|

|

|

|

|

|

|

|

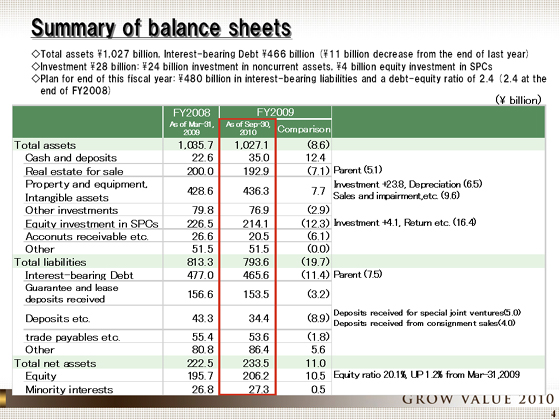

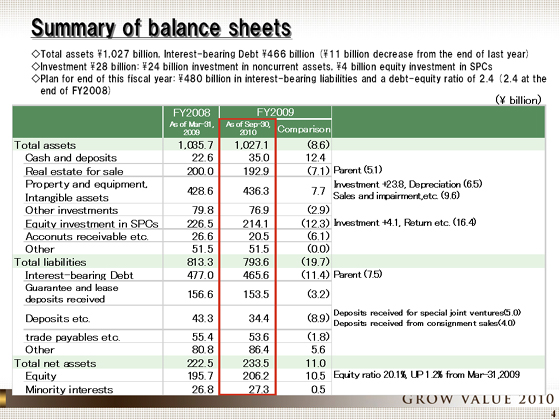

Now I will present a summary of our balance sheet. As of the end of September, total assets were ¥1027.1 billion, down ¥8.6 billion.

In the assets section, although some fixed assets were sold, there was also ¥23.8 billion in new investment, so that overall fixed assets increased by ¥7.7 billion. Also in the assets section, equity investment in SPCs declined by ¥12.3 billion, as we made progress in recovering our investments through the partial sale of our holdings in the Shiodome Building and other measures.

In the liabilities section, interest-bearing debt declined ¥11.4 billion from the end of previous fiscal year, to ¥465.6 billion, ¥49.4 billion less than the initial forecast. Our equity ratio improved 1.2 points from March 31, 2009, to 20.1%. Interest-bearing liabilities as of the end of the fiscal year (March 31, 2010) are expected to be ¥480 billion (as stated in the initial projection), the result of redirecting recovered funds to new investments, so that our debt-to-equity ratio at the end of the fiscal year is projected to be 2.4.

|

|

|