|

|

|

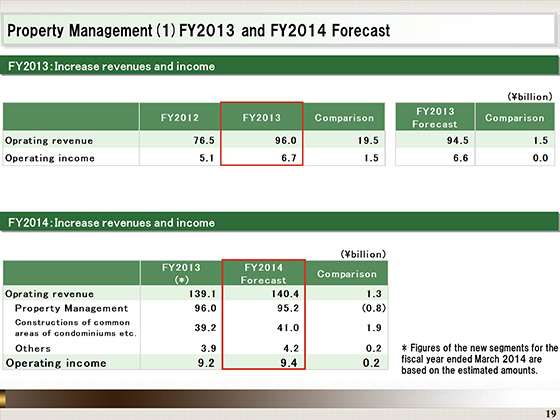

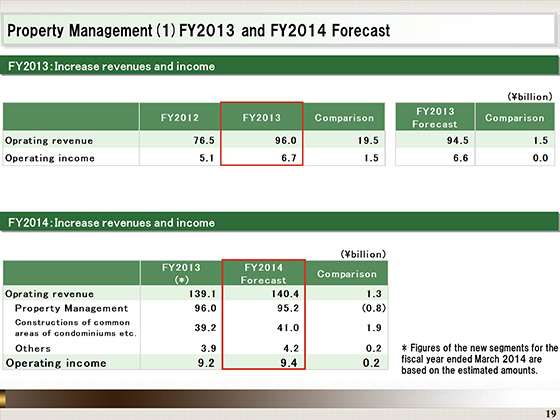

Next, I would like to present the results of the Property Management segment for the fiscal year ended March 2014 and the forecast for the Property Management segment for the fiscal year ending March 2015.

In the fiscal year ended March 2014, operating revenue rose ¥19.5 billion from the previous fiscal year, to ¥96 billion, and operating income increased ¥1.5 billion, to ¥6.7 billion.

Both revenues and income increased as a result of an increase in stock under management, which was mainly attributable to the inclusion of United Communities Co., Ltd. in consolidated subsidiaries by Tokyu Community Corporation in February 2013.

With respect to the forecast for the fiscal year ending March 2015, we expect operating revenue of ¥140.4 billion, up ¥1.3 billion from the previous fiscal year, and operating income of ¥9.4 billion, rising ¥0.2 billion year on year.

We expect higher revenues and income given an increase in the construction of common areas in condominiums and other items.

|

|

|