|

|

|

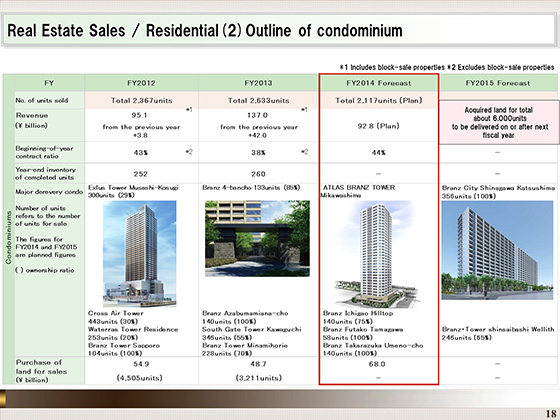

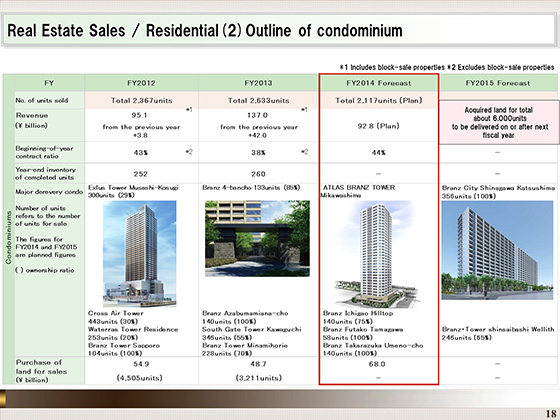

Next, I will outline our plan for condominiums for sale.

We plan to sell 2,117 units and record revenues of ¥92.8 billion for the fiscal year ending March 2015.

As a result of the change in the segment categories, block sales of buildings for investors, such as condominium properties for lease, are included in the Urban Development segment.

The contract ratio to sales plan for condominiums will stand at 44%, up 6 points year on year. The inventory of completed units remained at a low level, with 260 units at the end of March 2014.

We acquired land for 3,211 units for ¥48.7 billion in the fiscal year ended March 2014. As a result, we have land for a total of 6,000 units (proposed) to be delivered during the fiscal year ending March 2016 or thereafter.

Sales remain strong, and the number of visitors and other factors have not been noticeably affected either, even following the consumption tax hike in April.

|

|

|