|

|

|

|

|

|

|

|

I will now provide you with an overview of each segment.

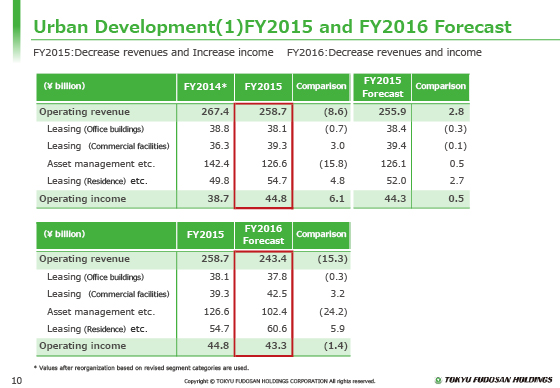

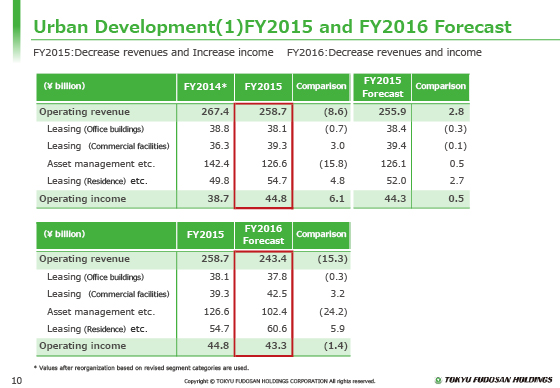

First, I will explain the results in the Urban Development segment.

This segment achieved operating revenue of ¥258.7 billion, down ¥8.6 billion year on year, and operating income of ¥44.8 billion, up ¥6.1 billion year on year, for the fiscal year ended March 31, 2016.

The decrease of ¥8.6 billion in revenue was caused by a decrease of ¥16.9 billion in gain on sale of for investors despite growth in revenue from the new operation, etc. of the rental business, including commercial facilities. buildings, etc.

On the other hand, the increase of ¥6.1 in operating income was the result of higher profitability and gain on sale partly due to increased prices of buildings, etc. for investors sold, in addition to growth in profit from new operations and other factors.

We now move on to the lower table, which presents our forecast for the fiscal year ending March 2017.

Operating revenue is projected to decline ¥15.3 billion year on year, to ¥243.4 billion, and operating income is expected to fall ¥1.4 billion year on year, to ¥43.3 billion.

Despite the increase in revenue and income from the new operations of Tokyu Plaza Ginza etc., we expect a decline income due to the reduced revenue etc. from the sales of buildings etc. for investors.

|

|

|