|

|

|

|

|

|

|

|

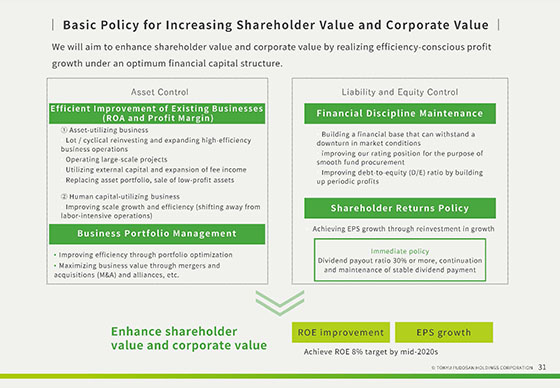

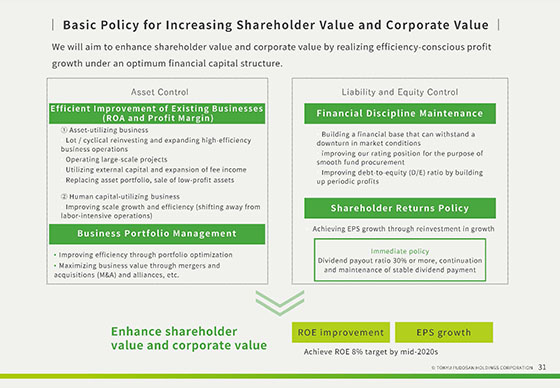

This is an explanation of our basic policy on improving shareholder value and corporate value.

While maintaining fiscal discipline through Asset control and Liability and equity control, we will realize efficiency-conscious profit growth and aim to improve ROE, grow EPS and, by extension, improve shareholder value and corporate value.

With Asset control, challenges are enhancing the efficiency of existing businesses and optimizing our business portfolio.

For specific measures to enhance the efficiency of existing businesses, in asset utilizing businesses, we will engage in the expansion of subdivision businesses, cyclical reinvestment businesses and high-efficiency businesses, the steady operation of large-scale development projects, the expansion of external capital utilization and fee income, asset portfolio replacement, sales of low-revenue assets, and other endeavors.

In human capital utilizing businesses, alongside growth in scale, we will improve efficiency through shifting away from labor-intensive operations, among other means.

With Liability and equity control, while maintaining fiscal discipline, we will establish a financial foundation that is also capable of withstanding market conditions when they have deteriorated and endeavor to maintain and improve our rating for the purpose of ensuring smooth financing.

Going forward, we will proceed to improve our D/E ratio by building up periodic income.

For the return of profit to our shareholders, we will establish EPS growth through growth reinvestment as our basic policy. However, as our policy in the immediate term, we will elevate our dividend payout ratio to 30% or more and to continue maintaining a stable level of dividends.

We will proceed to improve ROE through the above measures.

While our ROE for the previous fiscal year dropped considerably to 3.7% due to the impact of COVID-19, when bearing in mind the cost of shareholders’ equity, we believe that a ROE of 8.0% is the target that we should achieve at an early stage.

We will aim to achieve a target ROE of 8.0% by the middle of the 2020s.

|

|

|