|

|

|

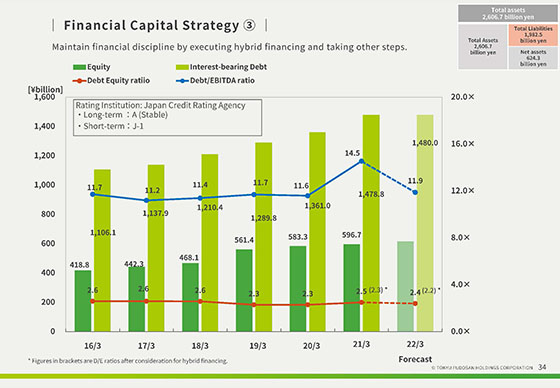

Next, we will explain movements in interest-bearing debt and other items located to the upper-right of the balance sheet.

Our targets for interest-bearing debt as of March 31, 2022, D/E ratio and D/E ratio after taking hybrid finance into consideration are 1,480.0 billion yen, 2.4x and 2.2x, respectively.

Additionally, for our long-term issuer rating by JCR, since being rated in January 2019, we have maintained our A-flat rating consistently even through the COVID-19 pandemic.

|

|

|