|

|

|

|

|

|

|

|

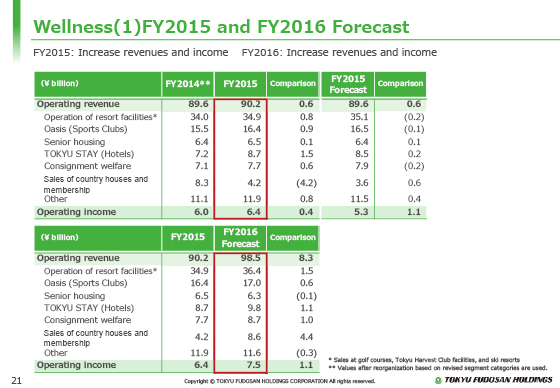

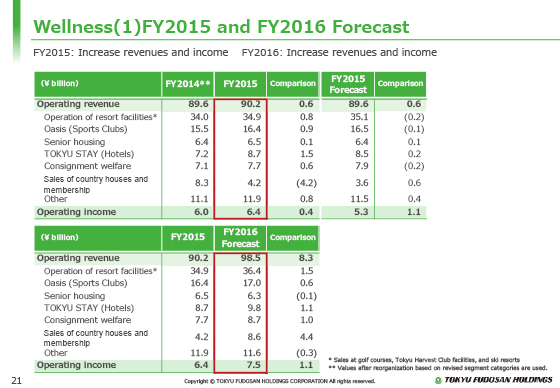

Next, I would like to explain the results and forecasts for the Wellness Business segment.

In the fiscal year ended March 31, 2016, operating revenue rose by ¥0.6 billion year on year, to ¥90.2 billion, and operating income grew by ¥0.4 billion year on year, to ¥6.4 billion.

Although there was a decline in revenue after the sale of a cottage in connection with the start of operation and delivery of Harvest Club Kyoto Takagamine & VIALA in the previous fiscal year, both the occupancy rate and guest room unit price at the medium- and long-term stay hotels, Tokyu Stay, increased primarily in response to growing demand for inbound tourism, and the launch of Tokyu Sports Oasis fitness club, Tokyu Stay, Harvest Club helped the segment achieve revenue and income growth.

In the fiscal year ending March 31, 2017, we expect that this segment will earn operating revenue of ¥98.5 billion, up ¥8.3 billion year on year, and operating income of ¥7.5 billion, up ¥1.1 billion year on year.

We forecast that both revenue and income will grow based on the improved operation of Harvest Club, ski resorts, and other existing facilities and the launch of new Tokyu Stay locations.

|

|

|