|

|

|

|

|

|

|

|

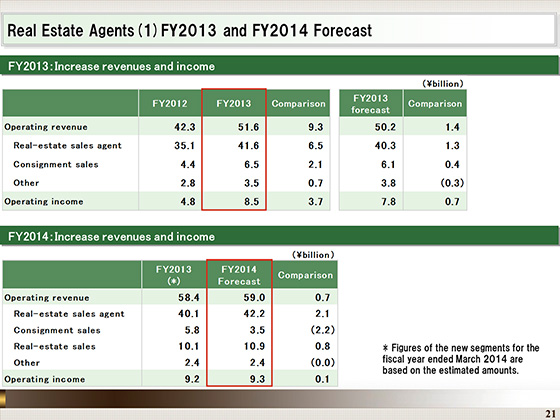

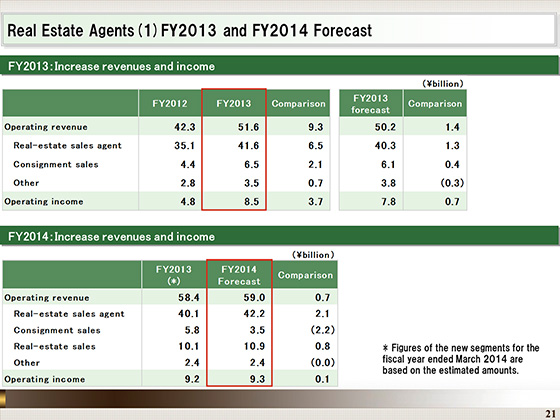

Next, I would like to present the results of the Real-Estate Agents segment for the fiscal year ended March 2014 and the forecast for the Real-Estate Agents segment for the fiscal year ending March 2015.

In the fiscal year ended March 2014, operating revenue rose ¥9.3 billion from the previous fiscal year, to ¥51.6 billion, and operating income increased ¥3.7 billion, to ¥8.5 billion.

The Real-Estate Agents segment recorded higher revenues and income due to a rise in the number of transactions and contracted prices in both retail sales and wholesale sales in the real estate sales agent business, as well as an increase in the number of deliveries in the consignment sales business.

As for the forecast for the fiscal year ending March 2015, we expect operating revenue of ¥59 billion, up ¥0.7 billion from the previous fiscal year, and operating income of ¥9.3 billion, rising ¥0.1 billion year on year.

We anticipate higher revenues and income in the segment, mainly reflecting continued strong performance in the real estate sales agent business, offsetting lower revenues in the consignment sales business, due to a decline in the number of deliveries of condominiums.

|

|

|