|

|

|

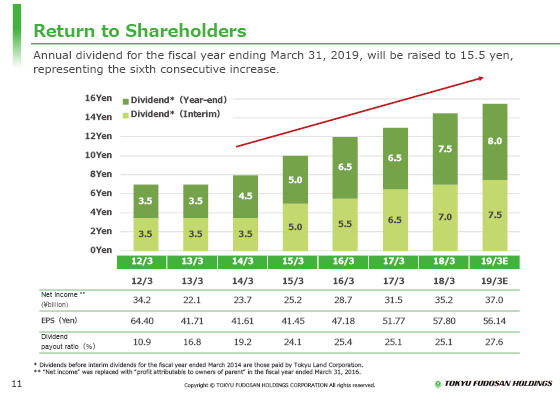

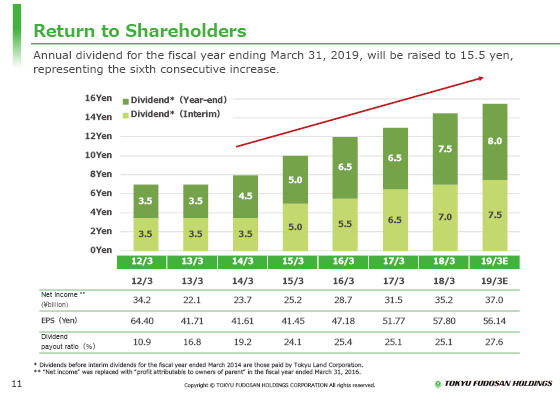

I will now explain the return to shareholders.

The basic policy for the return to shareholders is to continue and maintain stable dividends and a payout ratio of at least 25% under the medium-term management plan.

For the past five years, an increase in dividends was realized through the steady growth of profit attributable to owners of parent. For the fiscal year ending March 31, 2019, we plan to increase dividends to ¥15.5 per share for the sixth consecutive year since the Company was reorganized into a holding company, given that the profit is expected to hit a record high.

|

|

|