|

|

|

|

|

|

|

|

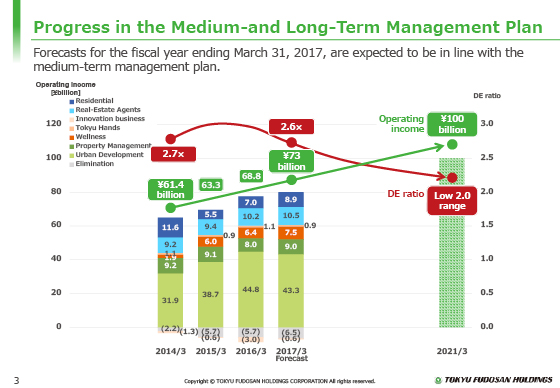

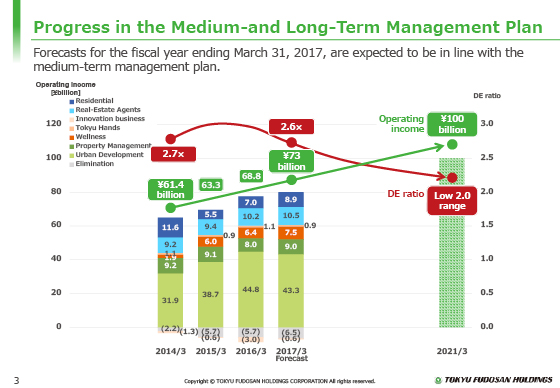

Our financial forecast for the fiscal year ending March 2017 includes ¥73.0 billion in operating income, as targeted in the medium-term management plan.

Revenue in the Urban Development business will appear to decline due to reduced gains on sales. In fact, the level of stable earnings is actually increasing thanks to the opening of the Ginza stores and other segments.

The Residential business segment is expected to see a substantial addition to the revenue targeted in the medium-term plan, as the revenues from high-end properties supplied in previous years will be recognized in the current fiscal year.

While the Innovation business segment is performing significantly below the target, the Real-estate Agent and Wellness business segments have been above the targets in the medium-term plan, and we expect that operating income of ¥73.0 billion is reasonably within our reach.

Beyond that, we will steadily implement large projects such as three Shibuya redevelopment projects and the Takeshiba project and raise the level of stable earnings in the Urban Development segment while growing other segments toward the fiscal year ending March 2021 (FY2020).

The DE ratio was reduced to 2.6 a year earlier than the target in the medium-term plan due to the market in the previous year, when investment was difficult. It is expected to remain the same in the current year.

We realize that strengthening our financial base is always an important task so that we can maintain stable growth for the future and make bold investments when necessary.

We will continue to add to our equity capital by accumulating yearly profit and improve our DE ratio as a natural consequence.

|

|

|