|

|

|

|

|

|

|

|

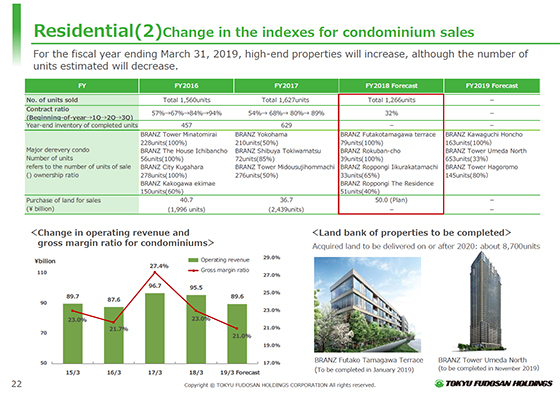

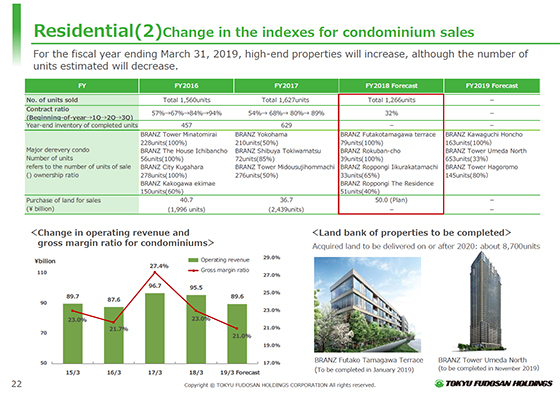

Next are changes in business performance indicators of condominiums.

The estimates for the fiscal year ending March 31, 2019 are, as stated in the red frame, 1,266 units, a decrease in the number of unit sales. However, sales of condominiums are estimated at ¥89.6 billion due to an increase of high-end properties.

The ratio of the contract secured to the forecast sales of condominiums is 32%. In the past two fiscal years, there were many relatively large-scale projects and the timing of the supply came early. Therefore the ratio exceeded 50% at the beginning of the fiscal year. The ratio of 32% should be the standard level.

In addition, the inventory of completed units at the end of the fiscal year ended March 31, 2018 was 629 units, showing an increase from the end of the previous fiscal year. This increase was mainly attributable to the properties completed in the fourth quarter. The Company intends to steadily proceed with sales activities without risk.

The purchase of land was, as stated in the investment in land below the table, ¥36.7 billion and the land for 2,439 units for the fiscal year ended March 31, 2018. The land bank (properties to be completed) (condominiums delivered) whose sales will be posted for and after the following fiscal year (fiscal year ending March 31, 2020) as a result of the business according to the policy of investment in strictly selected properties that will be applied continuously, as stated on the right, below the table, are about 8,700 units.

The gross margin for condominiums, as stated in the lower left, was 23% for the fiscal year ended March 31, 2018, and 27% for the fiscal year ended March 31, 2017, which was high because of many highly profitable properties. The standard gross margin for the condominium business of the Company is 21 to 22%. Therefore, the ratio of 23% is the estimated level. For the fiscal year ending March 31, 2019, the gross margin is estimated at 21%.

|

|

|