|

|

|

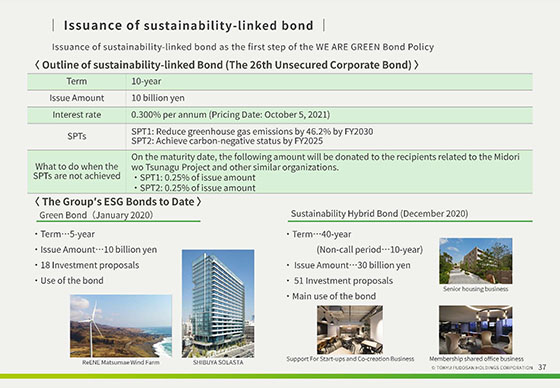

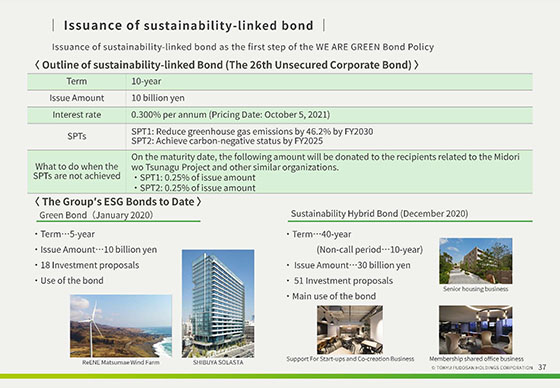

What follows is an explanation of sustainability link bonds, the first initiative under our WE ARE GREEN Bond Policy.

With these bonds, we have adopted a scheme in which we will employ two SPT (Sustainability Performance Targets) related to climate change, contribute to ESG through donations should we fall short of those targets and, in doing so, contribute to the realization of a more sustainable society.

Considerable demand and declarations of investment have been made for our issuance profile for these bonds, consisting of a 10 year term and issuance amount of 10.0 billion yen.

In the lower column, we feature the ESG bonds that we have introduced up to this point.

Going forward, we will continue to pursue financing while applying initiatives aimed at the ESG of the Group.

|

|

|