|

|

|

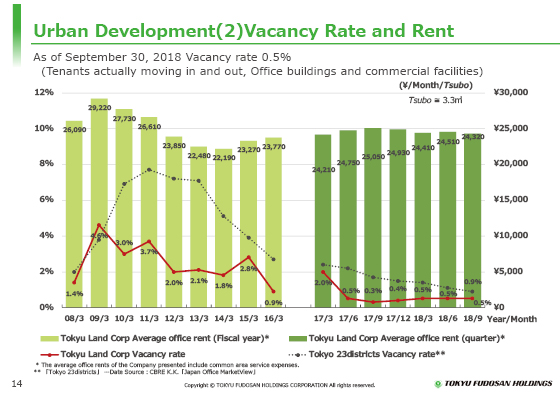

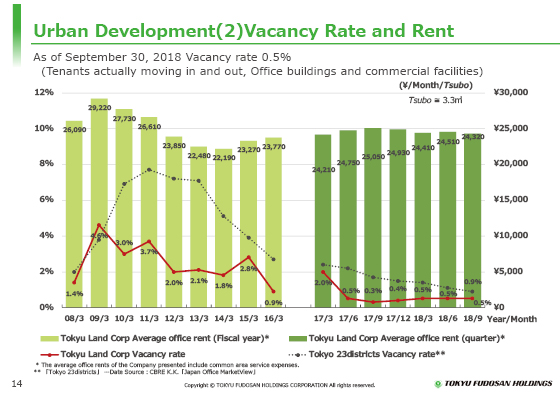

Next are trends in the vacancy rate and rents.

The vacancy rate continued to remain low at 0.5% at the end of September 2018 on the back of steady demand. The vacancy rate is calculated based on the number of occupancies.

The average monthly rent was ¥24,320 per tsubo at the end of September 2018, a fall of about ¥90 from the end of March 2018. This decline was caused by the replacement of the portfolio, and the rent increases for existing buildings upon the renewal of contracts went smoothly, resulting in a steady improvement in rent revenue.

|

|

|