|

|

|

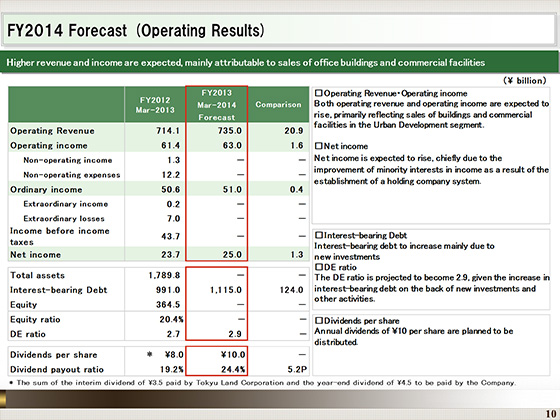

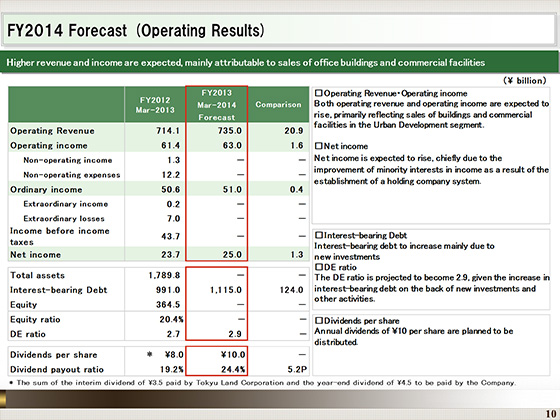

I will now provide you with a briefing on our full-year forecast for the fiscal year ending March 2015.

We expect operating revenue to be ¥735 billion, operating income to be ¥63 billion, ordinary income to be ¥51 billion, and net income to be ¥25 billion for the fiscal year ending March 2015.

We expect higher revenue and income, primarily reflecting sales of office buildings and commercial facilities in the Urban Development segment, and net income is also expected to rise, primarily due to the improvement of minority interests in income.

We anticipate that interest-bearing debt at the end of March 2015 will rise ¥124 billion from the end of March 2014, to ¥1,115 billion, mainly attributable to new investments by focusing on the replenishment of the portfolio. Meanwhile, the DE ratio is expected to be 2.9.

|

|

|