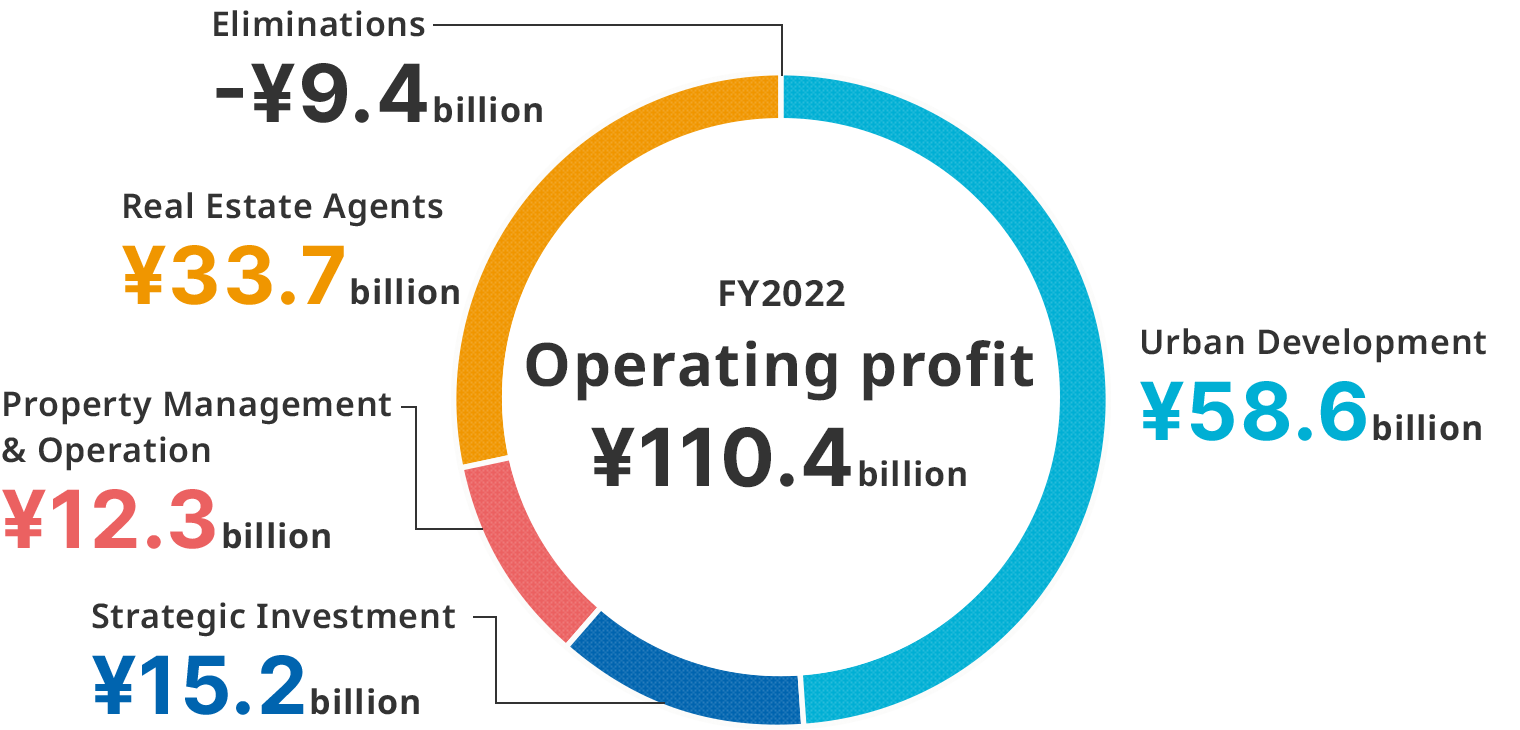

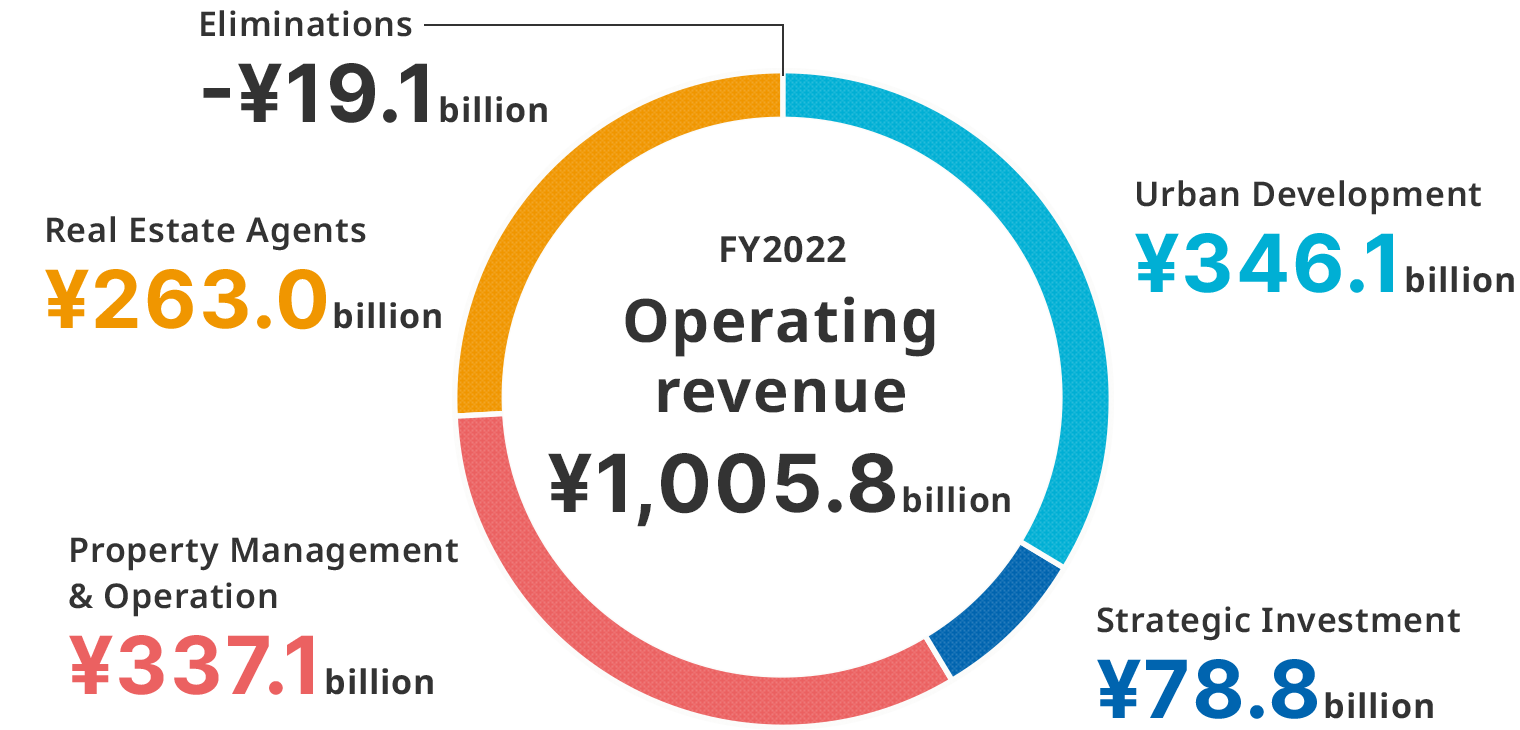

- Business Overview

- Holding Structure

- Executive Board

- History

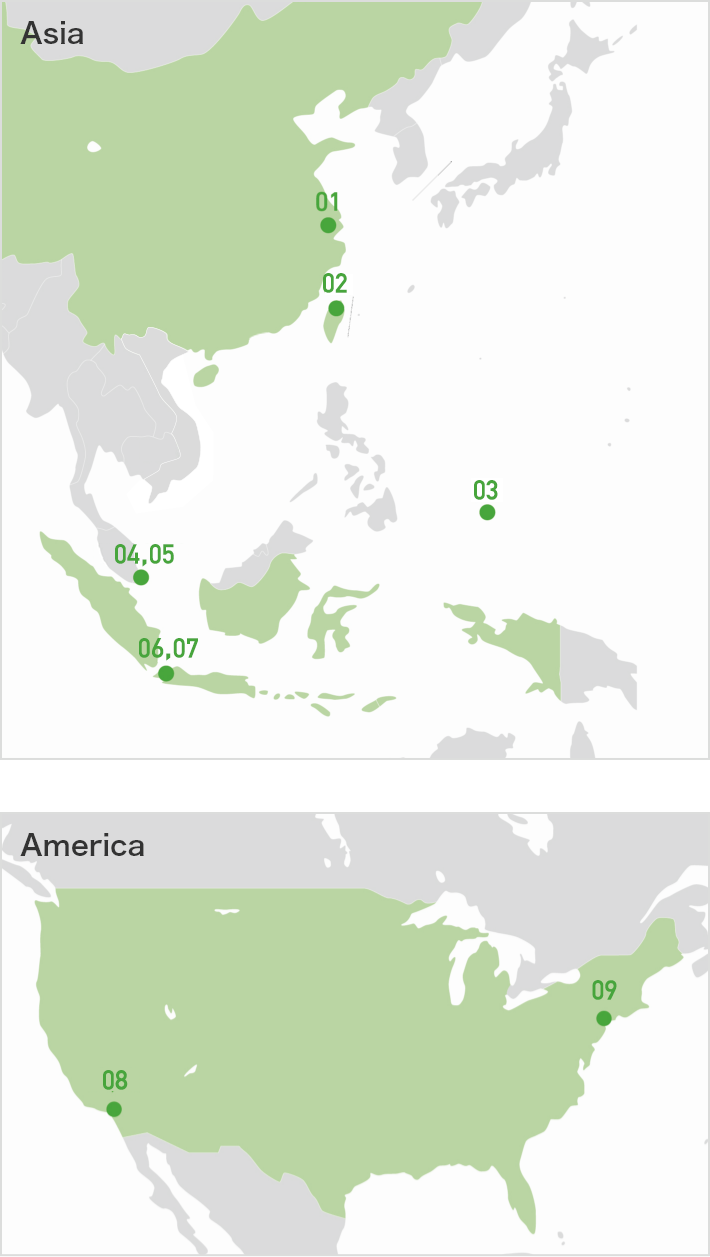

- Group Companies

- Corporate Governance

- Compliance

- Human capital management

- Media (Youtube)

- About the Tokyu Group

- News Release

- Investor Relations

- Sustainability

- Group Initiatives

![東急不動産[BRANZ] 環境先進を、住まいから](/img_hd/common/img_banner07.jpg?211214)