|

|

|

|

|

|

|

|

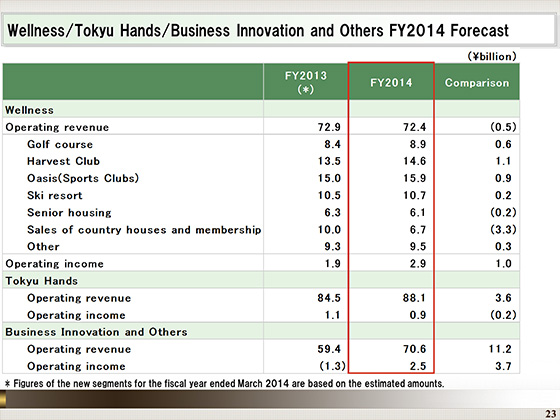

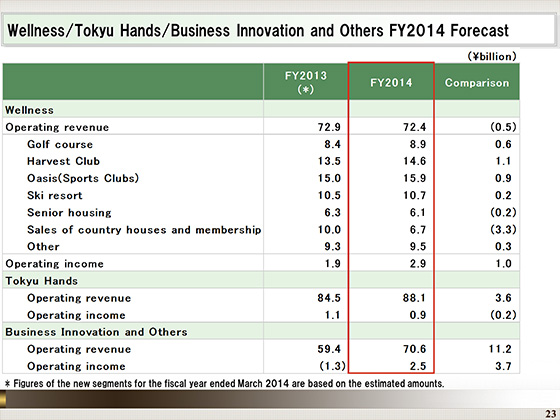

Next, I would like to present the forecast for the Wellness segment, the Tokyu Hands segment and the Business Innovation and Others segment for the fiscal year ending March 2015.

In the Wellness segment, we expect operating revenue of ¥72.4 billion, down ¥0.5 billion from the previous fiscal year, and operating income of ¥2.9 billion, rising ¥1 billion year on year.

We anticipate a decline in overall revenues, given a decline in revenues including sales of Harvest Club country houses and memberships, despite higher revenues from new operations, the opening of Harvest Club Kyoto Takagamine in October. Operating income, on the other hand, is expected to rise, mainly reflecting a decline in the loss on valuation of inventory related primarily to country houses that was recorded in the previous fiscal year.

In the Tokyu Hands segment, we expect operating revenue of ¥88.1 billion, up ¥3.6 billion from the previous fiscal year, and operating income of ¥0.9 billion, falling ¥0.2 billion year on year.

We expect that revenues will rise, mainly on the back of the opening of new stores, but that income will fall due to the increase in expenses for opening new stores and other expenses.

In the Business Innovation and Others segment, we expect operating revenue of ¥70.6 billion, up ¥11.2 billion from the previous fiscal year, and operating income of ¥2.5 billion, increasing ¥3.7 billion year on year.

We anticipate higher revenues and income, primarily reflecting an increase in sales of properties.

|

|

|