|

|

|

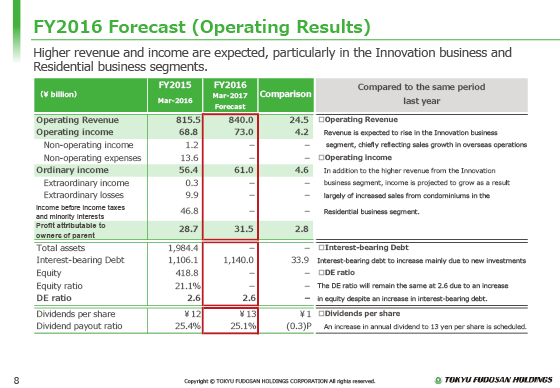

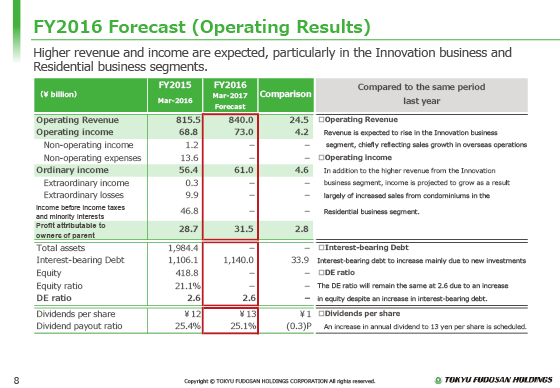

Next, we will discuss our forecast for the fiscal year ending March 31, 2017.

According to our forecast for the fiscal year ending March 31, 2017, operating revenue will stand at ¥840.0 billion, operating income at ¥73.0 billion, ordinary income at ¥61.0 billion, and profit attributable to owners of parent at ¥31.5 billion.

Increased revenue and income are projected based primarily on revenue growth in the overseas business of the Innovation business segment and profit growth in the Residential business segment due to higher sales of condominiums.

At the end of the fiscal year, interest-bearing debt will stand at ¥1,140.0 billion, an increase of ¥33.9 billion from the end of fiscal year ended March 2016 due to the new investment, etc.

The DE ratio is expected to be 2.6, unchanged from the end of the fiscal year ended March 2016 due to the addition of equity capital that will offset an increase in interest-bearing debt.

|

|

|