|

|

|

|

|

|

|

|

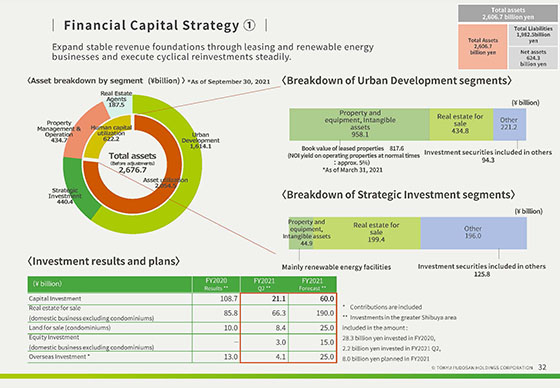

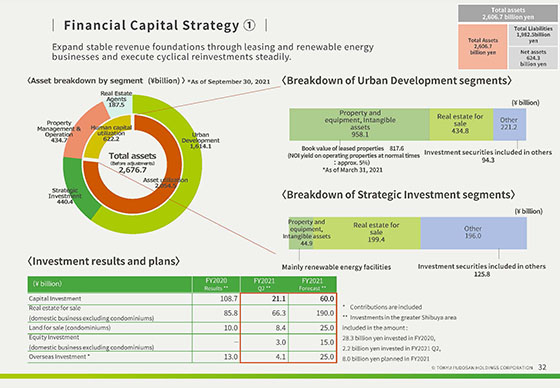

Next is an explanation of our financial capital strategy.

We will start with the left side of the balance sheet, or assets.

The circle graph on the upper-left indicates the figures for each segment as of September 30, 2021.

The Urban Development business segment and the Strategic Investment business segment, two asset utilization-type segments, account for 77% of all assets.

Moreover, a breakdown of assets in those two segments is indicated on the right side.

For the Urban Development business segment, non-current assets include rental offices and commercial facilities and other assets include investment securities, etc.

Among non-current assets, the book value of leased properties is 817.6 billion yen as of March 31, 2021. Our NOI yield on a cruising basis is approx. 5.0%.

For the Strategic Investment business segment, non-current assets include renewable energy facilities, etc. and other assets include investment securities, etc.

On the bottom-left are our investment results and plans.

For the fiscal year ending March 31, 2022, as we are not scheduling the completion of any large-scaled properties, our investments in non-current assets will decline. Conversely, our plans call for an increase in investments in inventories in order to promote cyclical reinvestment. This plan is progressing steadily as of the second quarter.

For both asset utilization-type segments, we will steadily pursue investments in non-current assets, which constitute our stable earnings foundation, and cyclical reinvestment, and aim to realize the turnover rate and profit margin cited in our long-term vision.

|

|

|