|

|

|

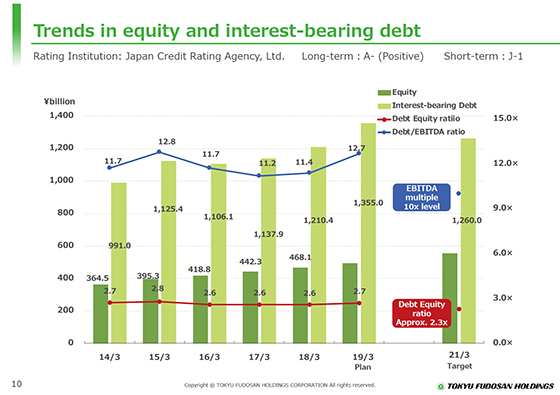

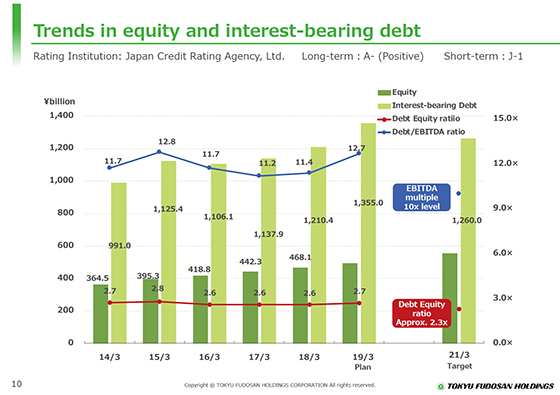

Change in equity capital and interest-bearing debt are explained.

For the fiscal year ended March 31, 2018, interest-bearing debt increased ¥72.5 billion to ¥1,210.4 billion due to new investments, etc. However, the increased equity caused the debt equity ratio to remain the same as in the previous fiscal year, 2.6 times.

For the fiscal year ending March 31, 2019, mainly due to investments in large projects, such as the Shibuya redevelopment projects currently underway and new investments, interest-bearing debt will increase from ¥144.6 billion year on year to ¥1,355.0 billion and both the debt equity ratio and the EBITDA ratio will increase. However, they are expected to decrease with the start of operations of large projects, among others, toward the fiscal year ending March 31, 2021, which is the final fiscal year under the medium-term management plan.

|

|

|