|

|

|

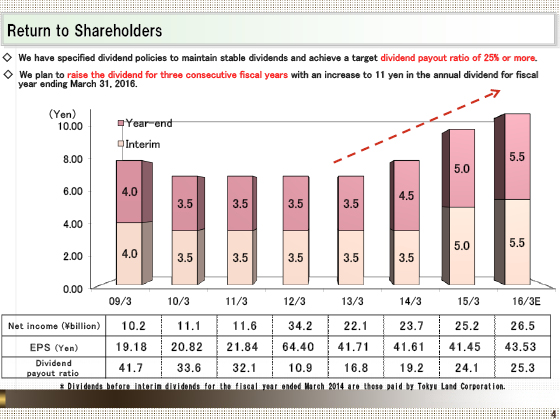

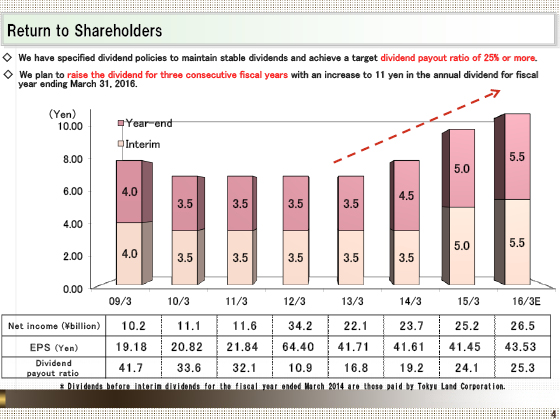

This is about returns to shareholders.

As we explained the last time, regarding dividends based on having positioned the current medium- and long-term management plan as representing a growth phase, our policy is to:

(1) Continue to maintain steady dividends and

(2) decide on profit distribution by targeting a dividend payout ratio of at least 25%.

As per the initial plan, we expect a dividend payments of 5.5 yen both at the interim and at the end of the fiscal year, for an annual total of 11 yen, representing an increase in dividends for three consecutive fiscal periods. Thus, we will distribute dividends to shareholders, basically in proportion to profit growth.

|

|

|