|

|

|

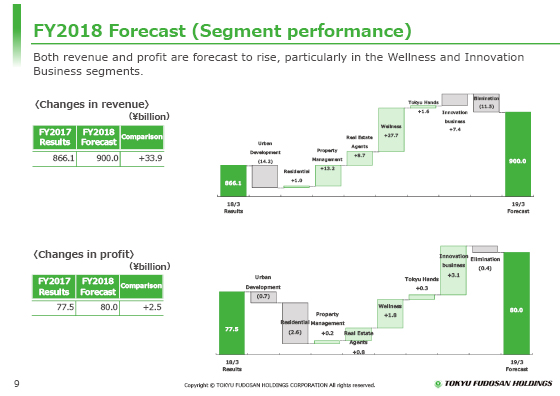

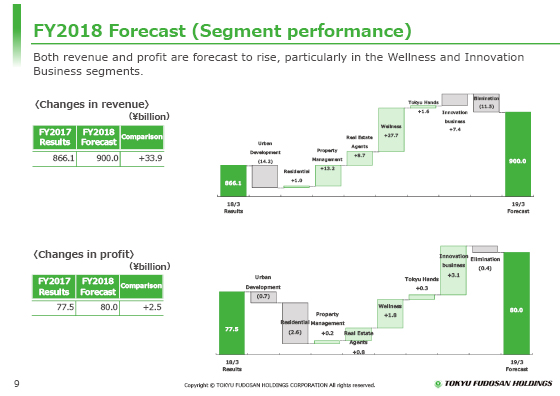

Next are changes in operating revenue and operating profit by segment.

As shown in the bar chart in the upper part, operating revenue will decline in the Urban Development segment mainly due to a fall in revenue from sales of properties, including buildings for investors, but operating revenue is forecast to increase in the Wellness segment where Tokyu Harvest Club Karuizawa & VIALA will be delivered and asset sales will increase, the Property Management segment where sales of construction work will increase due to the effect of the integration of the renovation business, and the Innovation Business segment where the posting of condominiums in Indonesia will begin.

Operating profit shown in the lower part is forecast to increase ¥2.5 billion year on year due to a rise in profit in the Wellness and Innovation Business segments, as in operating revenue, although profit will decline in the Urban Development and Residential segments.

|

|

|