|

|

|

We will now introduce the progress in the environmental management set forth in our Group policy under GROUP VISION 2030, which we announced in May.

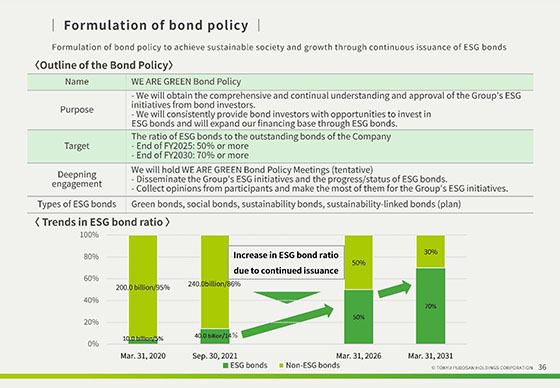

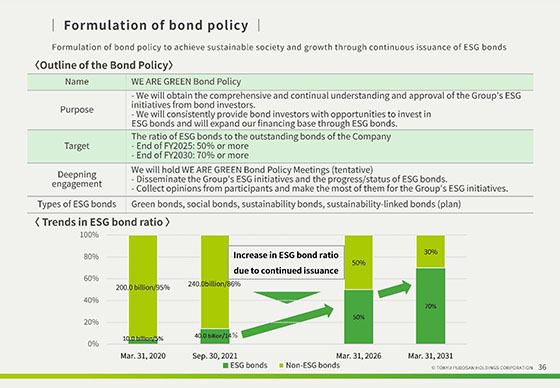

In September, we formulated our WE ARE GREEN Bond Policy, the long-term issuance policy for our first domestic ESG bonds.

Through this policy, we indicate our intention to elevate the ratio of ESG bonds to our bond balance over the long term.

In addition to eliciting understanding of the Company Group’s initiatives geared towards ESG through the ongoing issuance of ESG bonds, we will strive to realize a sustainable society and growth together with our bond investors and all of our other stakeholders.

Our ESG bond ratio, which was 5,0% as of March 31, 2020, was 14.0% as of September 30, 2021.

We aim to elevate that ratio to 50.0% or higher by the end of FY2025 and to 70.0% or higher by the end of FY2030.

|

|

|