|

|

|

|

|

|

|

|

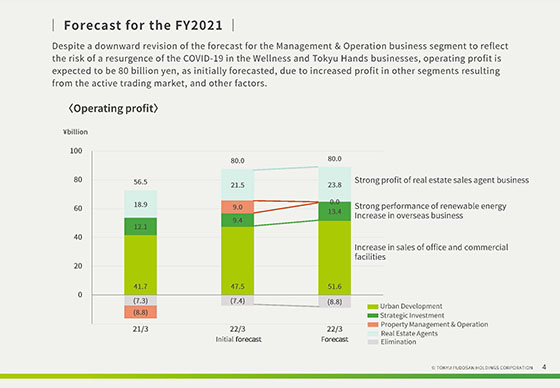

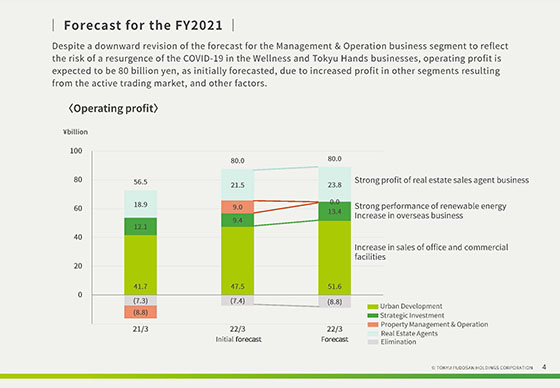

We will now go over our business performance forecast for the fiscal year ending March 31, 2022.

This graph shows our business results for the last fiscal year and operating profit for each segment under both the full-year forecast that we originally announced and the full-year forecast that we recently announced.

It continues to be difficult to predict when COVID-19 will subside.

In our business results forecast, while is currently difficult to estimate the impact that our business has, for some of our businesses, we revised our forecast after taking into consideration the future risk of the virus spreading anew.

Relative to our initial forecast, Property Management & Operation business segment will see a decline in profit. The other three segments will post an increase in profit.

In Property Management & Operation business segment, we performed a downwards revision for Wellness business and Tokyu Hands business, which continue to be impacted by COVID-19.

While that impact is limited compared to the prior fiscal year, we factored in delays in our recovery with the assumption that there would be a future resurgence in the COVID-19.

For the other segments, we experienced an increase in gains from the sales of office building and commercial facility asset in Urban Development business segment, the favorable operation of renewable energy generation facilities and the sale of properties under overseas operations in strategic Investment business segment, and the favorable performance of real estate agent operations in Real Estate Agent business segment. Due to these and other factors, we are targeting an increase in profit over our initial forecasts for each segment.

While our performance alternates between favorable and unfavorable depending on the business, we intend to cover the risk of COVID-19-induced downswing with our strong-performing businesses and steadily achieve operating profit of 80 billion yen.

|

|

|