|

|

|

|

|

|

|

|

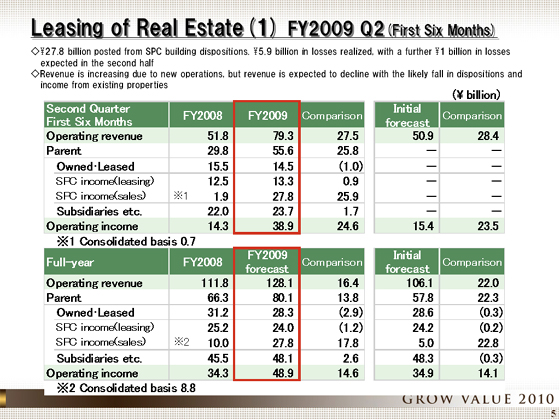

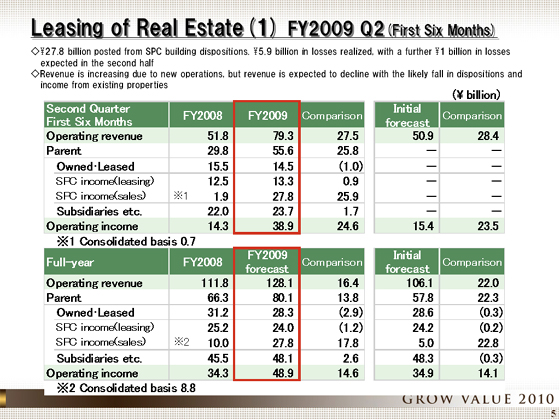

I will now present an overview of each segment, starting with the Leasing of Real Estate segment. Results for the first half were ¥79.3 billion in revenue, up ¥27.5 billion from the same period of the previous year, and ¥38.9 billion in operating income, up ¥24.6 billion year-on-year.

The breakdown is as follows: operating revenue from owned and leased property declined due to disposition of property and lease terminations. SPC lease income increased slightly, mainly due to contributions from the full-year operation of buildings that were opened during the previous fiscal year, whereas SPC sales income increased substantially, with ¥27.8 billion posted as a result of the partial sale of our holdings in the Shiodome Building.

As for operating income, losses were realized for regional properties and properties temporarily held by SPCs, with ¥1.7 billion in disposition losses and ¥4.2 billion in valuation losses, coming to a total of ¥5.9 billion. However, these losses were more than offset by a substantial increase in SPC disposition dividends so that operating income increased overall.

The forecast for the fiscal year is for revenue to increase by ¥16.4 billion to ¥128.1 billion, and for operating income to increase by ¥14.6 billion to ¥48.9. No SPC sales income is scheduled for the second half of the fiscal year. On the other hand, SPCs are expected to realize losses in the order of about ¥1 billion during the second half.

Looking at a breakdown in the changes in operating income as compared to the previous year, the major factor is a ¥19 billion increase in SPC sales income. Realized losses are also expected to increase by ¥1.5 billion while contributions form new supply (including SPCs and owned/leased property) is projected to increase by ¥3 billion. Missed earnings opportunities from disposed properties are expected to amount to about ¥4 billion, while rental income from existing properties is set to deteriorate by ¥1 billion and fees are likely to decline by ¥1.2 billion. The overall result of all of these factors is a ¥14.6 billion increase in operating income from the previous year.

|

|

|