|

|

|

|

|

|

|

|

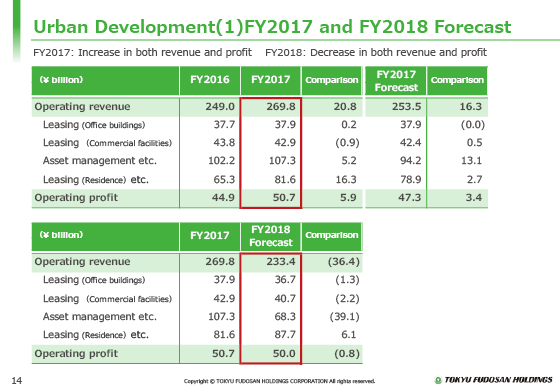

Next is an overview of each segment.

The actual results for the fiscal year ended March 31, 2018 are shown in the upper part. The full-year forecasts for the fiscal year ending March 31, 2019 are shown in the lower part.

For the fiscal year ended March 31, 2018, both revenue and profit increased, mainly due to the increased revenue from sales of properties, including buildings for investors, which is categorized in asset management, etc. and the contribution by the National Students Information Center acquired through M&A in November 2016 in the category of residential leasing, etc. as well as the improved revenue from the existing buildings.

Revenue and profit for the fiscal year ending March 31, 2019 are expected to decrease. Revenue will decrease due to a decrease in revenue from sales of properties, including buildings for investors. Profit is also forecast to decrease mainly due to an increase in costs with the progress of the redevelopment projects and lost profit for the properties sold in the previous fiscal year, despite increased profit from new operations and increased gains on sales of buildings for investors.

|

|

|