|

|

|

|

|

|

|

|

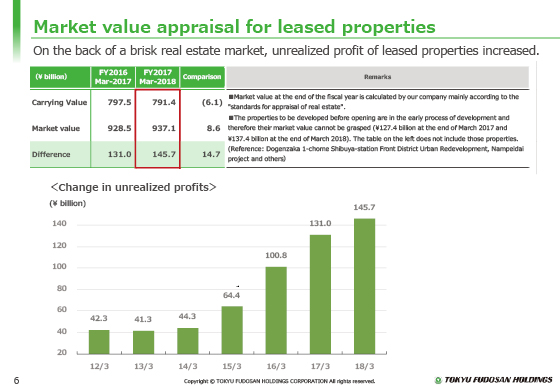

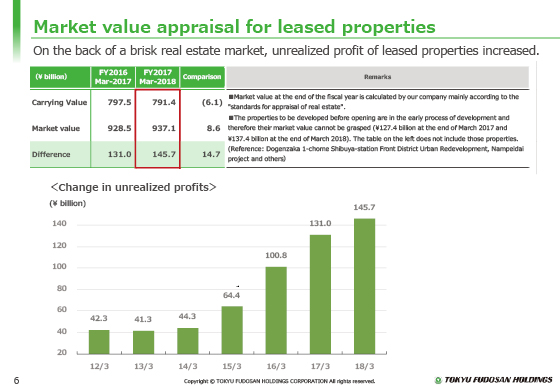

The market value appraisal for leased properties is explained.

The information above summarizes the notes for the market value appraisal for leased properties stated in the Annual Securities Report and other documents. For office buildings and commercial facilities, the book value of leased properties is ¥791.4 billion at the end of the fiscal year ended March 31, 2018, and the corresponding market value is ¥937.1 billion, with unrealized profits of ¥145.7 billion.

On the background of brisk real estate market conditions, an increase in lease revenues and a decrease in the capitalization rate, among other factors, caused unrealized profits from leased properties to increase steadily since around 2013.

As stated in the notes in the upper right, the prices for the properties to be developed before opening are not included in the market value and the book value in the disclosure, mainly because the market price of those properties cannot be grasped.

Specifically, those properties include the Shibuya redevelopment projects Dogenzaka 1-chome Shibuya-station Front District Urban Redevelopment, Nampeidai Project (tentative name) and Shibuya Station Sakuragaokakuchi District Redevelopment Plan.

|

|

|