|

|

|

|

|

|

|

|

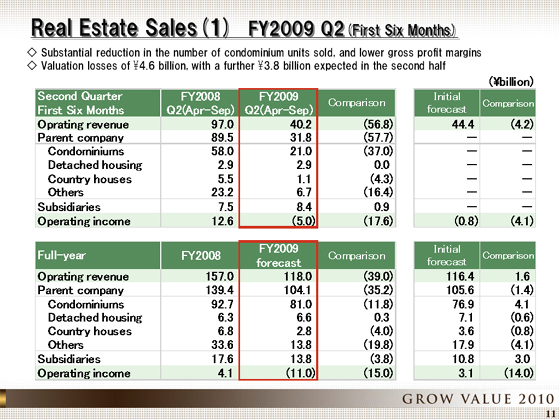

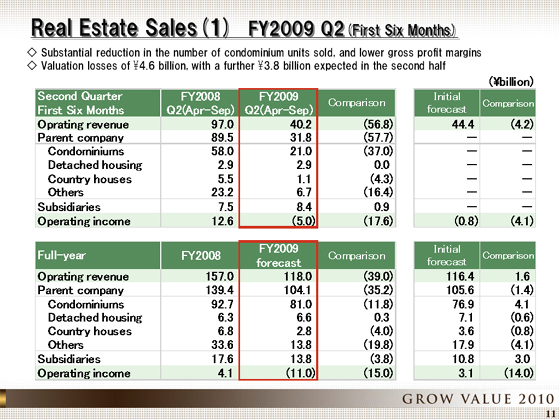

Next I will look at the Real Estate Sales segment.

Sales for the first half ended September 30 came to ¥40.2 billion, down ¥56.8 billion year on year. Operating income declined ¥17.6 billion, to a loss of ¥5 billion year on year. The first half of the previous fiscal year saw the delivery of high margin condominiums as part of large developments, which were contracted while the market was brisk. However, in this fiscal year the total number of units fell by half and the gross profit margin also fell significantly, leading to substantial declines in both income and profit.

Properties that were written down in the previous fiscal year will be recognized this fiscal year, and so although sales conditions are recovering, unfortunately an increasing number of these properties are not contributing to profit. Since the previous fiscal year, we have also adopted a policy of using appropriate price adjustments to turn inventories over quickly. We have been able to substantially reduce our inventories of completed condominiums from 816 units at the end of March to 344 units at the end of September. �In this first half we took ¥4.6 billion in valuation losses for inventories (mainly country houses and condominiums) following a revision of prices.

The bottom half of the chart shows the forecast for the fiscal year, ending March 31, 2010. Operating revenue is expected to come in at ¥118 billion, down ¥39 billion year over year. Operating loss is expected to reach ¥11 billion, down ¥15 billion compared to the previous year. The declines in both revenue and income are due to a reduction in the sales volume of condominiums and low gross margins. Initially valuation losses for the current fiscal year were projected at ¥2 billion, mostly in condominiums but, factoring in the valuation losses for country houses experienced in the first half of the fiscal year, we now anticipate a further ¥3.8 billion in valuation losses during the second half of the year (mainly in inventories for investment purposes) so that valuation losses for the full year are expected to come to ¥8.4 billion.

|

|

|