|

|

|

|

|

|

|

|

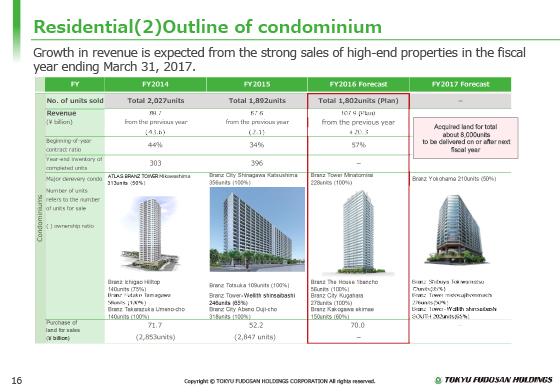

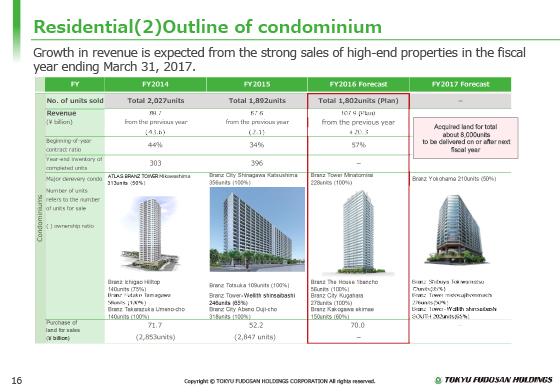

Next, I will outline our plan for the sale of condominiums.

We plan to sell 1,802 units and record revenues of ¥107.9 billion in the fiscal year ending March 2017.

As I mentioned earlier, we will be selling a number of units at high-end sites such as Minato Mirai and Ichibancho, shown in the red box in the table, and we plan to record sales of ¥107.9 billion despite a year-on-year decrease of 90 in the number of units sold, to 1,802.

The contract ratio to sales forecast for condominiums is 57% as indicated in the middle section of the table, which has been growing as planned.

The gross margin on condominiums is expected to be approximately 24%.

We acquired land for 2,847 units for ¥52.2 billion in the fiscal year ended March 2016 as presented in the value of investment in land.

As a result, we have land for a total of 8,000 units already scheduled to be accounted during the fiscal year ending March 2018 or thereafter as indicated at the upper right section of the table.

As for the land acquisition during the fiscal year ending March 2017, we plan to invest ¥70 billion under the policy of carefully selecting redevelopment projects and property units, etc., located particularly in central Tokyo.

We expect that sales of condominium units, especially those in central Tokyo and high-end or rare ones, will generally remain strong.

|

|

|