|

|

|

|

|

|

|

|

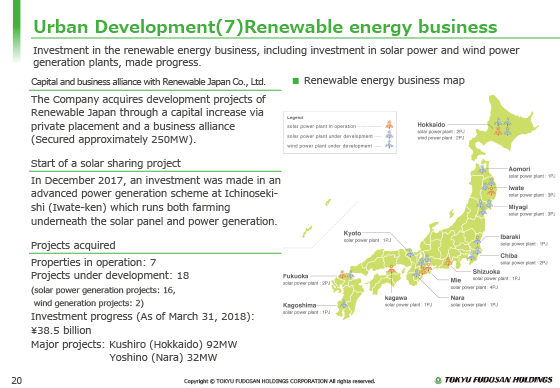

Next is the state of engagement in the renewable energy business.

Under the current medium-term management plan, “expansion of the field of the cyclical reinvestment business” is placed as part of the growth strategy. Infrastructure, industries, hotels, residences for students and other similar assets will be added to the existing assets for investment such as offices and commercial facilities to increase the earning power.

In the fiscal year ended March 31, 2018, as stated in the upper left, a capital and business alliance was entered into with the developer of the renewable energy business, Renewable Japan Co., Ltd. in August 2017. Acquisition of the development projects of the said company continued.

As a result of such business activities, the state of securing the projects for the renewable energy business at the end of March 2018 is seven properties in operation, 16 solar power plant projects and two wind power plant projects under development (18 in total). The investment amount at the end of March is ¥38.5 billion.

|

|

|