|

|

|

|

|

|

|

|

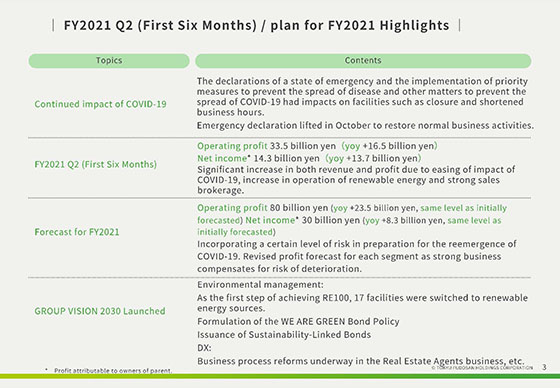

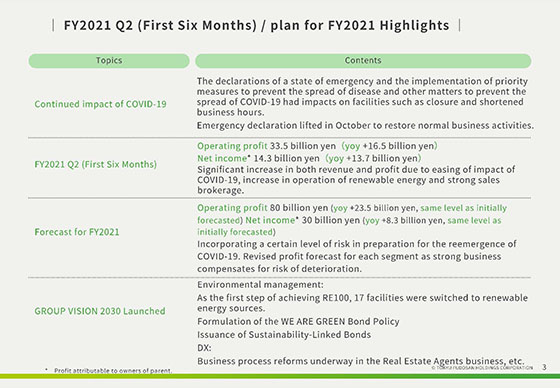

Please allow us to present financial highlights.

The effects of COVID-19 are still ongoing.

A situation punctuated by the intermittent decree of state of emergency and the implementation of priority measures persisted in this fiscal year as well. The impact of the situation on our business performance particularly reared itself in our commercial facilities , Wellness business and Tokyu Hands business.

With the various declaration and whatnot being rescinded in October, we expect that our business activities will recover to a normal form.

In such conditions, for our financial results in the second quarter, operating profit came to 33.5 billion yen and profit attributable to owners of parent came to 14.3 billion yen.

Same period of the previous year, the limited impact of the spreading of COVID-19 coupled with an increase in cases of renewable energy generation facility operation and the strong performance of sales brokerage resulted in a significant increase in revenues and profit.

For our full-year forecast for the fiscal year ending March 31, 2022, there is no change in the figure that we announced in May: operating profit of 80.0 billion yen and profit attributable to owners of parent of 30.0 billion yen.

However, based on trends in its business performance up to the second quarter, we have modified its breakdown per segment.

The details are explained on the following page.

The long-term vision that we announced in May has gotten underway.

We will brief you on progress in the environmental management and DX set forth in our Group policy.

In environmental management, as our first initiative to achieve RE100, we switched from using electric power to renewable energy at a total of 17 office buildings and commercial facilities in the Greater SHIBUYA area.

Furthermore, in September, we formulated the WE ARE GREEN bond policy that forms the long-term issuance policy for our first domestic ESG bonds and issued sustainability link bonds as the first step of that policy.

In addition to eliciting understanding of the Company Group’s initiatives geared towards ESG through the ongoing issuance of ESG bonds, we will strive to realize a sustainable society and growth together with our bond investors and all of our other stakeholders.

Additionally, for DX as well, we have multiple initiatives underway in the area of business process reforms.

Those initiatives will be explained in detail later.

|

|

|