|

|

|

|

|

|

|

|

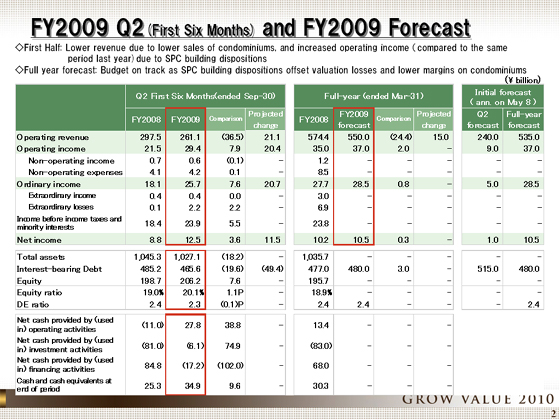

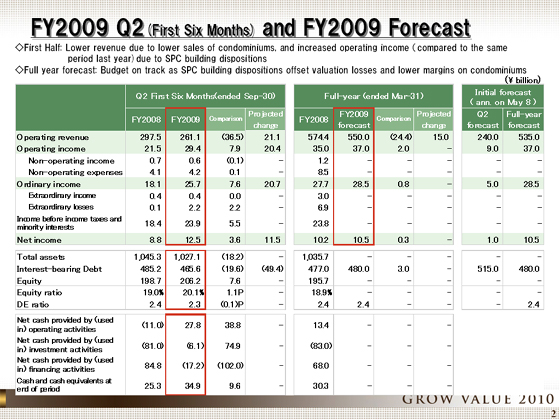

I'd like to start by giving an overview of the financial highlights for the first half ended September 30, 2009.

Operating revenue was ¥261.1 billion, down ¥36.5 billion from the same period last year; operating income was ¥29.4 billion, up ¥7.9 billion; and ordinary income was ¥25.7 billion, up ¥7.6 billion. Revenue declined due to lower sales of condominiums but, as has already been announced in the revised earnings forecast released on August 28, we booked SPCs disposition dividends of ¥27.8 billion resulting dividends resulting from the sale of part of our holdings in Shiodome Building, which offset the losses realized in the Real Estate Sales and Leasing of Real Estate and the falling margins on condominiums. Ultimately, then, profits were actually higher both higher than for the same period last year and higher than initial forecast.

As for the earnings forecast for the full year, operating revenue is expected to fall ¥24.4 billion to ¥550 billion, but operating income, ordinary income and net income are all expected to increase, to ¥37 billion, ¥28.5 billion and ¥10.5 billion respectively. For the second half of the fiscal year, we have factored in deteriorating profits for condominiums and the realization of losses for other assets, but these will be offset by the SPCs disposition dividends from the first half, and hence we expect to achieve the profits in the initial projections.

I will present an overview of our balance sheets in a moment.

|

|

|