|

|

|

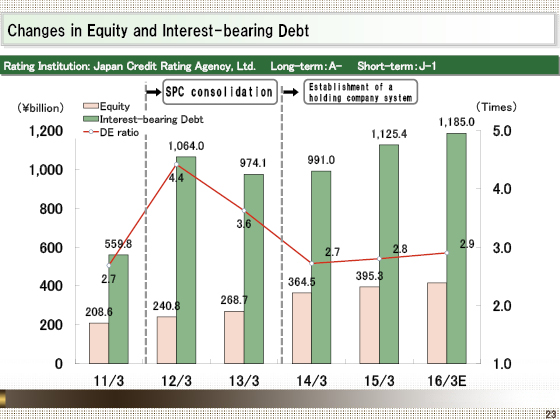

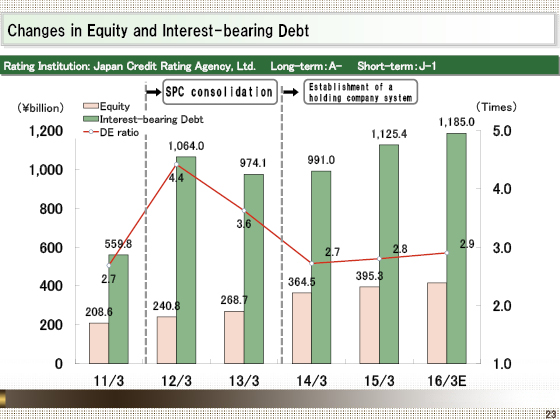

Finally, I will describe the trends in our equity capital and interest-bearing debts.

At the beginning of the fiscal year ended March 31, 2012, the consolidation of SPC resulted in increased interest-bearing debts and a rise in the D/E ratio to 4.4. During the three years of the previous medium-term management plan, interest-bearing debts decreased due to the sale of assets to REIT, the accumulation of profits during the period, the transfer to the holding-company system, and other activities. Meanwhile, equity capital increased, and in the fiscal year ending March 2015, the D/E ratio was reduced to 2.8.

In the fiscal year ending March 31, 2016, while we expect to see growth in interest-bearing debts and the D/E ratio increase to 2.9 due to asset replacement, etc., we are planning to restrict the D/E ratio to 2.6 during the fiscal year ending March 31, 2017, as stated in the medium-term management plan.

|

|

|