|

|

|

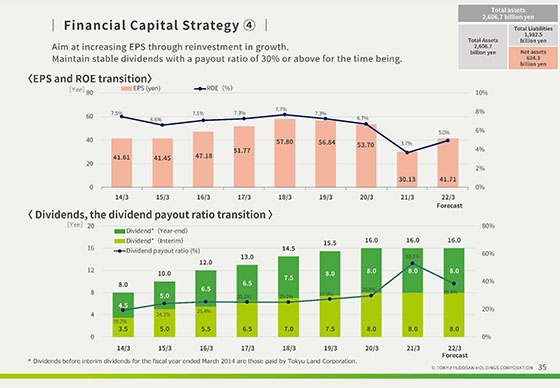

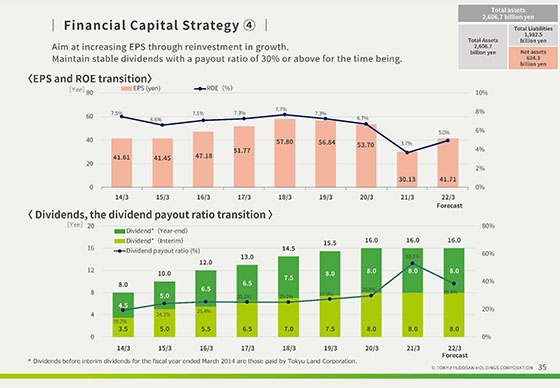

The bottom-right of the balance sheet pertains to total net assets.

Our policy is to strive to grow EPS and improve ROE in order to improve shareholder value and corporate value.

For the fiscal year ending March 31, 2022, our target ROE is 5.0%.

Additionally, under our long-term vision, we will endeavor to maintain a dividend payout ratio of 30% or more and stable dividends as our immediate-term policy to return profits to our shareholders.

For the fiscal year ending March 31, 2022, we will keep said a dividend amount of 16 yen, same level as the previous fiscal year, with a payout ratio of 38.4%.

|

|

|