|

|

|

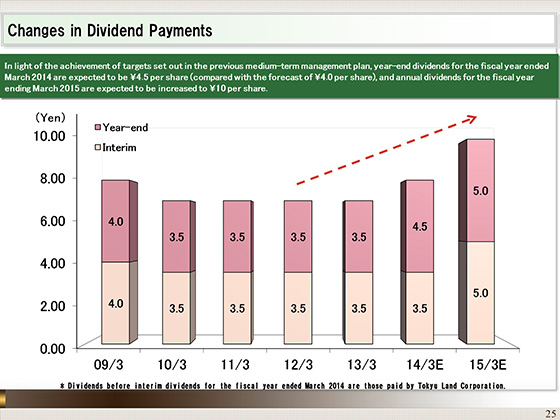

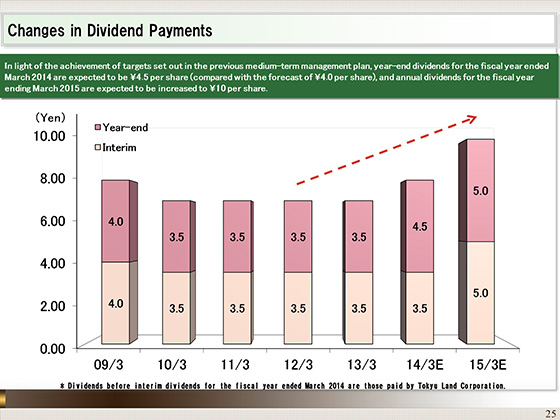

Finally, I would like to explain the trend of dividends.

We originally planned to pay a year-end dividend of ¥4 per share for the fiscal year ended March 2014. However, considering the achievement of the targets of the previous the medium-term management plan and other factors, we have decided to raise the dividend by ¥0.5 per share and pay ¥4.5 per share.

We also forecast higher dividend payments for the fiscal year ending March 2015, with annual dividend payments of ¥10 per share, comprising an interim dividend of ¥5 per share and a year-end dividend of ¥5 per share.

The dividend payout ratio is expected to be 24.4%.

We will continue to focus on returning profits to our shareholders in the future as one of our key policies.

|

|

|