|

|

|

|

|

|

|

|

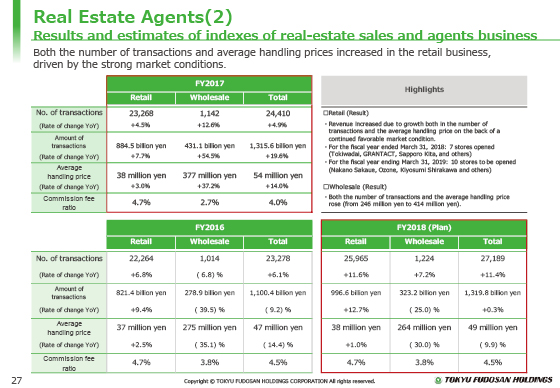

Next, the performance indicators in sales agency operations are explained.

With regard to the results for the fiscal year ended March 31, 2018, an increase in revenues was recorded in the Retail sector, reflecting increases in the number of transactions and in the average handling price mainly due to the opening of seven new stores and the continued efforts to increase the service menus such as the “Liveable Intermediary Guarantee Service.” In the Wholesale sector, we also achieved an overall increase in revenue thanks to an increase in the number of transactions, including large contracts, despite the decreased commission rate.

With regard to the plan for the fiscal year ending March 31, 2019, which is shown on the right in the lower part, both the Retail and Wholesale sectors continue to project an increase in the amount of transactions. In the Wholesale sector, revenue is expected to increase, although the amount of transactions and the average handling price will drop due to the lack of transactions equivalent to the large contracts in the fiscal year ended March 31, 2018.

|

|

|