|

|

|

|

|

|

|

|

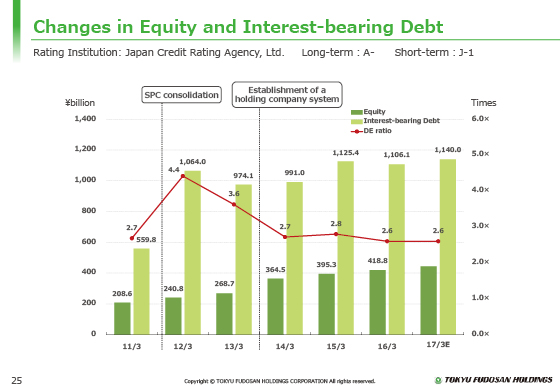

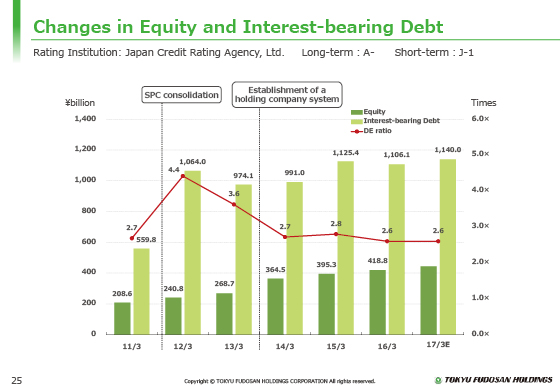

Finally, I will describe the trends in our equity capital and interest-bearing debts.

At the beginning of the fiscal year ended March 31, 2012, the consolidation of SPC resulted in increased interest-bearing debts and a rise in the DE ratio to 4.4. During the three years of the previous medium-term management plan, interest-bearing debts decreased due to the sale of assets to REIT, the accumulation of profits during the period, the transfer to the holding-company system, and other activities. Meanwhile, equity capital increased, and in the fiscal year ending March 2014, the DE ratio was reduced to 2.7.

Interest-bearing debt increased significantly with new investments during the fiscal year ended March 31, 2015, but decreased in the fiscal year ended March 31, 2016. In addition, due to the increased equity capital, the DE ratio improved to 2.6, as targeted in the medium-term plan for the fiscal year ending March 31, 2017.

In the fiscal year ending March 31, 2017, while we will continue to see growth in interest-bearing debts under the policy of carefully selecting investments, the DE ratio is expected to remain at 2.6 due to the accumulation of profits during the fiscal year.

This concludes my presentation.

The reference material at the end of the document includes a supplementary explanation about the change in segment categories, trends in total floor areas and AUM, and other information for you to look at later.

|

|

|