|

|

|

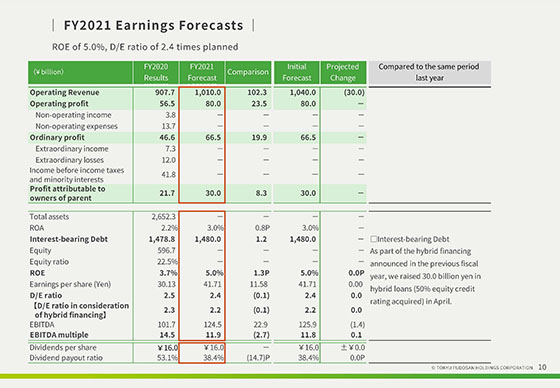

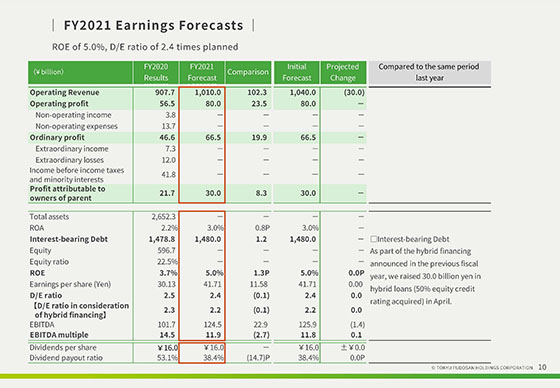

This is an explanation of our business performance forecast for the full year.

We are targeting 1,010.0 billion yen in operating revenue, 80.0 billion yen in operating profit, 66.5 billion yen in ordinary profit, and 30.0 billion yen in profit attributable to owners of parent.

Expect of operating revenue, no changes have been made from our initial forecast. However, based on trends in our business performance up to the second quarter, we changed the breakdown for each segment.

No changes have been made from our initial forecasts for ROE and D/E ratio, which remain at 5.0% and 2.4x, respectively.

As our policy on the return of profits to our shareholders in the immediate term, we will endeavor toto maintain a dividend payout ratio of 30% or more and to maintain stable dividends

We will keep the amount of dividends for the fiscal year ending March 31, 2022 at 16.0 yen per share, the same level as last fiscal year, and are scheduling a dividend payout ratio of 38.4%.

|

|

|