|

|

|

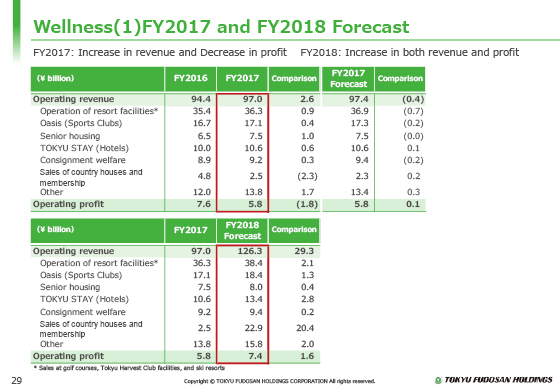

Next, the Wellness segment is explained.

In the fiscal year ended March 31, 2018, the segment recorded an increase in revenues and a decrease in profit.

The decrease in profit was attributable partly to a reaction to the posting of sales of profitable country houses in previous the fiscal year, although revenues increased as the Grancreer Setagaya Nakamachi senior residence was opened and new facilities of the Tokyu Stay urban style hotels showed strong performances, in addition to the strong performance of existing resort facilities.

We forecast increases in both segment revenues and profit for the fiscal year ending March 31, 2019, based on the planned delivery of the jointly owned portion of land and buildings for the TOKYU Harvest Club Karuizawa & VIALA scheduled to open in July 2018 in sales of country houses and membership.

|

|

|