|

|

|

|

|

|

|

|

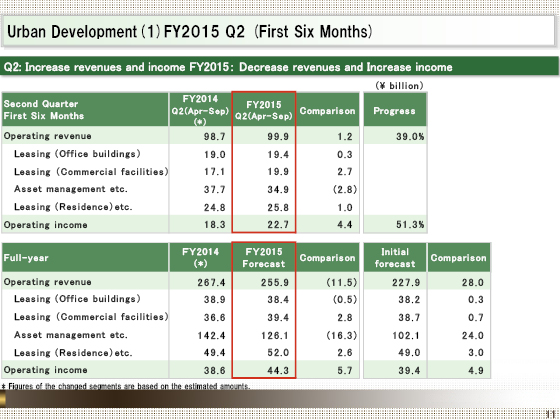

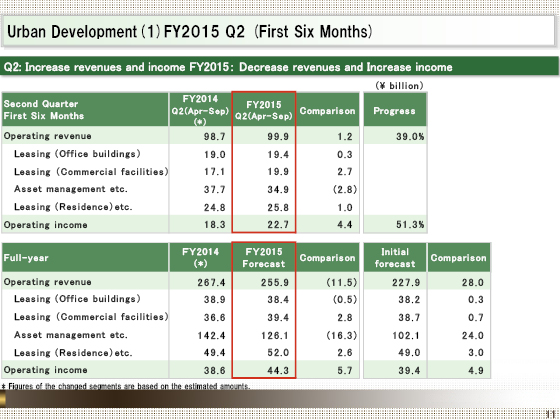

I will now provide an overview of the results and forecasts by segment. First, I will explain the results in the Urban Development segment.

In the first six months of the fiscal year ending March 2016, both operating revenue and operating income increased.

Revenue grew largely due to the new operation of Northport Mall and Shinjuku I-Land that were acquired in the previous fiscal year, which offset a decrease in the sale of buildings for investors, etc. and the loss of revenue following the sale of property.

Operating income rose owing to an increased gain on sale of buildings for investors, etc. in addition to growth in income from the new building operation.

We expect a decline in revenue and an increase in income for the fiscal year ending March 31, 2016.

While a decreased gain on the sale of buildings for investors, etc. will reduce the revenue, we expect increased income as a result of new building operation, a gain on sale of buildings for investors, etc., improvement of existing buildings, etc.

|

|

|