|

|

|

|

|

|

|

|

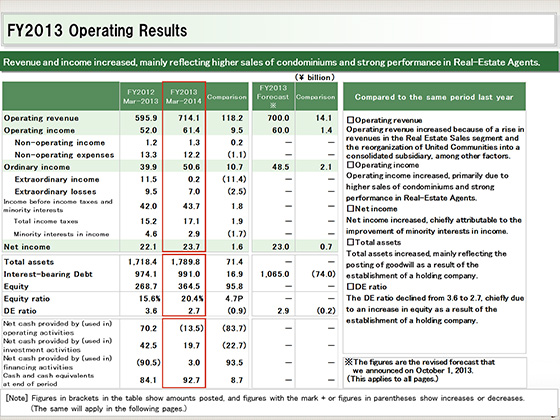

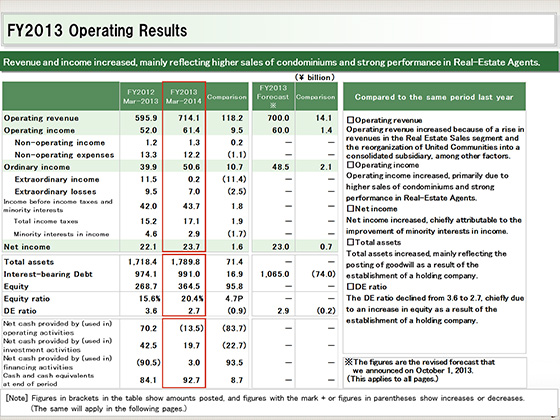

I would now like to provide an overview of our financial results for the fiscal year ended March 2014.

Operating revenue increased ¥118.2 billion from the previous fiscal year, to ¥714.1 billion, mainly reflecting stronger sales of condominiums and other properties in the Real Estate Sales segment and contributions from United Communities Co., Ltd., which Tokyu Community Corporation acquired in February 2013. Operating income rose ¥9.5 billion year on year, to ¥61.4 billion, primarily attributable to increased sales of condominiums and strong performance in the real estate sales agent business, the same as for the rise in operating revenue.

Net income climbed ¥1.6 billion year on year, to ¥23.7 billion, mainly reflecting the improvement of minority interests in income as a result of the establishment of a holding company system, offsetting the effects of the recording of extraordinary income from the asset transfer to Activia Properties Inc. in the previous fiscal year.

Moreover, with an increase in equity as a result of the establishment of a holding company, the DE ratio declined from 3.6 at the end of the fiscal year ended March 2013 to 2.7, and the equity ratio also improved to 20.4%.

Meanwhile, net cash used in operating activities came to ¥13.5 billion due to the progress in the acquisition of inventories such as office buildings and commercial facilities.

|

|

|