|

|

|

|

|

|

|

|

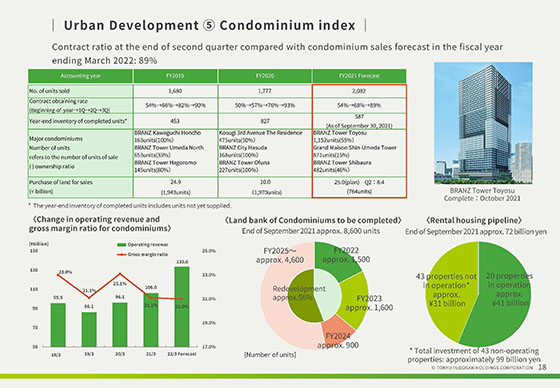

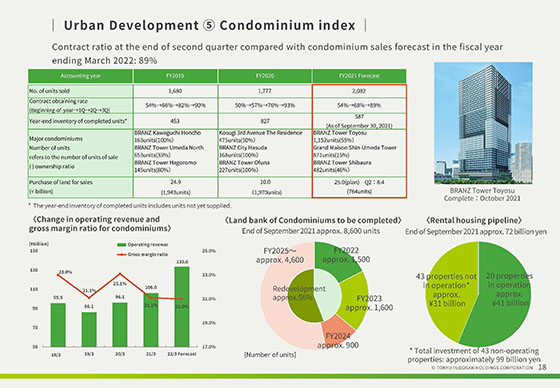

These are movements in operating index for condominiums for sale.

We are planning on selling 2,082 units in the fiscal year ending March 31, 2022, with sales at 133.6 billion yen.

The sales situation for condominiums is continuing to trend steadily.

Contract obtaining rate for the fiscal year ending March 31, 2022 was 89% as of the end of the second quarter, with completed inventory of 827 units at the beginning of the fiscal year. This figure decreased to 587 units as of the end of September, indicating that sales are progressing smoothly.

Our gross margin on condominiums up to the second quarter was low at 18% due to the low percentage of newly-sold properties. We plan on raising this figure to 21% (initial forecast of 20%) for the full fiscal year ending March 31, 2022.

Regarding investment, from the beginning of the fiscal year, progress has been made in 8.4 billion yen in land acquisition, or 764 units in terms of number of units, with approx. 8,600 units in land back scheduled to be posted in the fiscal year ending March 31, 2023 and beyond.

The percentage of redevelopment properties in land back is approx. 56%. Going forward, we will continue to engage in investment while placing emphasis on redevelopment properties with high value-added.

|

|

|