|

|

|

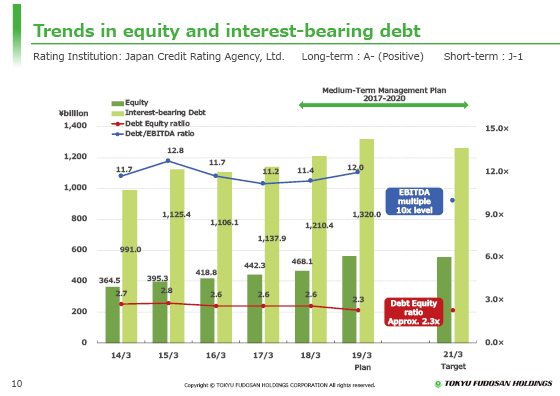

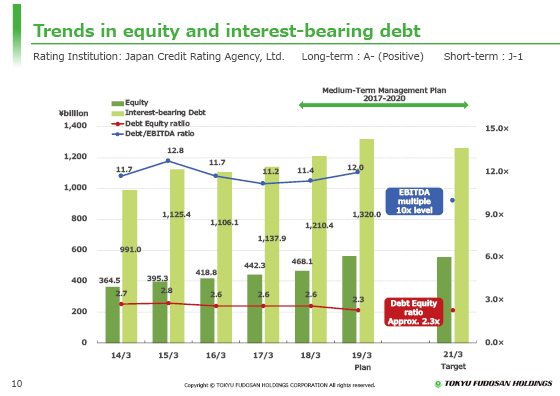

I will now explain the trends in equity and interest-bearing debt.

For the fiscal year ending March 31, 2019, interest-bearing debt will increase ¥109.6 billion from the previous fiscal year, to ¥1,320 billion, due to investments in large projects such as the Shibuya redevelopment projects that are currently ongoing and new investments.

The debt-to-equity ratio will improve from 2.6 times at the end of the previous fiscal year to 2.3 times, mainly due to the capital increase through public stock offering, and will achieve the target in the medium-term management plan two years ahead of schedule.

|

|

|