|

|

|

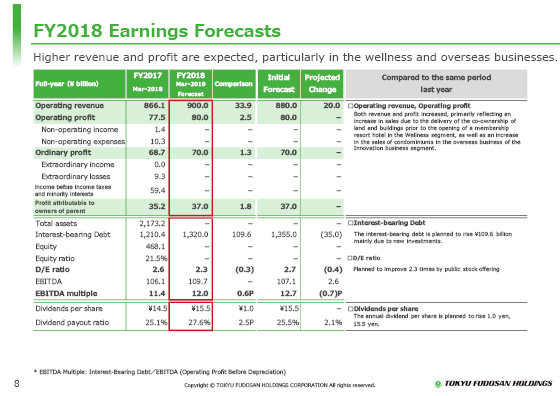

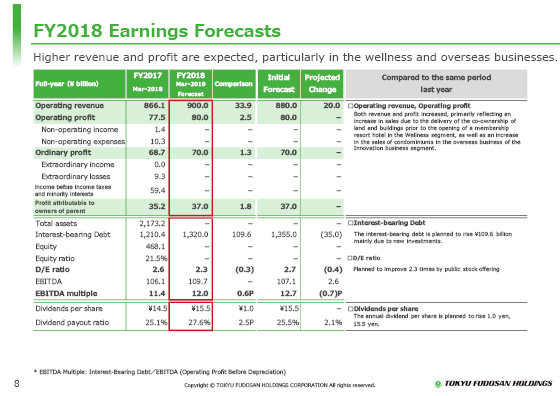

I will now explain our earnings forecasts for the fiscal year ending March 31, 2019.

We have increased only operating revenue by ¥20 billion yen from the initial forecast announced in May, to ¥900 billion yen, and operating profit, ordinary profit and profit attributable to owners of parent are estimated to be ¥80 billion, ¥70 billion and ¥37 billion, respectively.

We expect that both revenue and profits will increase, particularly in the Wellness segment and overseas operations.

Interest-bearing debt at the end of the fiscal year will be ¥1,320 billion due to the capital increase through public stock offering conducted in October, and the debt-to-equity ratio is estimated to improve from 2.7 times in the initial forecast to 2.3 times, which is the target in the medium-term management plan.

Annual dividends will be ¥15.5 per share as initially forecast (interim dividend of ¥7.5 and year-end dividend of ¥8).

|

|

|