|

|

|

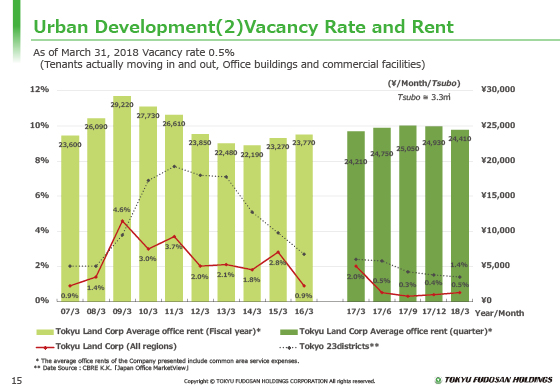

Next are changes in the vacancy rate and rent.

The vacancy rate remains at a low level of 0.5% at the end of March 2018 as shown by the red line graph on the right end. The vacancy rate is calculated based on the number of occupancies.

In addition, the average monthly rent dropped to ¥24,410 per tsubo at the end of March 2018 from the level in December 2017. This rent decrease was caused by the acquisition of a building whose unit price of rent is low in the fourth quarter.

The rent increase for the existing buildings upon the renewal of the contract progressed steadily. The rent revenue has steadily improved.

|

|

|