|

|

|

|

|

|

|

|

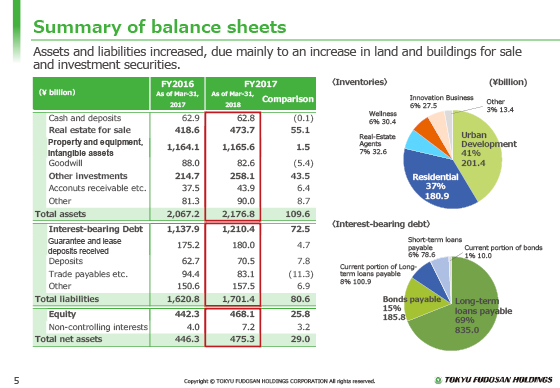

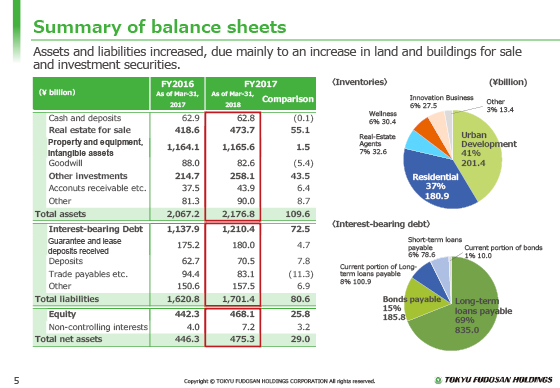

Next is the overview of the balance sheet.

Total assets increased ¥109.6 billion from the end of the previous fiscal year, to ¥2,176.8 billion at the end of March 2018.

Land and buildings for sale increased due to investment in the renewable energy business and other infrastructure-related projects.

As for investment and loans, investment securities increased mainly due to investment in the joint investment business with Norges Bank.

Liabilities increased ¥72.5 billion from the end of the previous fiscal year mainly due to new investment with interest-bearing debt of ¥1,210.4 billion.

In addition, from this presentation, the breakdown of inventories, including land and buildings for sale, and the breakdown of interest-bearing debt are stated in a pie chart on the right of the slide.

The breakdown of inventories includes the balance of the Urban Development segment, accounting for 41% of the whole, ¥201.4 billion, such as offices, commercial facilities and infrastructure-related properties. The balance of the Residential segment is 37%, ¥180.9 billion, specifically condominiums and rental housing. The balance of the Real-Estate Agents segment is 7%, ¥32.6 billion yen, including the purchase and resale business.

|

|

|